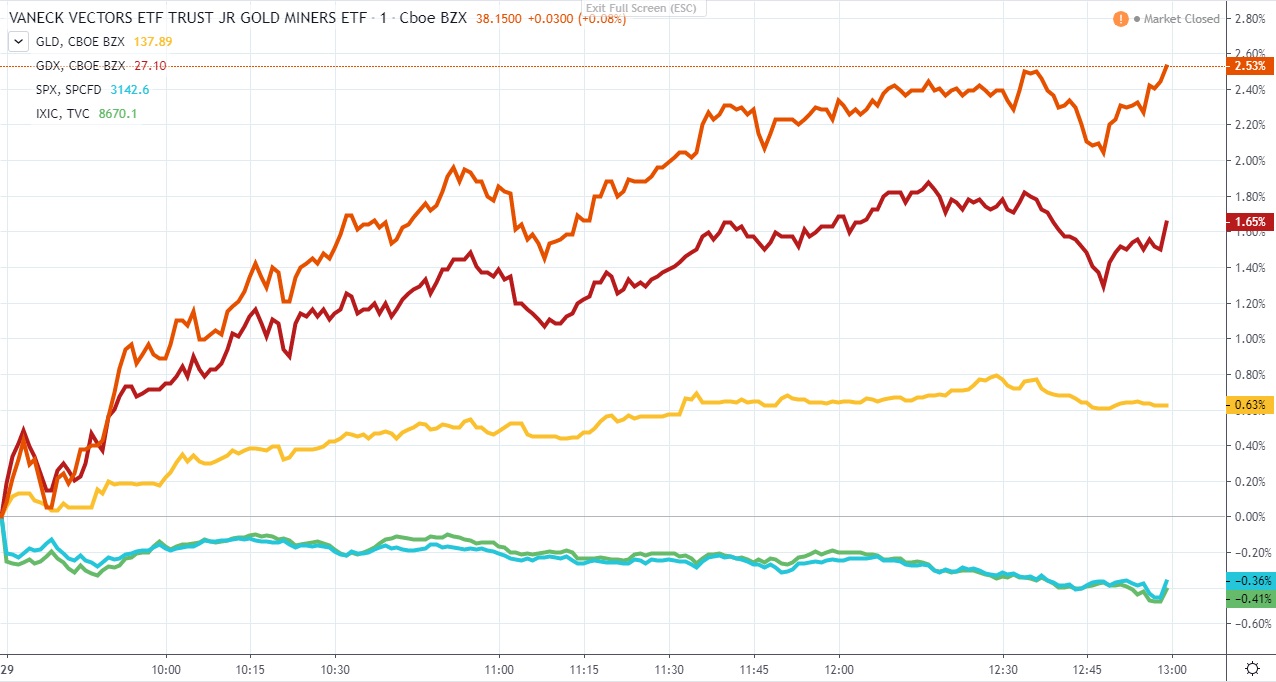

On Friday's half day of trading, VanEck Vectors Junior Gold Miners ETF (GDXJ) gained by 2.53% or 4.02X more than SPDR Gold Shares (GLD)'s gain of 0.63%. GDXJ is beginning to well outperform VanEck Vectors Gold Miners ETF (GDX), which gained by 1.65% or 2.62X more than SPDR Gold Shares (GLD)'s gain of 0.63%. Both the S&P 500 and NASDAQ declined on Friday by -0.36% and -0.41%, respectively.

On a full week basis, GDXJ's outperformance of GDX was much more pronounced. GDXJ gained last week by 3.02% or 6.29X more than GDX's gain of only 0.48%. The fact that GLD actually declined last week by -0.39% vs. both GDXJ and GDX posting gains was a very bullish sign that gold stocks are extremely undervalued relative to the price of gold with a much larger rally now imminent!

The GDXJ/GLD ratio, which shows the valuation of junior gold miners relative to the price of gold, surpassed its key breakout point on Tuesday of last week. This past Friday, the GDXJ/GLD ratio exploded past its 100-day moving average to finish last week at its highest closing price in over two months. Its chart appears to be setup perfectly right now for a major upward explosion.

The GDXJ/GDX ratio, which shows the valuation of junior gold miners relative to large-cap gold miners, exploded past its key breakout point on Friday. Previously, each time that the GDXJ/GDX ratio hit its resistance level, it simutaneously had a relative strength index (RSI) of approximately 67-69. On Friday, not only did the GDXJ/GDX ratio break through its resistance level, but it did so with a much lower RSI of less than 62. This means junior gold miners have a lot more catching up to do with large-cap gold miners in the short-term.