TRT Gains for 6th Time in 7 Days

Trio-Tech International (TRT) surged 2.99% today to $6.20 per share, rising for the 6th time…

TRT Gains for 5th Time in 6 Days

Trio-Tech International (TRT) surged 4.88% yesterday to $6.02 per share, rising for the 5th time…

QIMC Surges 14.87% as HGRAF Plunges 11.03%

We told you last night, “The world’s wealthiest people are investing big into natural hydrogen,…

Peter Thiel Sells More Palantir, Super Copper CEO Buying Big

Last week, Peter Thiel sold another $289,707,507 worth of Palantir (PLTR). His Apeiron Investment Group…

TII to Ship First Graphite Product

Titan Mining to Start Shipping First Graphite Product and Feasibility Study Underway for 40,000 tpa…

Kevin Bambrough Bullish on Earthlabs (TSXV: SPOT)

Somebody linked us to this... and in this situation Kevin Bambrough is 100% correct: Kevin…

QIMC Hits New ATH of $2.37 Up 507.69% Since NIA’s Suggestion

QI Materials (CSE: QIMC) was at one point today up as much as 22.80% to…

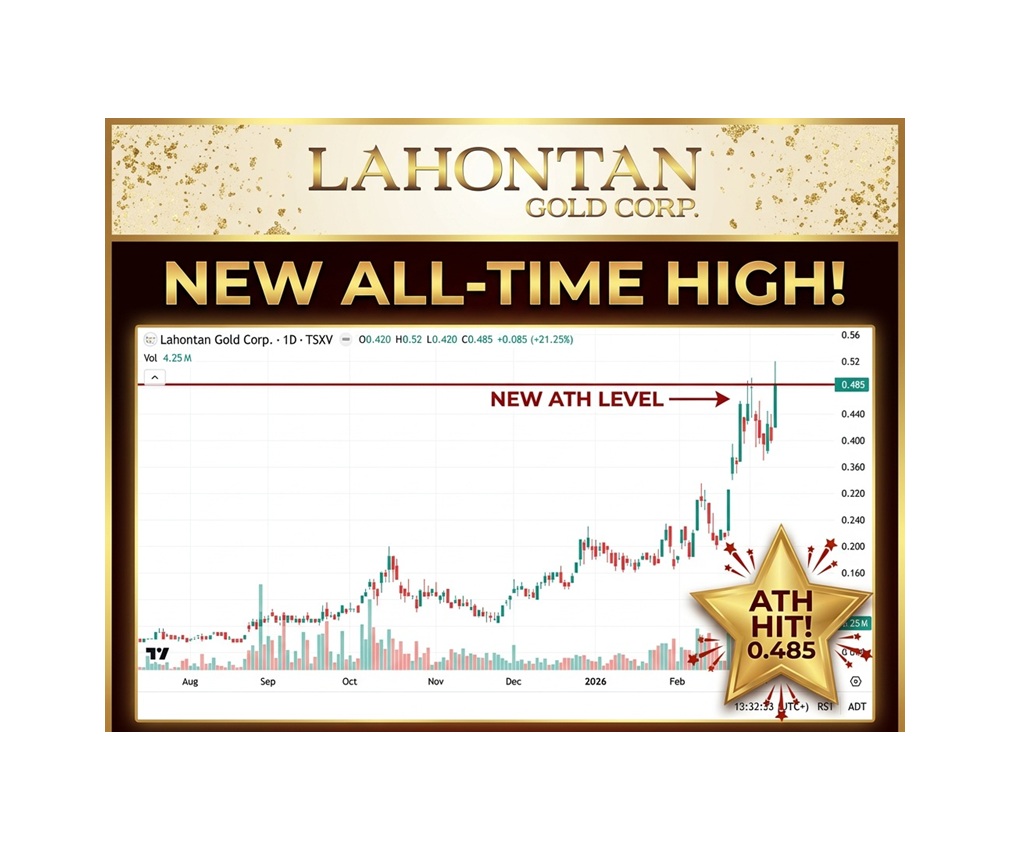

Lahontan Gold (TSXV: LG) Soars 21.25% to New All-Time High of $0.485 and Already Up 385% Since Release of NIA Report

On October 8th, NIA said, "Lahontan Gold (TSXV: LG) is the Nevada gold explorer with…

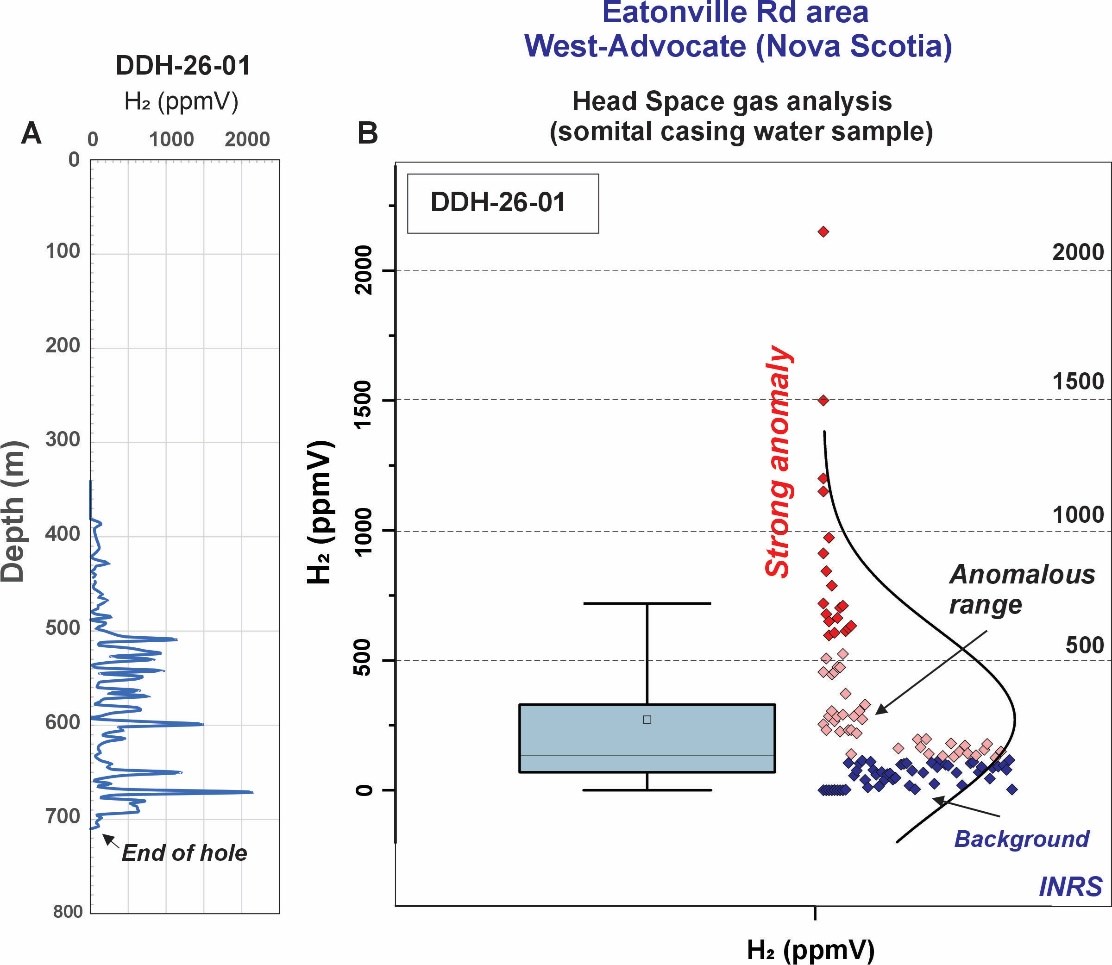

QIMC Completes 711 Metre Discovery Hole, Hydrogen System Confirmed at Depth

QIMC Completes 711 Metre Discovery Hole DDH-26-01 at West-Advocate, Nova Scotia: Hydrogen System Confirmed at…

CTGO’s Acquisition of DVS the Best in History?

What we meant to say earlier is: "Contango ORE (CTGO) shareholders are about to vote…