Vale (VALE) Is Second Largest EWZ Holding

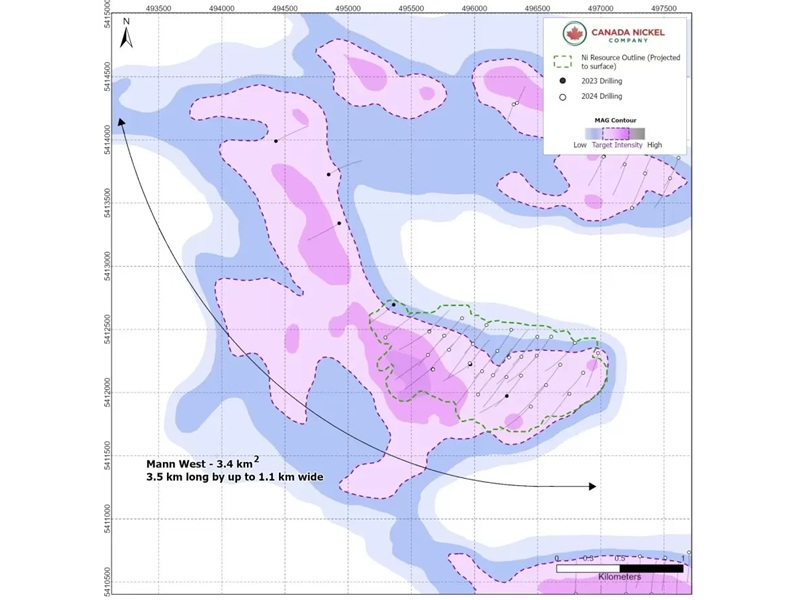

Vale (VALE) is the second largest EWZ holding and it operates Canada's largest producing nickel…

NIA’s #1 ETF Pick EWZ Is Crushing VOO and GDX

On October 17th, NIA sent out an alert entitled 'EWZ Has 100% Chance of Outperforming…

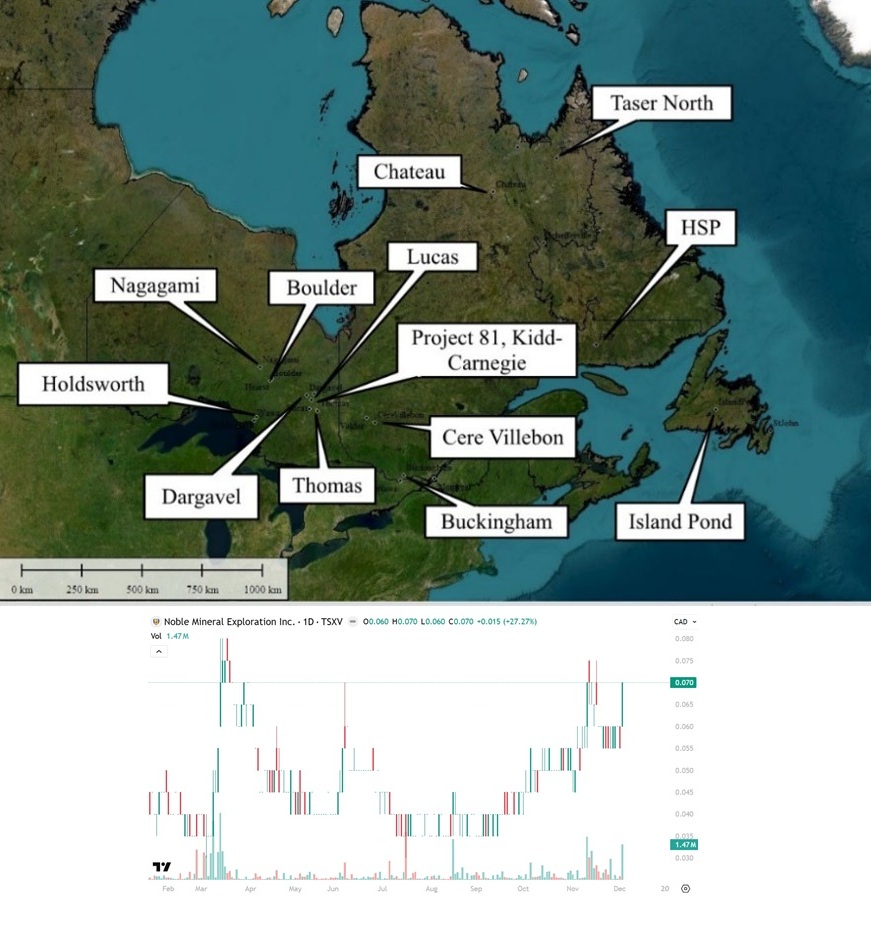

Noble (TSXV: NOB) Gains 14.29% to $0.08 Per Share

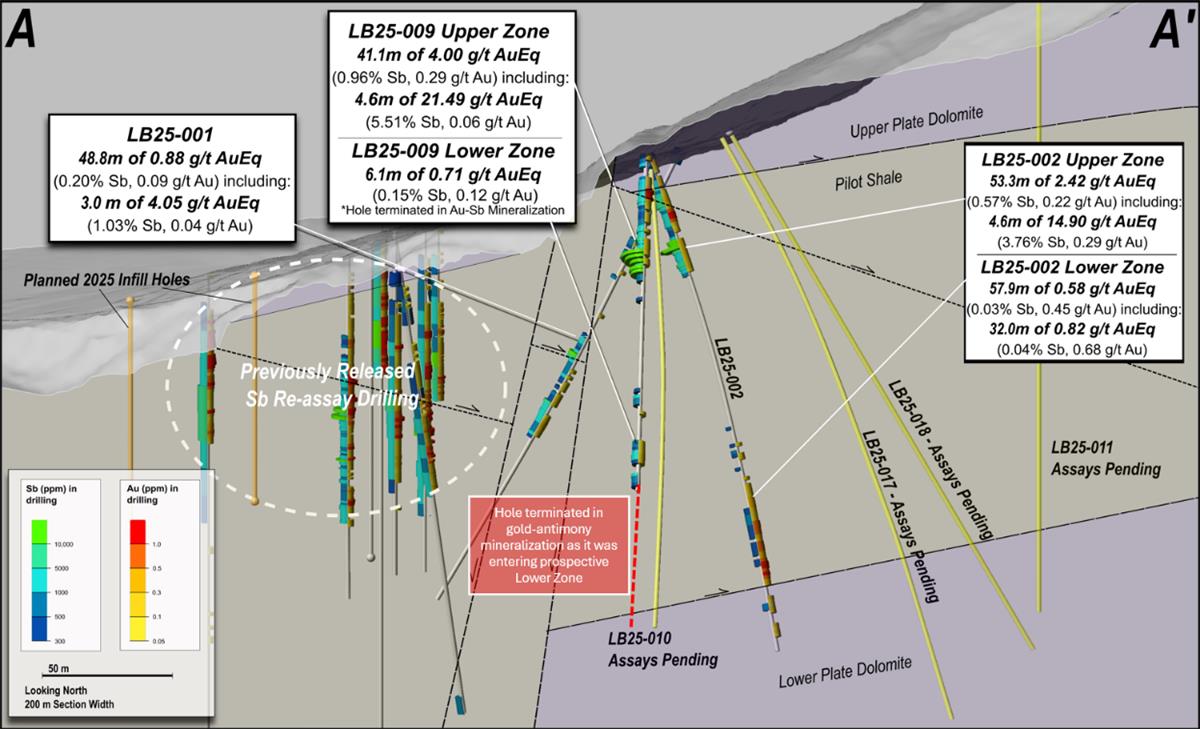

Yesterday, NIA announced Noble Mineral Exploration (TSXV: NOB) as its latest brand-new stock suggestion. NOB…

Highlander Silver (TSX: HSLV): New All-Time Closing High

Highlander Silver (TSX: HSLV) gained by 4.43% today to a new all-time closing high of…

Contango ORE (CTGO) Gains 6.27% to $25.61!

NIA's #1 favorite producing gold miner Contango ORE (CTGO) gained by 6.27% today to $25.61…

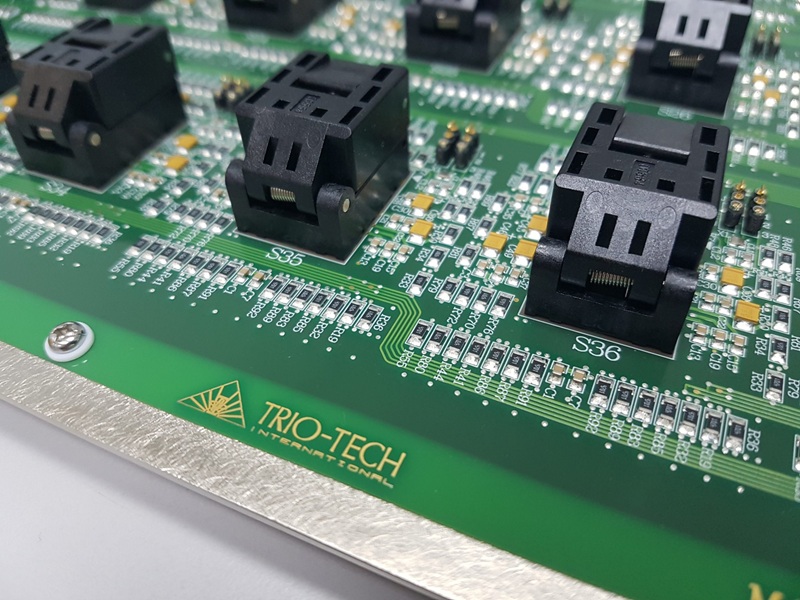

Going All in on Trio-Tech (TRT) Here at $8.30?

We're not saying it's necessarily a good idea to go "all in" on Trio-Tech International…

QIMC Expands Phase 1 Winter Hydrogen Drilling in Nova Scotia to Over 5,000 Metres

QIMC Expands Phase 1 Winter Hydrogen Drilling Program in Nova Scotia to Over 5,000 Metres…

Noble (TSXV: NOB) Gains 27.27% to $0.07 Per Share

This morning, NIA announced Noble Mineral Exploration (TSXV: NOB) as its latest brand-new stock suggestion.…

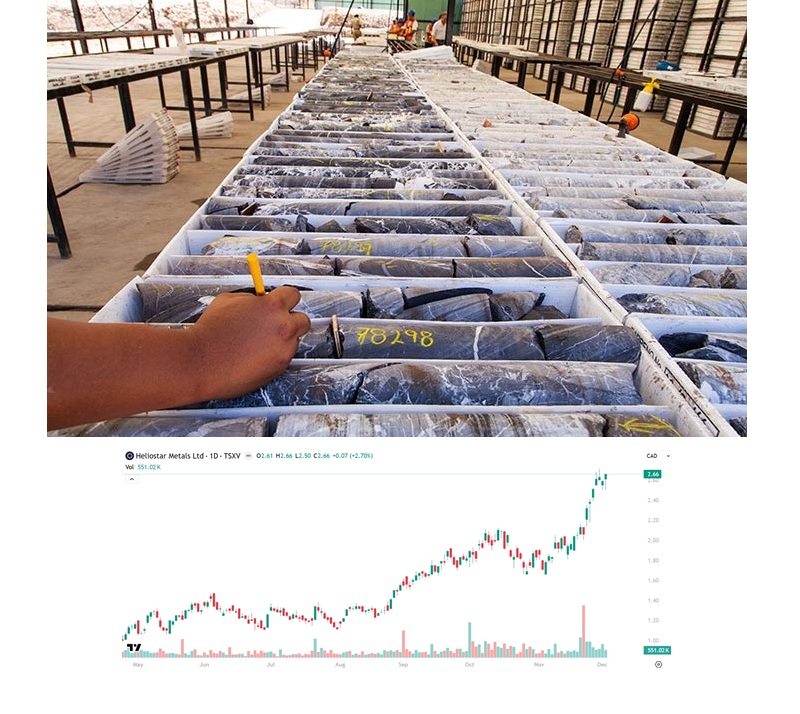

Heliostar: New All-Time Closing High of $2.66

NIA's #2 favorite producing gold miner Heliostar Metals (TSXV: HSTR) gained by 2.70% today to…

Nickel Sentiment Has Never Been Worse… That’s Exactly Why NOB Could Explode

NIA BREAKING REPORT: Nickel sulphide currently has the most negative sentiment in the natural resource…