Madison Square Garden Sports (MSGS) the owner of the Knicks and Rangers has just hit a new 52-week high this morning on news of the Miami Dolphins selling a minority stake at a valuation of $8.1 billion.

It is easy to understand why MSGS is rising to new 52-week highs on a day the market is down. MSGS has a market cap of only $5.146 billion plus about $1 billion in debt, for an enterprise value of about $6.1 billion or 5.94X revenue.

Forbes was only estimating a valuation for the Miami Dolphins of $6.2 billion for ALL of it, and it is clear their value estimations are way too low! Click here to see for yourself!

The Dolphins have $646 million in revenue so a valuation of $8.1 billion is a multiple of 12.54X revenue for a minority stake. Investors buying MSGS shares believe it has potential to gain by 100% in value.

Celtic plc (LSE: CCP) or CLTFF at an enterprise value of less than 1X revenue has potential to gain by 500%+ in value.

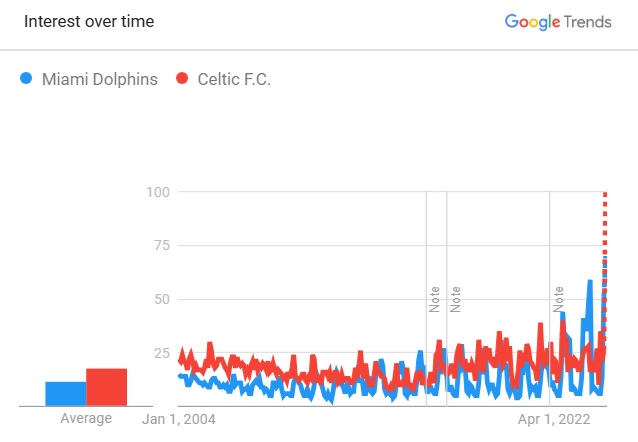

Celtic is BIGGER and more popular than the Miami Dolphins on an international basis:

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.