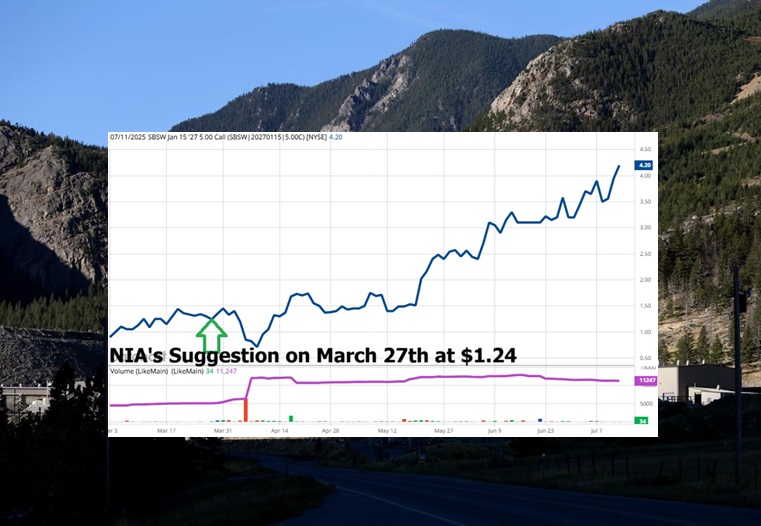

NIA’s SBSW Call Option Up 238.70%, NIA Members Profiting 7-Figures

NIA's Sibanye-Stillwater (SBSW) January 2027 $5 Call Option closed this week at a new high of $4.20 and…

Imagine Discovering 242m of 9.06 g/t Gold

Imagine discovering 242m of 9.06 g/t gold. It would be one of the best intercepts…

Titan Mining (TSX: TI) Hits New Multi-Year High

Titan Mining (TSX: TI) finished this week at a new multi-year high of $0.73 per…

Most Silver Stocks Are Extremely Overvalued

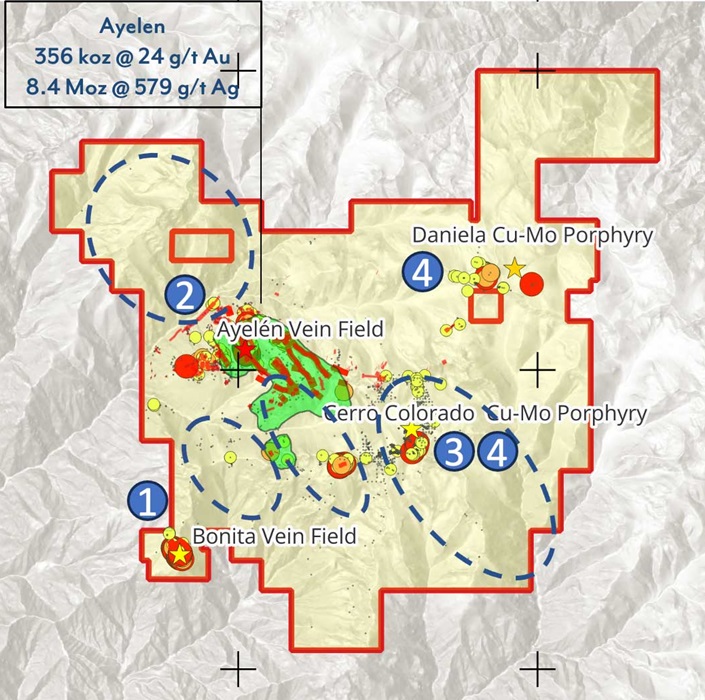

Most silver stocks are extremely overvalued relative to gold stocks. Highlander Silver (TSX: HSLV) we…

Highlander Silver (TSX: HSLV) Gains by 10.98% to $2.83 Up 102.14% Since NIA’s Feb 12th Suggestion

Highlander Silver (TSX: HSLV) gained by 10.98% today to $2.83 per share a new closing…

Minaurum (TSXV: MGG) Gains by 12.77% to $0.265, Fully Permitted High-Grade Silver

NIA's latest brand-new stock suggestion Minaurum (TSXV: MGG) gained by 12.77% today to $0.265 per…

Focus on Fully Permitted Gold/Silver Projects

The endangered tiny little desert fish Speckled Dace near the Beatty Gold District is something…

Augusta Gold (TSX: G) Gains by 2.96% to $1.39 Per Share

Augusta Gold (TSX: G) gained by 2.96% today to $1.39 per share and has the…

Hydreight (TSXV: NURS) Gains 19.60% to $2.38 Up 103.42% Since NIA’s Suggestion

NIA's #1 favorite technology stock suggestion Hydreight (TSXV: NURS) gained by 19.60% today to $2.38…

TSX Venture World’s Largest Gaining Market

The TSX Venture Composite Index is today's largest gaining market with an increase of 1.70%…