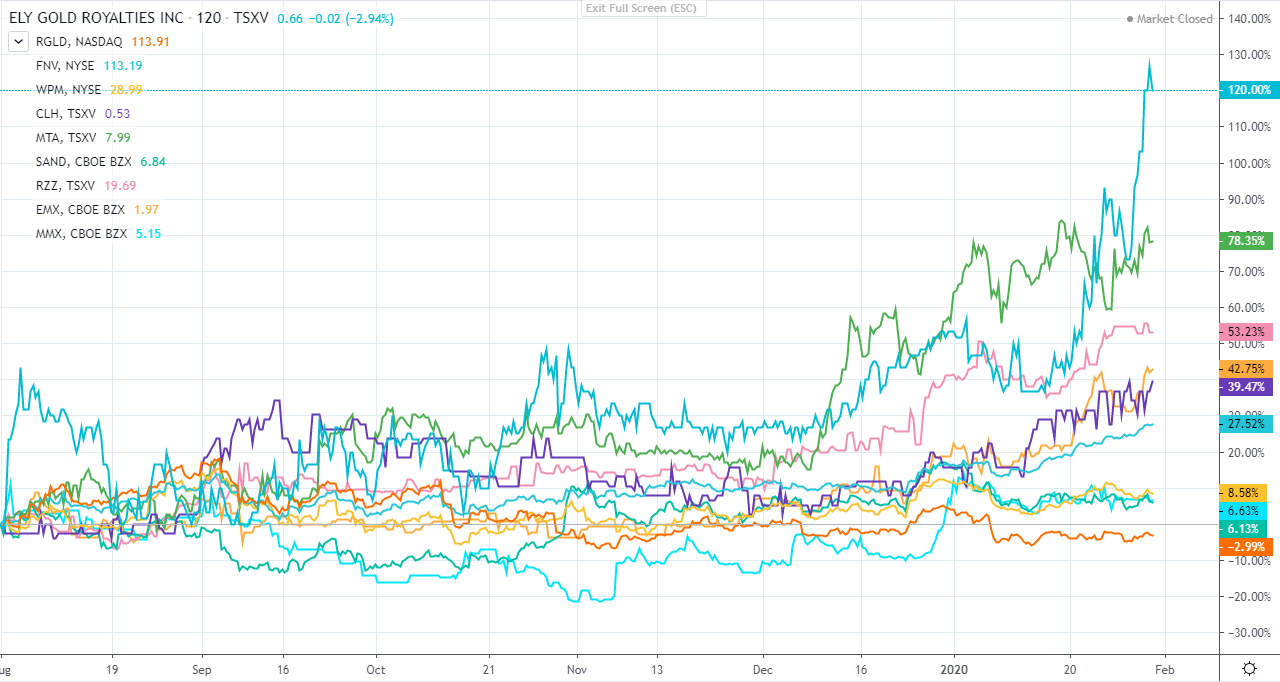

Since August 1, 2019, when NIA sent out its 'Most Profitable Way to Play Gold' report about how gold/silver royalty & streaming stocks had gained nearly 15X more than gold/silver mining stocks since October 2008, gold/silver royalty & streaming stocks have achieved an average gain of 37.97% or more than triple the gains of gold and silver futures, which have gained by 12.03% and 11.21%, respectively. During this same time period, VanEck Vectors Gold Miners ETF (GDX), the largest gold miner ETF - has gained by 5.43% or less than half the gain of gold.

Keep in mind, GDX's third largest holding is Franco-Nevada (FNV), a gold royalty stock that represents 7.13% of GDX's total holdings. Out of GDX's ten largest holdings, FNV was by far its #1 best performer with a gain of 27.47%. Excluding FNV, GDX during this time period would only be up by 3.47%. Therefore, over the last six months, gold/silver royalty & streaming stocks have gained nearly 11X more than gold/silver mining stocks... continuing the trend that began in October 2008!

While FNV's six-month gain of 27.47% made it the #1 best performing stock out of GDX's top 10 holdings, FNV was only the #6 best performing gold/silver royalty & streaming stock. The #1 best performing gold/silver royalty & streaming stock over the last six months has been Ely Gold Royalties (TSXV: ELY) with a gain of 120%. Amazingly, only hours after NIA released its 'Most Profitable Way to Play Gold' report on August 1, 2019, NIA announced ELY at $0.30 per share as its #1 favorite gold royalty stock suggestion! Since NIA's announcement of ELY it has gained 4.37X more than FNV, 22.1X more than GDX, and 34.58X more than GDX excluding FNV.

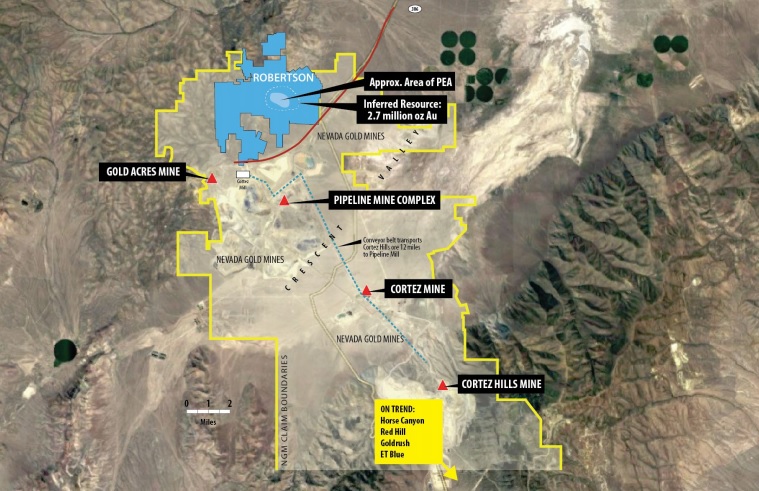

Entering the month of February 2020, NIA believes Coral Gold (TSXV: CLH) has the most short-term upside potential out of all gold/silver royalty & streaming stocks. CLH closed yesterday at a new 8-year high of $0.53 per share. With only 46.85 million shares outstanding, CLH's current market cap is only CAD$24.83 million. In June 2017, CLH sold its Robertson Gold Property in Nevada to Barrick Gold (GOLD) for a sliding-scale royalty worth between 1% and 2.25%, plus an upfront cash payment of USD$15.75 million, and guaranteed future cash payments totaling USD$5 million to be paid beginning on January 1, 2025 if Robertson isn't in production by December 31, 2024 (CLH will receive advance royalty payments of USD$500,000 per year for up to 10 years.)

Currently, CLH has CAD$13.85 million in cash and no debt, giving it an enterprise value of only CAD$10.98 million or USD$8.3 million. If we subtract CLH's guaranteed future cash payments of USD$5 million from its current enterprise value of USD$8.3 million, CLH is only receiving USD$3.3 million in additional value for the strong likelihood of Nevada Gold Mines bringing Robertson into production plus CLH's three additional gold exploration projects located near Robertson along the prolific Cortez trend!

In September 2019, Nevada Gold Mines completed a major two-year drilling campaign at Robertson and we expect Barrick to focus a lot of attention on Robertson in their February 12th earnings release, presentation, and conference call... as Robertson is becoming a very important project for the company. Without Robertson entering production, it will be impossible for Cortez to remain a Tier 1 gold mine.

After drilling 17 core holes at Robertson in 4Q 2017, Nevada Gold Mines drilled 45 core holes at Robertson in 2018, and ramped up its Robertson drilling to 84 core holes in 2019. Out of 21,000m of total exploration drilling at Nevada Gold Mine's Cortez complex in 2019, 13,271m were drilled at Robertson! With Nevada Gold Mines focusing 63.2% of their 2019 Cortez exploration budget on Robertson, all signs point to Nevada Gold Mines rapidly advancing Robertson towards production! CLH's management was just given an inclusive site visit and it appears as though major progress was made in 2019 on all fronts. Geologic modeling incorporating the 2019 work is underway to update the resource estimate and guide mine and facilities planning.

CLH previously defined a 2.7 million oz inferred gold resource at Robertson, but Nevada Gold Mines hasn't yet announced its own Robertson resource estimate. February 12th would be the perfect time for Barrick to announce its Robertson resource estimate (assuming it is ready). Regardless, we expect to hear a lot on February 12th about Robertson! Gold is up by over $10 today to $1,584 per oz! At the current gold price, CLH's Robertson royalty is worth 1.50%. As soon as gold breaks $1,600 per oz, CLH's royalty rises to 1.75% and instantly becomes 16.67% more valuable!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA was previously compensated by ELY USD$30,000 cash for a six-month marketing contract which has since expired. Never make investment decisions based on anything NIA says. This message is meant for informational and educational purposes only and does not provide investment advice.