This afternoon, the Federal Reserve released U.S. M2 Money Supply Data for November 2021. U.S. M2 Money Supply in November 2021 reached $21,425,900,000,000 for a year-over-year (YOY) increase of 12.712%. Although YOY growth in U.S. M2 Money Supply has declined from its growth of 24.419% one year earlier in November 2020, U.S. M2 Money Supply continues to grow at nearly double its 10-year median YOY growth rate of 6.427%! Even more alarming is the fact that U.S. M2 Money Supply in November 2021 grew by 1.1677% on a month-over-month (MoM) basis, which was its highest MoM growth in seven months! To put this into perspective, if U.S. M2 Money Supply continues to grow by 1.1677% on a MoM basis, its YOY growth rate will increase back up to 14.95%! This would make America's rapidly accelerating U.S. price inflation crisis impossible to contain!

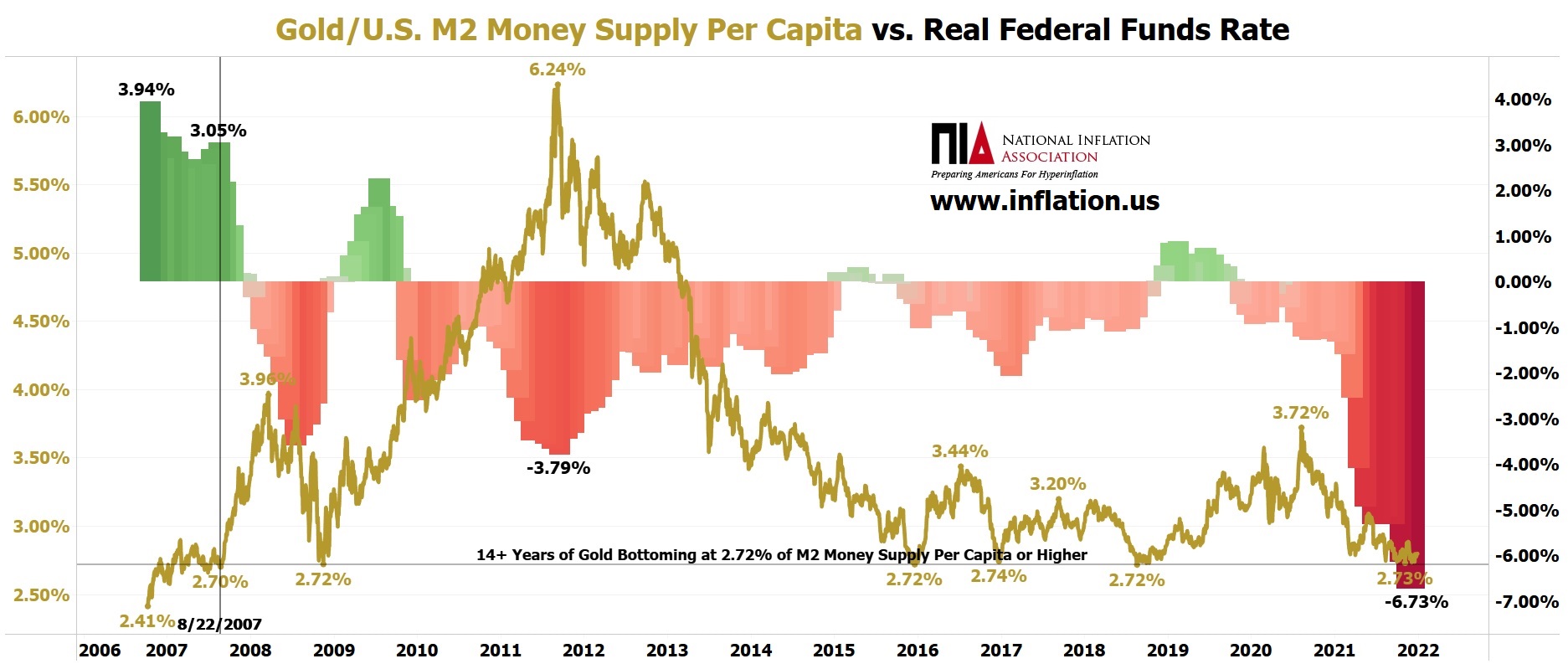

During the 2008 global financial crisis, gold bottomed on November 13, 2008, at $714 per oz. At that time, U.S. M2 Money Supply Per Capita was $26,210. Gold bottomed at 2.72% of U.S. M2 Money Supply Per Capita.

On the day the Federal Reserve launched its last Rate Hike Cycle, gold bottomed on December 17, 2015, at $1,049 per oz. At that time, U.S. M2 Money Supply Per Capita was $38,582. Gold bottomed at 2.72% of U.S. M2 Money Supply Per Capita.

One year later, gold bottomed on December 20, 2016, at $1,126 per oz. At that time, U.S. M2 Money Supply Per Capita was $41,025. Gold bottomed at 2.74% of U.S. M2 Money Supply Per Capita.

Twenty months later, gold bottomed on August 17, 2018, at $1,178 per oz. At that time, U.S. M2 Money Supply Per Capita was $43,350. Gold bottomed at 2.72% of U.S. M2 Money Supply Per Capita.

Last month, gold bottomed on November 3, 2021, at $1,763 per oz. At that time, U.S. M2 Money Supply Per Capita was $64,575. Gold bottomed at 2.73% of U.S. M2 Money Supply Per Capita.

For the last 5,242 days or 749 weeks or 172 months or 14+ years, gold has never settled a single trading day at a price of less than 2.72% of U.S. M2 Money Supply Per Capita.

Over 15 years ago, gold bottomed on October 6, 2006, at $561 per oz. At that time, U.S. M2 Money Supply Per Capita was $23,225. Gold bottomed at 2.41% of U.S. M2 Money Supply Per Capita. At that time, the U.S. had a Real Federal Funds Rate of 3.94%! Today, America's Real Federal Funds Rate is -6.73%! For the U.S. to get to a Real Federal Funds Rate of 3.94% today, the Federal Reserve would need to raise the nominal Federal Funds Rate up to a level of 10.75%, which would collapse the U.S. economy into the Greatest Depression in history!

Gold already bottomed last month, and we see no possible scenario that would cause gold to decline below 2.72% of U.S. M2 Money Supply Per Capita.

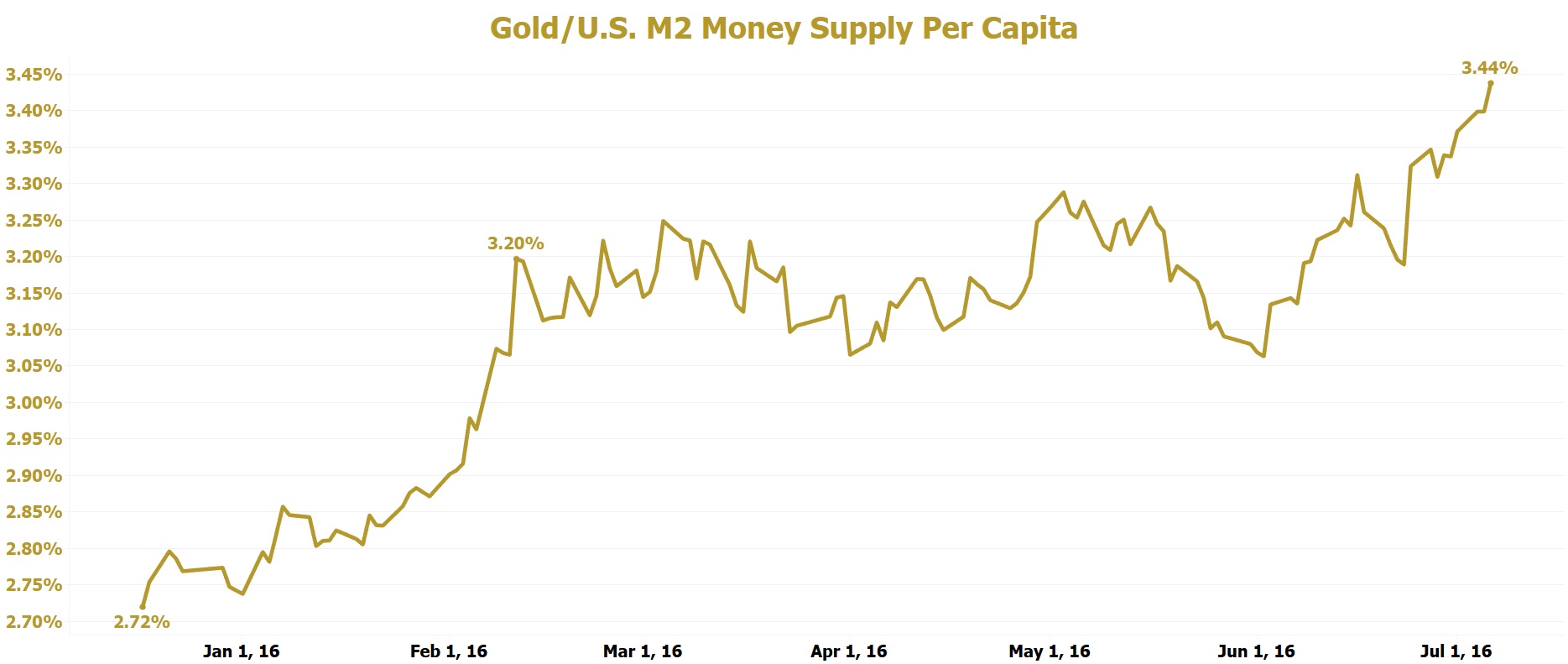

After the Federal Reserve launched its last Rate Hike Cycle on December 17, 2015, gold exploded from its bottom of 2.72% of U.S. M2 Money Supply Per Capita back up to 3.20% of U.S. M2 Money Supply Per Capita within eight weeks and continued trending higher to hit 3.44% of U.S. M2 Money Supply Per Capita on July 6, 2016.

NIA is 100% sure that the Fed will launch its new Rate Hike Cycle on March 16, 2022. Worst case scenario, gold will finish March 2022 back up to 3.20% of U.S. M2 Money Supply Per Capita, which will equal a gold price of $2,066.40 per oz. More likely than not, because gold already bottomed at 2.73% of U.S. M2 Money Supply Per Capita on November 3, 2021, gold will begin to breakout big at some point during the months of January/February 2022 well before the March 16, 2022 rate hike!

By the end of March, we should have a good idea from North Peak Resources (TSXV: NPR) that not only were the 1998 drill holes of near-surface, high-grade gold 100% accurate, but Black Horse's high-grade gold resource is likely to be MANY times larger than previously known! We believe the odds are extremely high that NPR hits $15+ per share by the end of March 2022!

There is ZERO chance of NIA's President selling a single share of NPR until it is trading SIGNIFICANTLY higher!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 200,000 shares of NPR in the open market. This message is meant for informational and educational purposes only and does not provide investment advice.