TII to Ship First Graphite Product

Titan Mining to Start Shipping First Graphite Product and Feasibility Study Underway for 40,000 tpa…

Kevin Bambrough Bullish on Earthlabs (TSXV: SPOT)

Somebody linked us to this... and in this situation Kevin Bambrough is 100% correct: Kevin…

QIMC Hits New ATH of $2.37 Up 507.69% Since NIA’s Suggestion

QI Materials (CSE: QIMC) was at one point today up as much as 22.80% to…

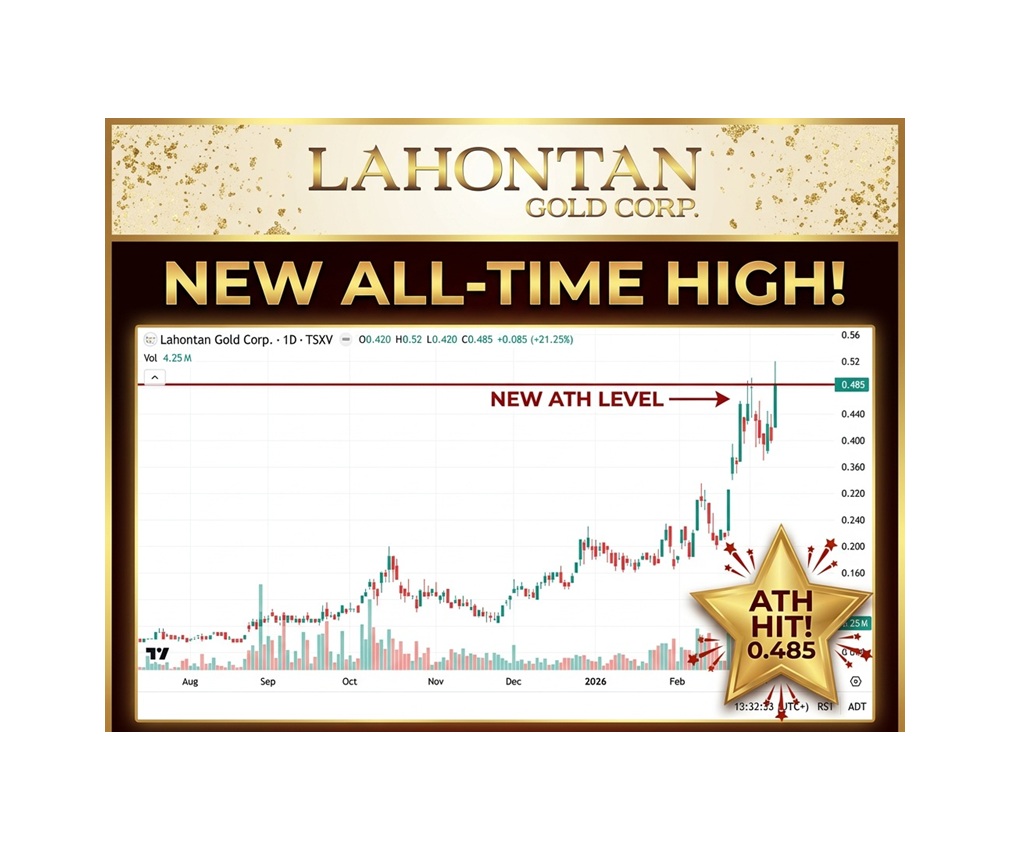

Lahontan Gold (TSXV: LG) Soars 21.25% to New All-Time High of $0.485 and Already Up 385% Since Release of NIA Report

On October 8th, NIA said, "Lahontan Gold (TSXV: LG) is the Nevada gold explorer with…

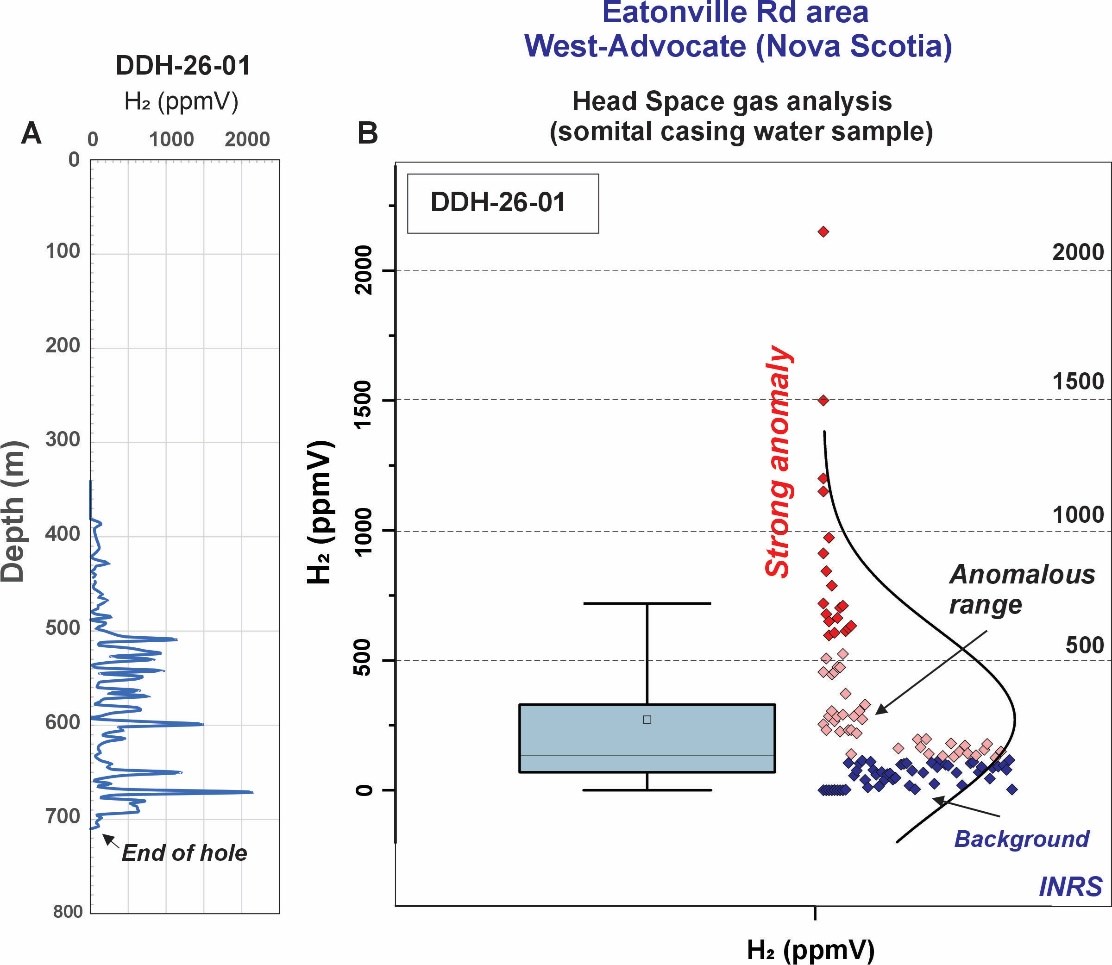

QIMC Completes 711 Metre Discovery Hole, Hydrogen System Confirmed at Depth

QIMC Completes 711 Metre Discovery Hole DDH-26-01 at West-Advocate, Nova Scotia: Hydrogen System Confirmed at…

CTGO’s Acquisition of DVS the Best in History?

What we meant to say earlier is: "Contango ORE (CTGO) shareholders are about to vote…

NIA Tuesday Morning Update: Huge Day Ahead

QI Materials (CSE: QIMC) still has a market cap of only CAD$248.02 million when Koloma…

Trio-Tech (TRT) Fair Value = $131.53 Per Share

Trio-Tech International (TRT)'s fair value is now $131.53 per share after Aehr Test Systems (AEHR)…

We Are Being Honest Unlike Kevin Bambrough

Hydrograph Clean Power (CSE: HG) continues to go up despite no revenue or any legit…

TRT Gains for Fourth Straight Day

This weekend, NIA explained Trio-Tech International (TRT) is the safest stock we have ever suggested…