How Much Upside Do Gold Stocks Have Left?!

NIA perfectly predicted the current bull market in gold stocks in February 2024 when the…

Contango ORE (CTGO) Will Early Pay Another $7 Million in Debt This Week

Contango ORE (CTGO)'s trailing twelve-month free cash flow as of March 31st is up to…

Most Bullish Chart in History

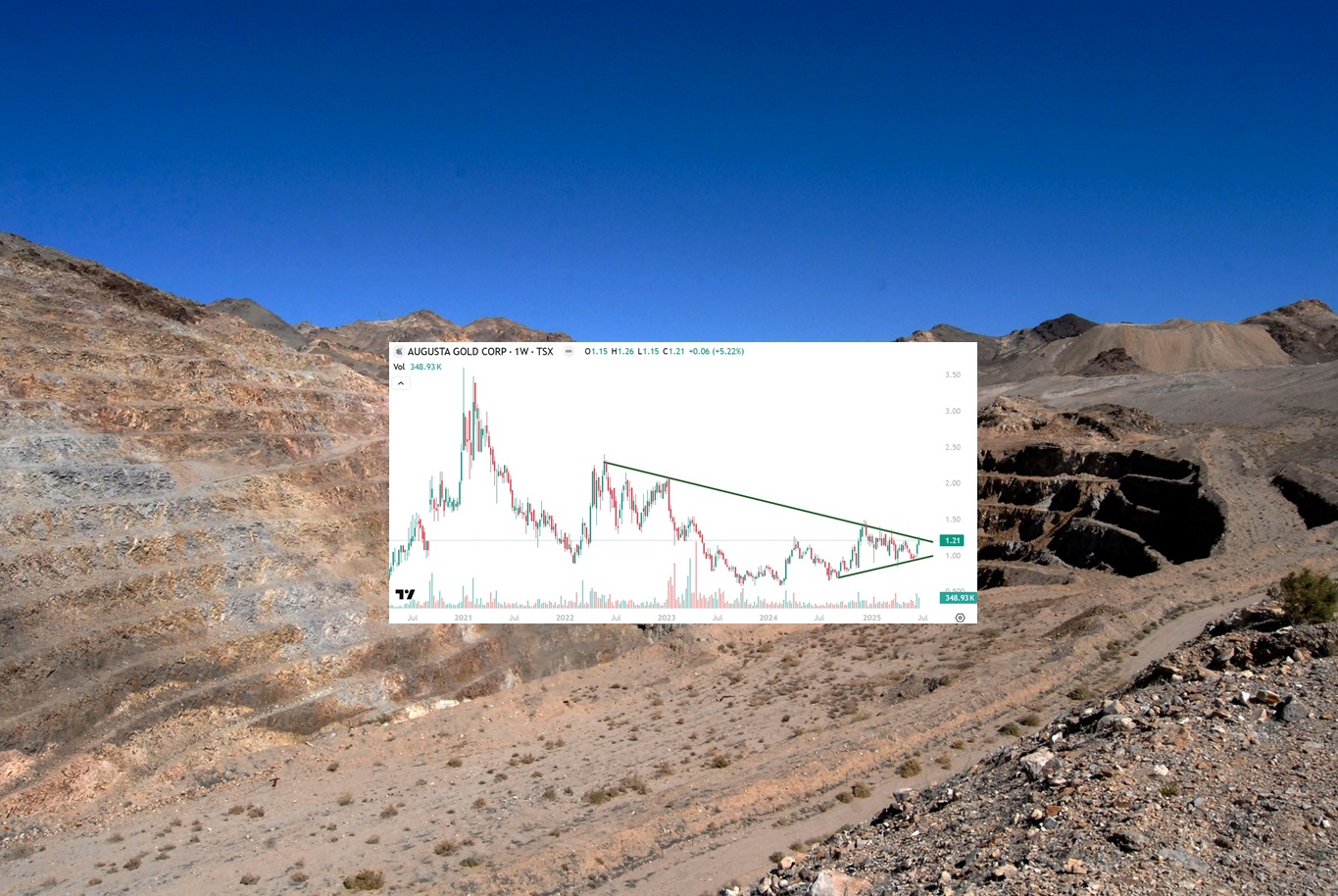

This following weekly chart of Augusta Gold (TSX: G) is the most bullish we have…

Is Circle the Best Crypto Innovation in 8 Years?

NIA Special Alert: From Ethereum at $18.50 to Augusta Gold’s Breakout Moment — Understanding the…

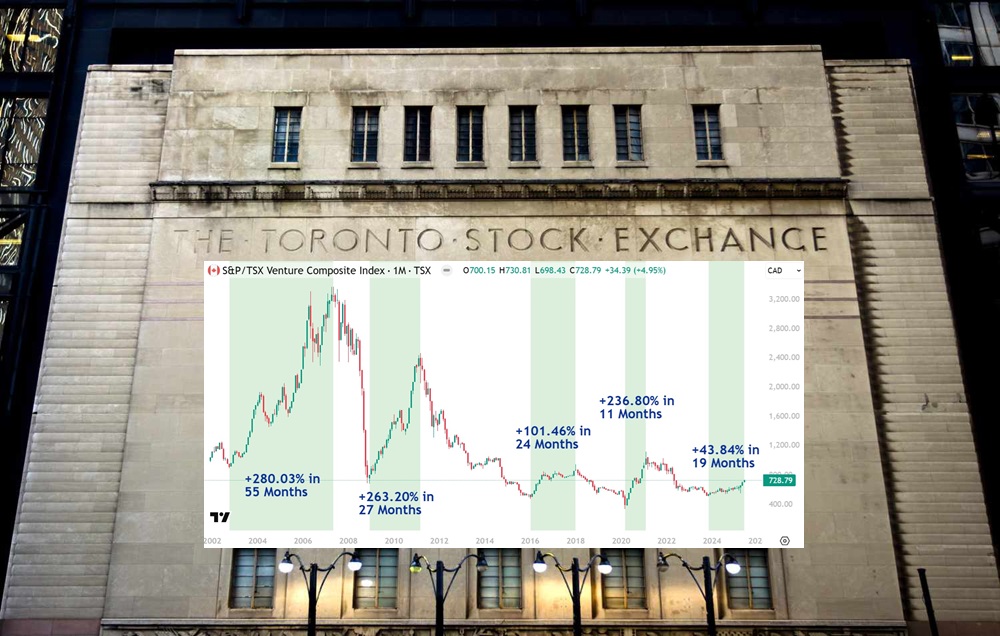

Today’s Stealth Bull Market in TSXV vs. Previous Bull Markets

The TSX Venture Composite Index has been in a stealth bull market for the last…

America’s FI/RE “Fire Movement” Cult Is Destroying Society

AI technology has a huge future ahead, a future that will require a lot of…

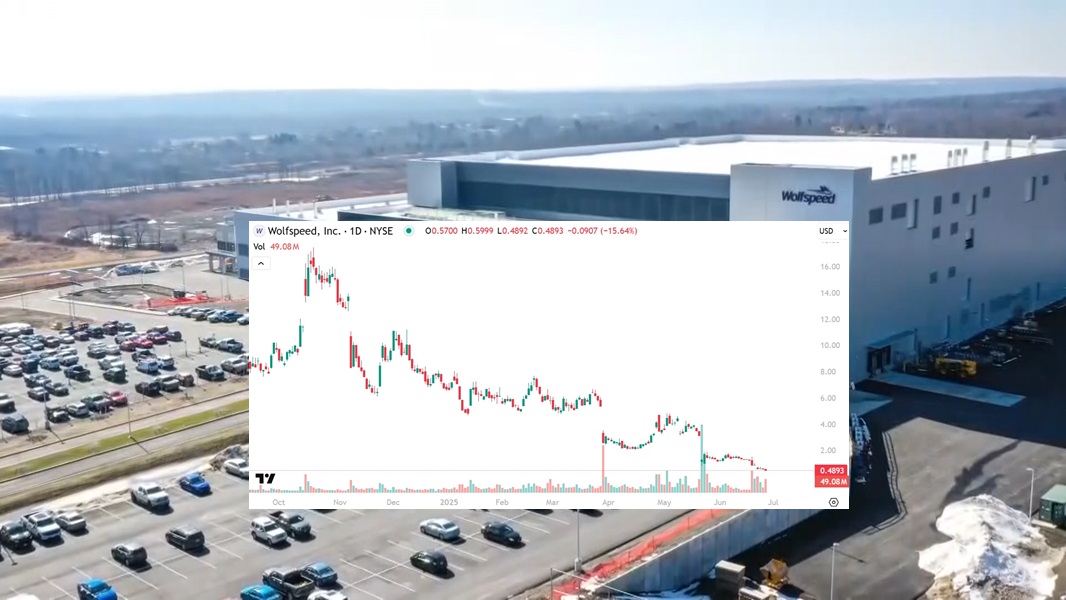

Wolfspeed Bankrupt 8 Months After Biden Gave $750M Grant

Wolfspeed (WOLF) has just filed for bankruptcy after Biden gave the company a free handout…

NIA’s SBSW Call Option Up 182.26%, NIA Members Profiting 7-Figures

NIA's Sibanye-Stillwater (SBSW) January 2027 $5 Call Option has just hit a new high of $3.50 and has…

Yikes, We Don’t Own Celtic (LSE: CCP) Yet

We think Richard Warke strategy of building companies like Augusta Gold (TSX: G) up to billion-dollar…

How Financing Packages Work

This is what we think will happen... EXIM completes due diligence on Augusta Gold (TSX:…