Gold is up by $10.10 today to $1,509.40 per oz but the TSX is closed for the Boxing Day holiday in Canada. NIA's #1 overall stock suggestion for 2020 Ascot Resources (TSX: AOT) is likely to explode tomorrow when the TSX reopens! For NIA's U.S. members, you are VERY lucky! Almost nobody is aware of this but AOT also trades on the U.S. OTC market under the symbol AOTVF! American investors have an amazing opportunity to take advantage of cheap Ascot shares today prior to the TSX reopening tomorrow!

Since October 31st when NIA announced AOT at $0.51 per share as its #1 overall stock suggestion for 2020, AOT has been the #2 largest gaining gold stock with a market cap of at least CAD$150 million. AOT has so far gained by 56.86% to a closing price on Tuesday of $0.80 per share, but this is absolutely NOTHING because... ALL of AOT's huge catalysts are STILL to come! Remember, NIA's #1 stock suggestion for 2019 Fiore Gold (TSXV: F) gained at its 2019 high by 173.91% from NIA's suggestion price and NIA strongly believes that AOT has MUCH greater upside potential!

Beginning as soon as tomorrow or Monday, AOT will release 3 separate resource updates for its three main gold deposits that are located adjacent to AOT's Premier Mill: Premier/Northern Lights, Big Missouri, and Silver Coin. It is very possible that AOT will release all 3 resource updates between tomorrow and the end of next week!

These resource updates are extremely important because the majority of AOT's high grade gold resource located adjacent to the Premier Mill is currently in the inferred category. Inferred resources are too speculative geologically to have economic considerations applied to them in Feasibility Studies. Only measured & indicated gold resources are eligible to be upgraded to proven & probable reserve status in Feasibility Studies!

This summer, AOT conducted an enormous infill drilling campaign at its Premier Gold Mine in preparation for the release of its Premier Gold Mine Feasibility Study in 1Q 2020! AOT completed 9,000m of infill drilling at Premier/Northern Lights, 22,000m of infill drilling at Big Missouri, and 11,000m of infill drilling at Silver Coin... for a total of 42,000m of infill drilling! All together, these three deposits currently have 644,000 oz of indicated gold vs. 1,218,000 oz of inferred gold!

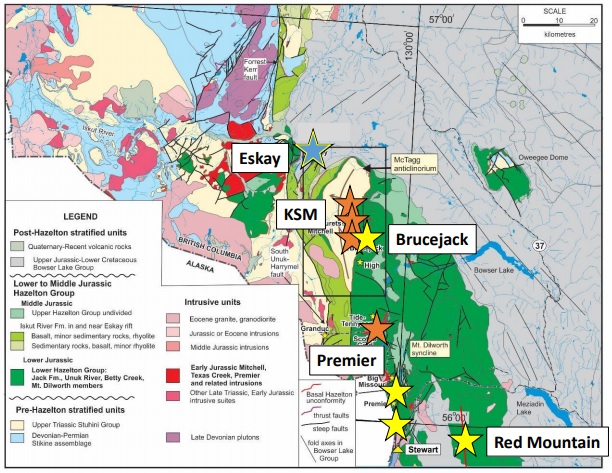

Based on AOT's extremely strong drilling results reported in recent months, with AOT consistently reporting gold intercepts with very high gold grades across all three deposits, NIA expects AOT's 3 imminent resource updates to successfully upgrade a large portion of its inferred gold resource to the indicated category. If AOT successfully upgrades just half of the inferred gold resources contained within its Premier/Northern Lights, Big Missouri, and Silver Coin gold deposits to the indicated category, their indicated gold resource will increase by 94.56% to 1,253,000 oz and including AOT's newly acquired Red Mountain high grade gold project located only 20km away from the Premier Mill (one of the top 10 lowest cost gold mines under development worldwide) plus Martha Ellen (a smaller gold deposit located north of Big Missouri), AOT will have a total measured & indicated gold resource of 2,058,600 oz Including silver (using the current gold/silver ratio of 84.40), AOT will have over 2.1 million oz of measured & indicated gold equivalent!

When IDM Mining (the company AOT acquired earlier this year) released a Feasibility Study for Red Mountain in mid-2017 as a standalone gold mine, it had a measured & indicated gold resource of 583,700 oz of which 473,000 oz were found to be economically viable This means 81% of its measured & indicated gold resource became a proven & probable gold reserve!

If AOT after its 3 imminent resource updates has a total measured & indicated gold resource of 2.1 million oz of gold equivalent and AOT's 1Q 2020 Feasibility Study finds 81% of it to be economically viable, AOT will have a total proven & probable gold reserve of 1.7 million oz of gold equivalent!

AOT's closest comparison in Canada, Pure Gold Mining the owner of the high grade Madsen gold mine released its Feasibility Study earlier this year and had a proven & probable gold reserve of 1 million oz. Pure Gold Mining currently has an enterprise value of USD$150 million or USD$150 per oz of proven & probable gold reserves.

Based on the high likelihood of AOT having a 1Q 2020 post Feasibility Study proven & probable gold reserve of approximately 1.7 million oz of gold equivalent a valuation of USD$150 per oz would give AOT an enterprise value of USD$255 million or CAD$334 million. This means AOT very conservatively deserves to be trading for $1.44 per share!

As we approach 2021 and AOT launching production at the Premier Gold Mine, AOT will likely deserve a valuation of at least USD$500 per oz based on the USD$2.54 BILLION enterprise value that Pretium Resources (PVG) is currently receiving for its Brucejack Gold Mine located 30km north of the Premier Gold Mine!

NIA's President has purchased 150,000 shares of AOT in the open market. Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. Never make investment decisions based on anything NIA says. This message is meant for informational and educational purposes only and does not provide investment advice.