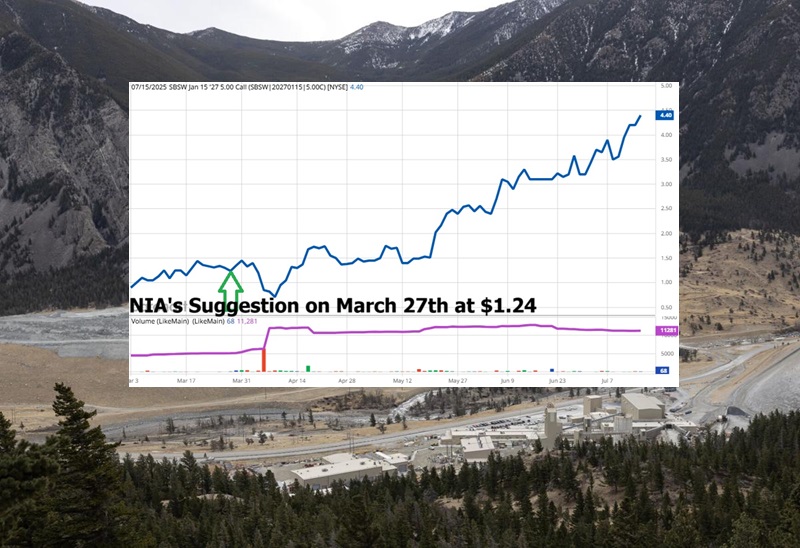

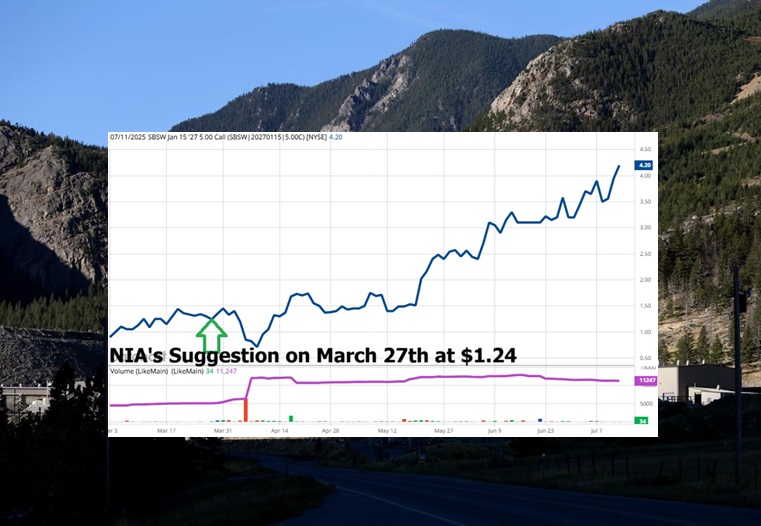

NIA’s SBSW Call Option Up 254.84%, NIA Members Profiting 7-Figures

NIA's Sibanye-Stillwater (SBSW) January 2027 $5 Call Option has just hit a new high of $4.40 and has…

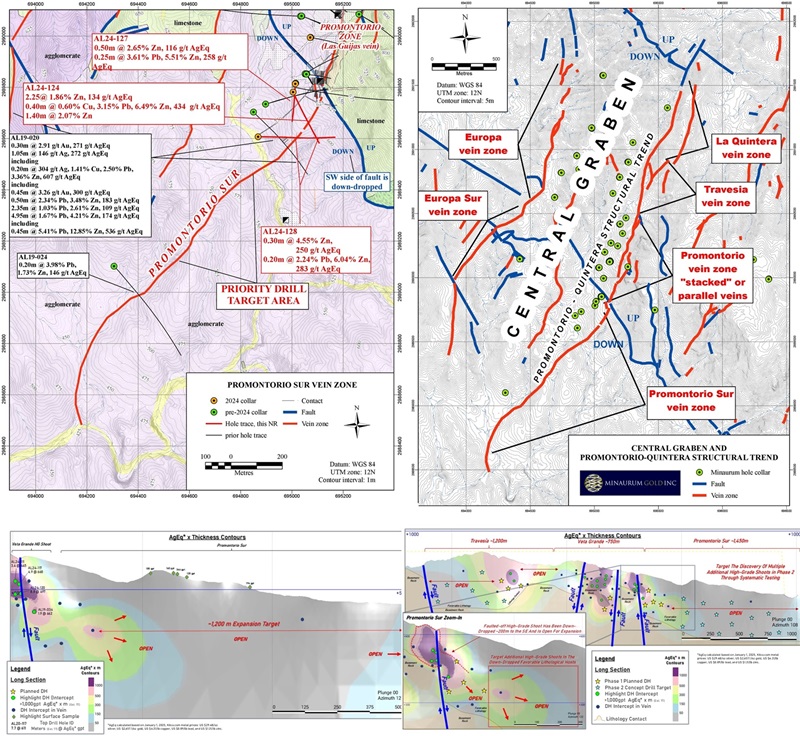

Minaurum Announces Drill Results from New Vein Zone Target; Promontorio Sur at Alamos Silver Project

Minaurum Gold Inc. (“Minaurum” or “the Company”) (TSXV:MGG) (OTCQX: MMRGF) is pleased to announce results from…

Heliostar Metals (TSXV: HSTR) Poised for Exponential Growth

Click here to read NIA's exclusive must read report on Heliostar Metals (TSXV: HSTR)!

NIA’s #1 Top Pick for 2025 OSS Hits New High of $5.07!

One Stop Systems (OSS) gained by 3.68% on Monday to a new 43-month closing high…

Augusta Gold (TSX: G) Gains by 2.19% to $1.40 Per Share

Augusta Gold (TSX: G) gained by 2.19% today to $1.40 per share and has the…

Important NIA Monday Morning Update

Silver is up another $0.476 this morning to $38.865 per oz! Click here to read…

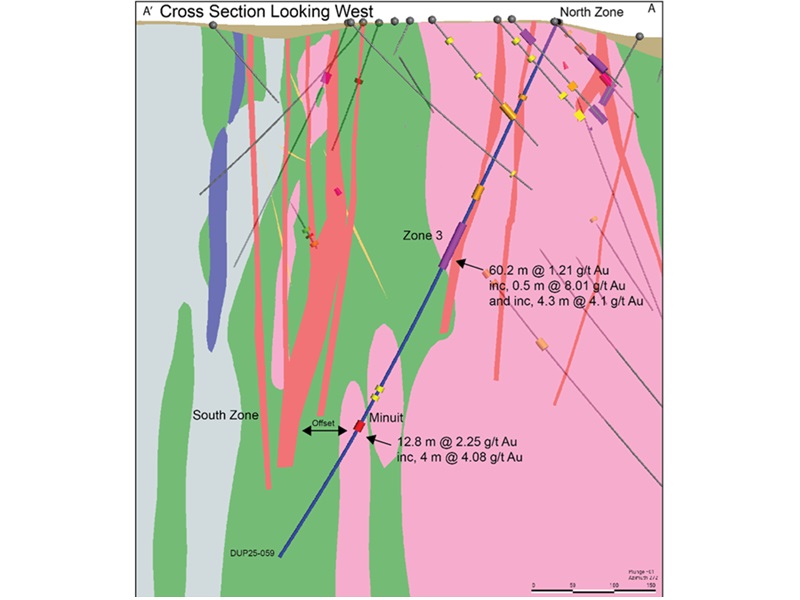

First Mining Discovers Significant New Gold Zone for Immediate Expansion at the Duparquet Gold Project

Minuit Discovery – A Newly Discovered Gold Zone located 75 m north of historical Donchester…

NIA’s SBSW Call Option Up 238.70%, NIA Members Profiting 7-Figures

NIA's Sibanye-Stillwater (SBSW) January 2027 $5 Call Option closed this week at a new high of $4.20 and…

Imagine Discovering 242m of 9.06 g/t Gold

Imagine discovering 242m of 9.06 g/t gold. It would be one of the best intercepts…

Titan Mining (TSX: TI) Hits New Multi-Year High

Titan Mining (TSX: TI) finished this week at a new multi-year high of $0.73 per…