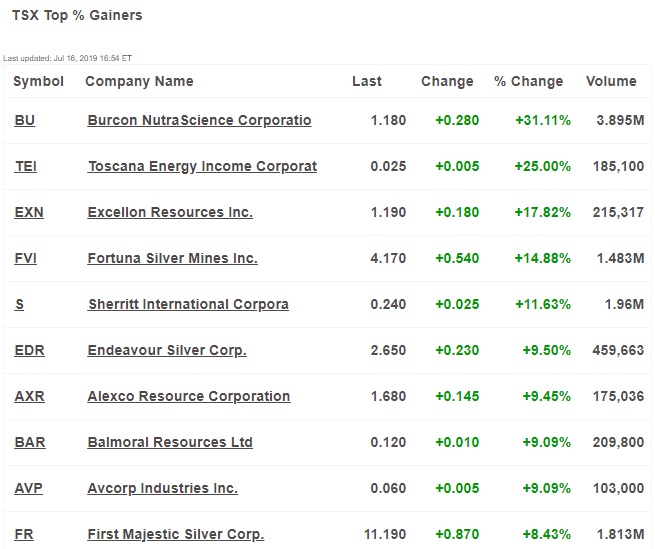

NIA's #2 favorite pea protein stock suggestion Burcon Nutrascience (TSX: BU) was today's #1 percentage gainer on the TSX exchange rising $0.28 or 31.11% to $1.18 per share. This was the 5th time that BU has made it to #1 on the TSX percentage gainers list since NIA's initial suggestion seven weeks ago on May 24th at $0.575 per share (adjusted for rights offering). After the recent closing of BU's oversubscribed rights offering, BU has all of the funds that it needs to build its new pea protein plant, repay its outstanding debt, and cover any additional operating expenses for the next twelve months. America's #1 pea protein meat company Beyond Meat (BYND) together with America's #1 pea protein dairy company privately held Ripple have created such HUGE demand for pea protein that the industry has been facing a nationwide shortage of the raw material. BU will add much needed pea protein supplies to the market for BYND, Ripple, and NIA's current #1 favorite pea protein stock suggestion and #2 favorite overall stock suggestion: Lifeway Foods (LWAY).

LWAY's chart is setup perfectly for an explosive move higher!

NIA is upgrading its confidence rating on LWAY from 95 out of 100 up to 98 out of 100.

NIA is downgrading its confidence rating on Ricebran Technologies (RIBT) from 90 out of 100 down to 70 out of 100.

NIA has always been much more confident about LWAY than RIBT due to the fact that LWAY has positive free cash flow and continues to repurchase shares vs. RIBT constantly burning through cash and diluting shareholders. LWAY's next upward explosion appears imminent!

We hope that most NIA members took profits on RIBT after it gained 17.93% within four trading days of our July 1st suggestion. If you still own RIBT, you may want to consider exiting for the time being and using the proceeds to accumulate more LWAY for the inevitable rally to $10+ per share. Afterwards, you may be able to reenter RIBT as low as $2.50 per share.

Only today are retail investors finally discovering BU as a pea protein play, a full seven weeks after NIA's initial suggestion! LWAY is a totally different situation that can't be compared to BU because the company is already a household name in America with their market leading probiotics products for gut health already sold inside of every major U.S. grocery store chain nationwide! LWAY doesn't need to be discovered like BU did! LWAY has a massive presence on social media and totally dominates the U.S. Kefir market with a stunning 70% market share!

LWAY is the best positioned company to capitalize on America's booming gut health trend with its highly rated lineup of probiotics beverages! The only reason LWAY isn't currently trading with a market cap of $350 million or higher like private VC-backed Ripple is the fact that vegans could never become LWAY customers - and vegans have been growing as a share of the total U.S. population. LWAY's newly launched Plantiful is a game-changer for the plant-based dairy market, with LWAY currently making major plans to give Ripple a run for its money!

Although Plantiful itself is only beginning to reach the shelves of large U.S. retailers, LWAY as a whole has a much larger distribution base than Ripple and shouldn't have any trouble convincing the majority of its largest customers to begin offering Plantiful on their store shelves. We expect LWAY's Plantiful to quickly catch up to Ripple's current level of U.S. distribution and this will cause LWAY's valuation multiple to increase significantly to its historical median levels! With Danone still the largest independent LWAY shareholder and never cashing out despite many opportunities todo so for a massive profit over the last 20 years, says a lot about Danone's ultimate goal, which is obviously to OWN 100% of the company!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has purchased 10,000 shares of LWAY and intends to sell for a profit in the future. Never make investment decisions based on anything NIA says. This message is meant for informational and educational purposes only and does not provide investment advice.