On Wednesday morning, NIA said in an alert analyzing gold's managed money net long position, "From our estimates every 50,000 contracts of buying results in about a $100 per oz rally in the price of gold."

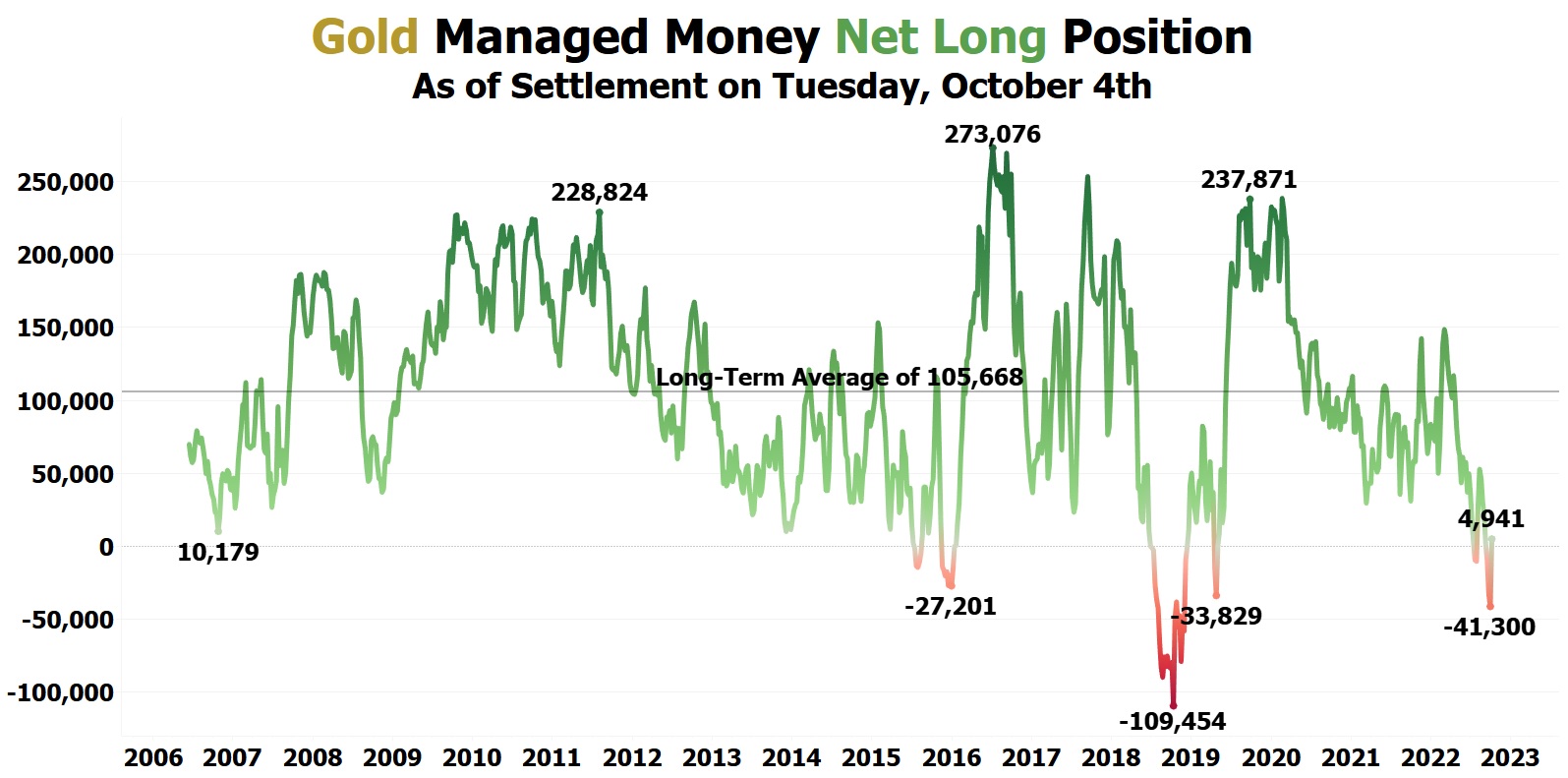

The CFTC released its new COT data this evening updated as of this past Tuesday. During the week ending Tuesday, October 4th, gold's managed money net long position increased by 46,241 contracts from -41,300 contracts up to 4,941 contracts. During this same one-week period, gold rallied by $96.60 per oz from $1,628.56 per oz up to $1,725.16 per oz.

A $96.60 per oz gold rally with 46,241 contracts being bought is equal to almost our exact estimate of a $100 per oz gold rally with 50,000 contracts being bought.

Over the last three trading days, gold dipped by $31.46 per oz from its Tuesday settlement price of $1,725.16 per oz back down to a Friday settlement price of $1,693.70 per oz. This means that gold's managed money net long position as of Friday's settlement price of $1,693.70 per oz is an estimated -10,789 contracts.

To get back to gold's long-term average managed money net long position of 105,668 contracts, gold will need to rally by an estimated $233.16 per oz up to $1,926.85 per oz.

Coming out of a double dip into net short territory gold's managed money net long position always returns to its long-term average of 105,668 contracts within approximately two months.

A gold rally to $1,926.85 per oz over the next two months should be enough to take Augusta Gold (TSX: G) up to $5+ per share.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 174,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.