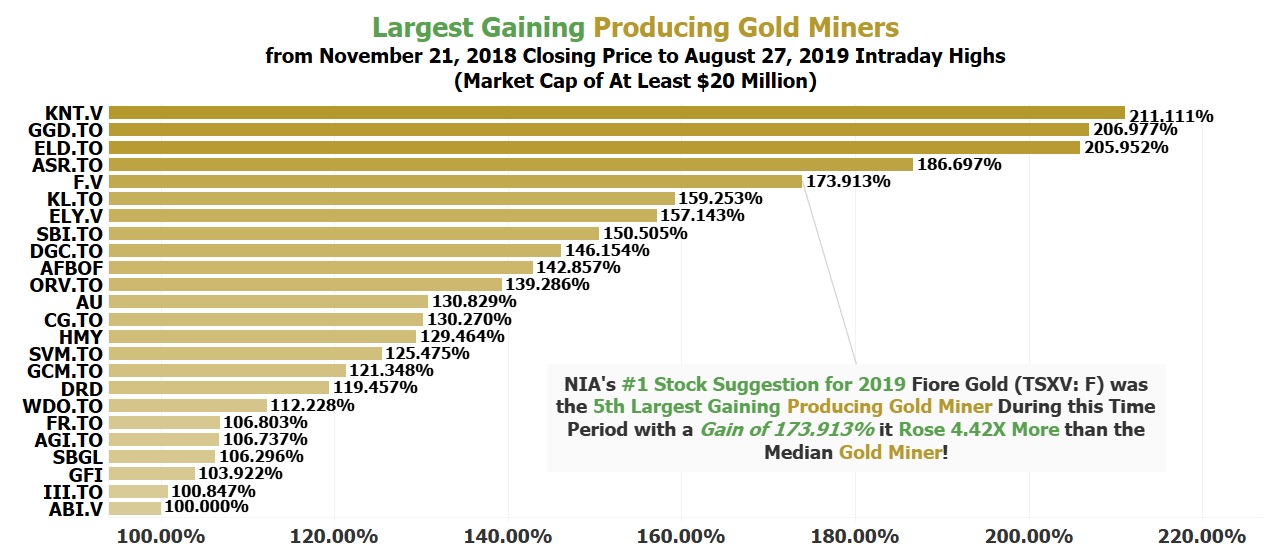

NIA is very pleased that NIA's #1 stock suggestion for 2019, Fiore Gold (TSXV: F), reached a new high since NIA's suggestion on Tuesday of $0.63 per share for a gain of 173.913% since NIA initially announced it on November 22, 2018 at $0.23 per share. During this time period, Fiore Gold was the 5th largest gaining gold stock out of 110 producing gold miners with a market cap of at least $20 million and gained 4.42X more than the median producing gold miner! On August 19th, NIA sent out an "extremely important update" predicting that Fiore Gold at $0.48 per share would see new 2019 highs of above $0.60 per share within 2-3 weeks, and NIA's prediction came true in only 8 days!

NIA is also very pleased that NIA's #1 stock suggestion for 2018, QIWI Plc (QIWI), just reached a new high since NIA's suggestion this morning of $24.86 per share for a gain of 77.825% since NIA initially announced it on December 28, 2017 at $13.98 per share. During this time period, QIWI has gained 8.59X more than the S&P 500, which has only gained by 9.06%!

NIA is announcing Coral Gold (TSXV: CLH) at $0.39 per share as its new perfect confidence rating of 100 out of 100 stock suggestion.

Recently, NIA suggested Ely Gold (TSXV: ELY) at $0.30 per share with a confidence rating of 95 out of 100 and it rapidly exploded by 56.67% to a new 8 1/2 year high of $0.47 per share.

Just like ELY, CLH is a gold royalty play! CLH only has 47.7 million shares outstanding for a market cap at $0.39 per share of CAD$18.603 million. Currently, CLH is sitting on a HUGE cash position of CAD$18.21 million and has NO debt!

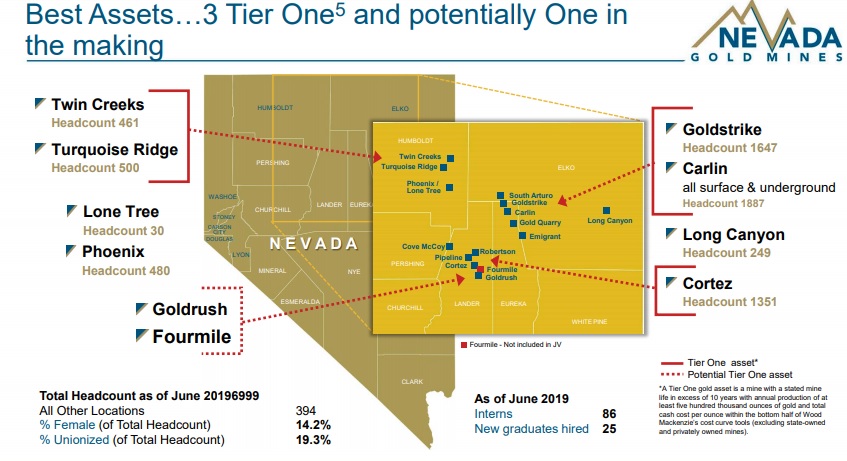

CLH holds a sliding scale 1% to 2.25% net smelter returns royalty in the Robertson Gold Project that it previously sold to Barrick Gold and is currently being developed as part of Nevada Gold Mines the newly formed joint venture between Barrick Gold and Newmont. When gold recently surpassed $1,400 per oz, CLH's royalty rose from 1.25% up to 1.50%. When gold surpasses $1,600 per oz, it will rise to 1.75%. When gold surpasses $1,800 per oz, it will rise to 2%. When gold surpasses $2,000 per oz, it will rise to 2.25%.

According to a map on the web site of Nevada Gold Mines, Robertson is now considered to be a part of the Cortez gold mine, the largest producing gold mine owned by Nevada Gold Mines.

According to Nevada Gold Mines, "The Robertson property is adjacent to Cortez, located just six kilometers north of the Pipeline mill. If successfully brought into production, material from the project would provide an additional feed for the Cortez mill, with the potential to extend open pit operations in the Cortez District. Robertson also has processing synergies with the Deep South underground expansion project at Cortez. In addition, the land package contains a number of promising near-mine exploration opportunities, as well potential new exploration targets in this highly prospective and prolific district."

CLH's Preliminary Economic Assessment (PEA) completed for Robertson in 2012 included an inferred gold resource of 2,741,673 oz! After acquiring Robertson from CLH in June 2017, Barrick completed 62 drill holes totaling 12,200 m of drilling over the following 18 months. After very promising results, Nevada Gold Mines has planned 13,290 m of additional drilling at Robertson for 2019. Between March and June, Nevada Gold Mines has completed 5,517 m of this year's Robertson drilling campaign.

Nevada Gold Mines is making steady, methodical progress at Robertson! NIA believes it could potentially add 200,000-300,000 oz of gold production per year for Nevada Gold Mines. Currently, CLH is receiving almost no value at all for its extremely valuable Robertson royalty!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. Never make investment decisions based on anything NIA says. This message is meant for informational and educational purposes only and does not provide investment advice.