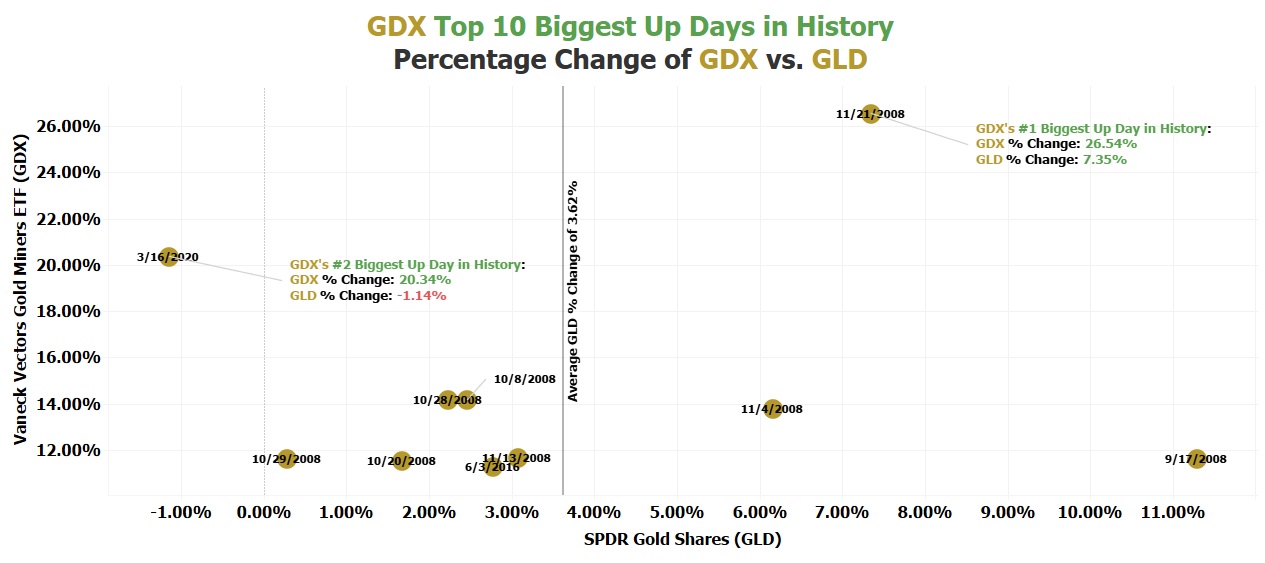

Monday was Vaneck Vectors Gold Miners ETF (GDX)'s #2 biggest up day of all-time with GDX achieving a gain of 20.34%. GDX's #1 biggest up day in history occurred back on November 21, 2008 when it gained 26.54%. GDX's #3 through #10 biggest up days in history all had gains of between 11.24% and 14.17%.

What makes yesterday so significant is the fact that GDX achieved its huge gain of 20.34% on a day that SPDR Gold Shares (GLD) declined by 1.14%. In comparison, back on November 21, 2008 when GDX gained by 26.54% it was on a huge gold up day with GLD gaining by 7.35%. On GDX's Top 10 biggest up days in history, GLD has made an average gain of 3.62%.

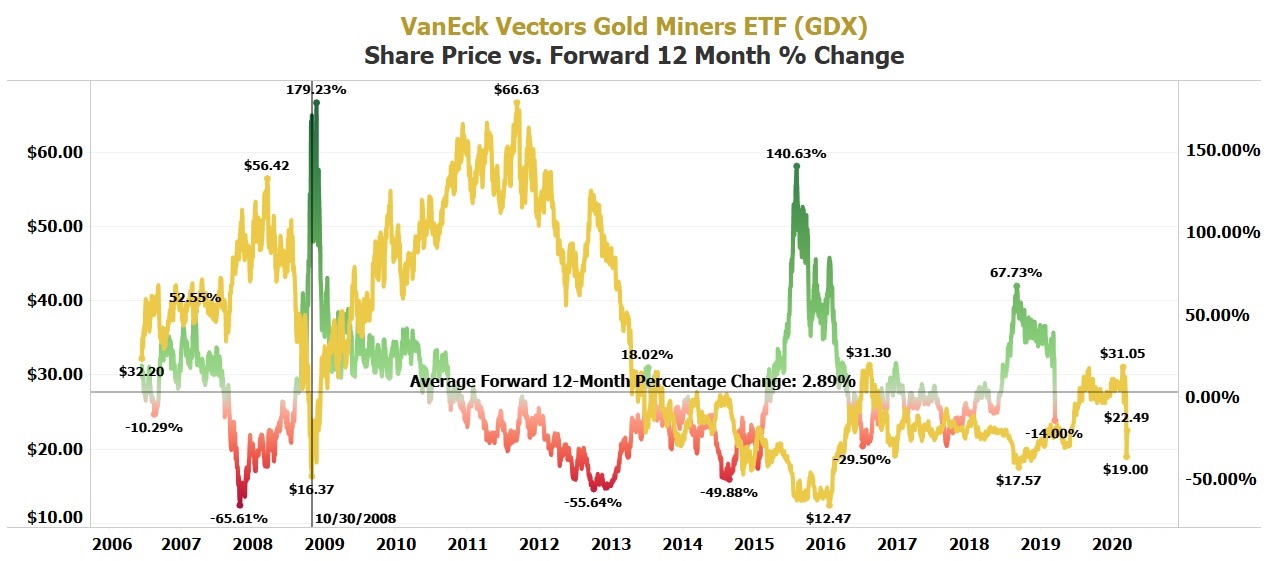

Yesterday was GDX's only Top 10 up day that occurred with GLD experiencing a decline! Prior to yesterday, GDX's largest gain on a day that saw GLD simultaneously decline by at least 1%, was on October 30, 2008 when GDX gained by 4.03% vs. GLD declining by 1.74%. Over the following twelve months, GDX gained by 95.25% for one of its largest one year gains in history!

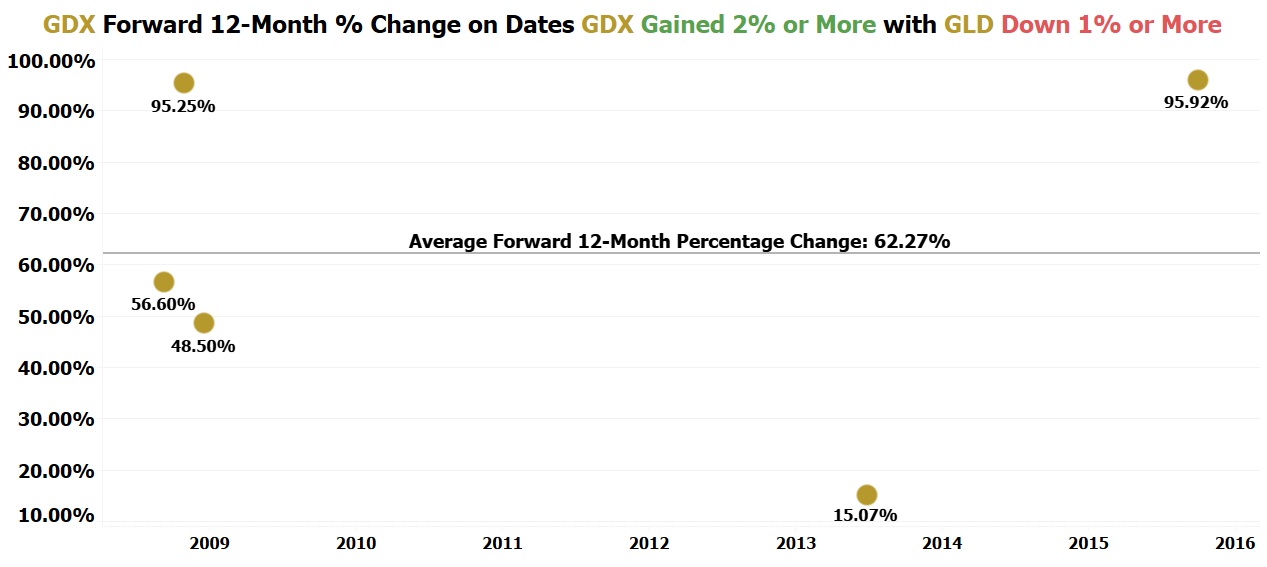

Monday was only the 6th time in history that GDX gained by 2% or more on a day that GLD declined by 1% or more! Prior to yesterday, it most recently occurred 4 1/2 years ago on September 30, 2015, when GDX gained by 2.46% vs.GLD declining by 1.04%. Over the following twelve months, GDX gained by 95.92% for one of its largest one year gains in history!

After the 5 previous occasions that GDX gained by 2% or more on a day that GLD declined by 1% or more, GDX has averaged a gain of 62.27% over the following twelve months! Not once has GDX ever declined during the twelve month period following this #1 most bullish indicator for gold mining stocks!

NIA strongly encourages its members to begin researching the stock: Idaho Champion Gold Mines Canada Inc. (CSE: ITKO). It closed yesterday at $0.075 per share. ITKO has discovered six high-grade, near-surface gold intercepts of between 4.80 g/t and 9.02 g/t over an average width of 5.29m in its very first drilling campaign at a brand new, unexplored gold project located in a Top 10 ranked mining jurisdiction and adjacent to a major new high-grade gold mine that is about to enter production... yet it is trading at a market cap of less than USD$5 million! Adding to the insanity, ITKO owns a second past producing Idaho gold project that previously produced approximately 25,000 oz of gold per year!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from ITKO of USD$30,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.