Marvel Discovery (TSXV: MARV) owns 62,400 hectares of mineral claims in the Newfoundland Gold Belt that are adjacent to either New Found Gold (TSXV: NFG)'s Queensway Gold Project, Marathon Gold (TSX: MOZ)'s Valentine Gold Project, or First Mining Gold (TSX: FF)'s Hope Brook Gold Project!

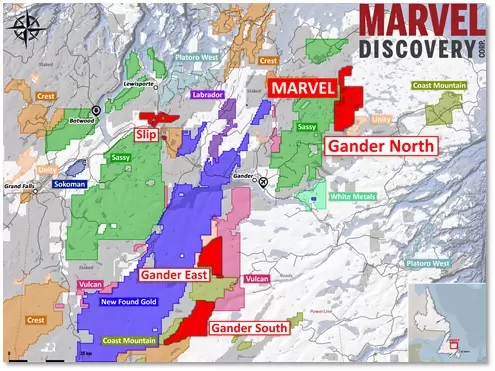

MARV's 3,700 hectare Slip Gold Project is located within 17km of NFG’s Queensway Gold Project! NFG has gained by 675.38% since its August 2020 IPO and has a market cap of $1.532 billion! An analysis of the regional magnetic data suggests that MARV's Slip Gold Project lies within a similar structural setting as NFG's Queensway Gold Project!

Recent exploration at MARV's Slip Gold Project uncovered surface mineralization with grab samples as high as 44.5 g/t gold! MARV has contracted Roland Quinlan (one of the most highly regarded and well-known prospectors in the Newfoundland Gold Belt) to begin a systematic prospecting program of MARV's entire Slip Gold Project. A detailed, systematic exploration program is now underway!

In February 2017, Roland Quinlan while conducting a systematic prospecting program for Aurion Resources (TSXV: AU) at its Risti project in northern Finland, uncovered gold-rich subcrop within a 700m X 1,100m wide area! His discovery caused AU's share price to gain by 286% within a single week with AU's market cap rising from $27.64 million up to $106.69 million! Click here to read an article about Roland's discovery while working for AU!

Roland's work will be assisted by a high-resolution magnetic gradiometer survey that MARV has contracted Balch Exploration Consulting to conduct. The high-resolution survey will outline the structural features that MARV believes are present at the Slip Gold Project!

MARV's 17,100 hectare Gander South Gold Project is located within 10km of the Dog Bay-Appleton-Grub Line fault system that hosts NFG's Queensway Gold Project and lies along strike from the Exploits Subzone boundary being explored by Exploits Discovery (CSE: NFLD), whose stock has gained by 208.1% over the last twelve months! NFLD's market cap of $113.42 million is nearly 8.25X larger than MARV's market cap at $0.185 per share of only $13.75 million!

MARV's 11,875 hectare Gander North Gold Project is located within 25km of NFG’s Queensway Gold Project and is contiguous to Sassy Resources (CSE: SASY)'s Gander North Gold Project. SASY's market cap of $34 million is nearly 2.5X larger than MARV's market cap at $0.185 per share of only $13.75 million!

Between MARV's Slip Gold Project, Gander South Gold Project, and Gander North Gold Project... MARV owns 32,675 hectares of mineral claims adjacent to NFG's Queensway Gold Project! Although NFG's Queensway Gold Project is the biggest recent gold discovery in the Newfoundland Gold Belt, Marathon Gold (TSX: MOZ)'s Valentine Gold Project has the largest known gold resource in the region. MOZ's Valentine Gold Project has a measured & indicated resource of 56.7 million tonnes grading 1.72 g/t gold for 3.14 million oz of contained gold!

MARV's 10,650 hectare Victoria Lake Gold Project is located within 18km of MOZ's Valentine Gold Project and exhibits similar style gold bearing veins and larger regional structures. Preliminary work on MARV's Victoria Lake Gold Project located several quartz-arsenopyrite veins returning grab samples ranging in value from 15.5 to 24.9 g/t gold and 18.6 to 139.9 g/t silver! MOZ has gained by 44.74% over the last twelve months and has a market cap of $774.2 million!

MARV's 19,075 hectare Hope Brook Gold Project is located directly adjacent to the Hope Brook Gold Project of NIA's recent gold stock suggestion First Mining Gold (TSX: FF). FF's Hope Brook Gold Project has an indicated resource of 5.5 million tonnes grading 4.77 g/t gold for 844,000 oz of contained gold! Big Ridge Gold (TSXV: BRAU) gained by 124.32% within 17 trading days of its June 8th closing on an earn-in agreement with FF to begin exploring its Hope Brook Gold Project! BRAU's market cap of $27.17 million is nearly 2X larger than MARV's market cap at $0.185 per share of only $13.75 million even though BRAU doesn't yet own any stake in FF's Hope Brook Gold Project or any other Newfoundland Gold Belt projects!

MARV's Hope Brook Gold Project is also directly adjacent to the Newfoundland Gold Belt projects of Sokoman Minerals (TSXV: SIC), whose stock has gained by 325% over the last twelve months! SIC's market cap of $95.5 million is nearly 7X larger than MARV's market cap at $0.185 per share of only $13.75 million!

Although NIA believes that MARV's 62,400 hectares of Newfoundland Gold Belt projects are what will attract the most interest from gold investors due to the 2021 Newfoundland Gold Belt boom... MARV has a potentially huge catalyst ahead due to the company's currently ongoing 16 hole diamond drilling campaign at its Blackfly Gold Project in Ontario!

MARV's 1,296 hectare Blackfly Gold Project is located along strike and within 14km of Agnico Eagle Mines (AEM)’s Hammond Reef Gold Deposit. AEM's Hammond Reef Gold Deposit has a large measured & indicated resource of 208 million tonnes grading 0.67 g/t gold for 4.5 million oz of contained gold! On July 8th, MARV disclosed in a press release that it had completed the first three diamond drill holes of the 16 drill holes planned for the summer field season. MARV's CEO said in reference to the first three completed drill holes that, "visually the core is looking very promising".

MARV explained in its press release, "The first 3 drill holes are now complete and core logging is underway. The field team believes that gold zones were reached in each hole with visible gold found in a vein intersected at a depth of 8m in drill hole BF21-15."

This is an extremely bullish sign... there is nothing better than finding visible gold especially when it is so close to the surface!

Click here to read MARV's July 8th press release!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from MARV of USD$50,000 cash for a six-month marketing contract. NIA has received compensation from FF of USD$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.