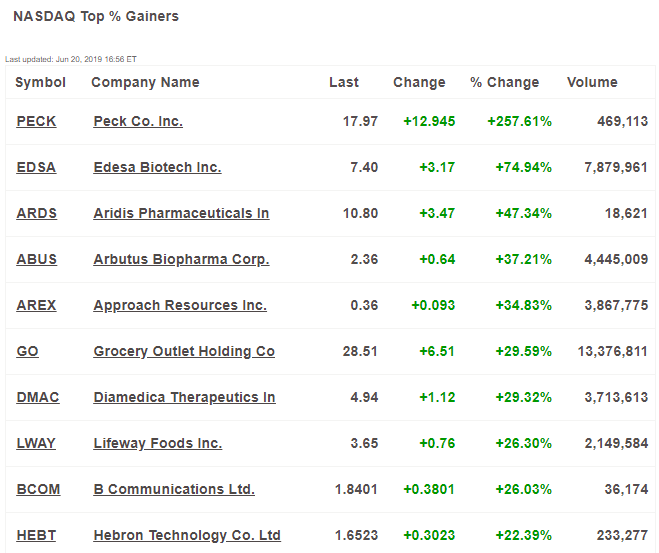

NIA's #2 favorite overall stock suggestion Lifeway Foods (LWAY) was the NASDAQ's 8th largest percentage gainer on Thursday exploding $0.76 or 26.30% to close at $3.65 per share on record volume of 2,154,100 shares! LWAY reached a high of day of $4.75 per share for a gain of 126.2% from NIA's initial June 7th suggestion at $2.10 per share!

Yesterday morning with LWAY trading for $2.89 per share, NIA sent out an alert entitled, 'Huge NIA Morning Update!'. In this alert NIA said, "Look for LWAY to return to a minimum of $4.63 per share in the short-term!" NIA's prediction came true only hours later!

Back on June 7th, NIA announced Lifeway Foods (LWAY) at $2.10 per share as its new #1 pea protein stock suggestion. NIA explained in its initial alert that, "LWAY's enterprise value at $2.10 per share is only $35.32 million with trailing twelve month revenues of $99.22 million. LWAY's current enterprise value/revenue ratio at $2.10 is only 0.355!"

NIA predicted on June 7th that LWAY was about to explode due to its new Plantiful line of pea protein beverages. NIA explained that Beyond Meat (BYND) has been the hottest IPO of the decade rising from from its IPO price of $25 per share to a high of over $200 per share due to its plant-based meat containing pea protein and LWAY is the only other publicly traded company to have launched a major plant-based product based on pea protein!

On the morning of June 10th, with LWAY trading up to $2.40 per share, NIA sent out an alert entitled, 'Why LWAY is About to Explode'. NIA described LWAY as a major turnaround situation and discussed how during 1Q 2019 the company generated positive free cash flow of $1.05 million its highest quarterly free cash flow of the past two years. NIA showed how when LWAY generated similar free cash flow of $1.17 million in 1Q 2017, LWAY was trading for $10.73 per share!

NIA said in this alert, "LWAY is getting ready to test its medium-term key breakout point of $2.56 per share. If LWAY can successfully break through $2.56 per share this week, it could explode very quickly back into the $5-6 per share range."

Later on June 10th, NIA sent out an afternoon update entitled, 'LWAY Surpasses Key Breakout Point'. NIA began this update by saying, "Lifeway Foods (LWAY) has just surpassed its medium-term key breakout point of $2.56 per share and is up by $0.26 or 10.78% to $2.66 per share! With Beyond Meat (BYND) just hitting a market cap this afternoon of $10 BILLION or 62.19X its current revenue run rate, LWAY in our opinion is a sure thing to explode from its current market cap of only $42.03 million or 0.45X its current revenue run rate!"

NIA went onto explain how, "LWAY traded as high as $22.38 per share back on March 30th, 2015. At that time, LWAY had an enterprise value of $363.8 million, which valued the company at 3.06X its trailing twelve month revenues of $118.96 million. Currently at $2.66 per share, LWAY is down 88.11% from its March 2015 all-time high, even though its revenues have only declined by 16.59% to $99.22 million!"

NIA pointed out that not only has LWAY seen no dilution since March 2015, but it has actually repurchased 560,000 shares since then, thereby reducing its shares outstanding from 16.35 million down to 15.79 million. NIA stressed that LWAY didn't borrow the money to repurchase these shares, but has actually repaid $4.326 million in debt since March 2015 including $1.33 million that LWAY repaid last quarter alone! LWAY reduced its debt by 22% last quarter and has reduced its debt by 48% since March 2015!

In this same update, NIA explained, "LWAY's 1Q 2019 revenues grew sequentially by 6.87% from 4Q 2018 to $24.61 million! Meanwhile, LWAY's gross margins saw a significant improvement! LWAY's 1Q 2019 gross profit grew sequentially by 23.71% to $6.303 million!"

NIA predicted that LWAY's enterprise value/revenue ratio would soon return to its 3-year median of 1.112, which would currently value LWAY at $6.85 per share!

One week later on June 17th, NIA officially announced LWAY at its then price of $2.52 per share as its #2 favorite overall stock suggestion, giving LWAY a confidence rating of 95 (on a scale of 1 to 100). NIA began this LWAY report by explaining, "One of the reasons NIA is so extremely confident that Lifeway Foods (LWAY) will explode back to $6.85 per share in the short-term to trade once again at its trailing three year median enterprise value/revenue ratio of 1.112 is the fact that LWAY's shares are very tightly held. Insiders (directors and management) own a combined 8,117,746 shares or 51.3% of LWAY's shares outstanding. LWAY's largest independent shareholder is Danone SA (BN.PA) the world's largest yogurt company! Danone owns 3,454,756 LWAY shares for a 21.8% stake in the company!"

NIA explained that Danone originally purchased a 20% stake in LWAY back in 1999 at $2.50 per share, paying a 33.33% premium at the time, and saw its stake gradually increase to 21.8% as LWAY repurchased $14,186,000 worth of shares over the last two decades! NIA found it significant that, "Despite LWAY rising over the following 15 years (after Danone's investment) to a March 30, 2015 all-time high of $22.38 per share valuing Danone's stake at $77.317 million for a profit of $68.68 million ($69.2 million including dividends) Danone NEVER sold a single share!"

On the morning of June 19th, NIA sent out an alert entitled, 'LWAY is Getting Ready to Explode!' In this alert, NIA said, "BYND's market cap has just surpassed $12 BILLION despite having a current annualized revenue run rate of only $160.824 million, which is valuing BYND at nearly 75X revenue! LWAY already has trailing twelve month revenue of $99.22 million and we expect LWAY's revenues to begin growing rapidly once again in 2020 after Plantiful launches sales at major retailers between now and year end. LWAY dominates the U.S. Kefir market and despite its revenues declining by a total of 20% from its 2016 peak of $123.88 million, the U.S. market for probiotics is growing rapidly due to the new "gut health" trend. Plantiful will allow LWAY to capture the HUGE market of U.S. vegans who want probiotics and a healthy gut. LWAY has invested big on expanding its manufacturing capacity in recent years and already has the ability to produce $500 million worth of annual product completely in-house!"

We believe LWAY will be double digits in the near-future!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has purchased 10,000 shares of LWAY and intends to sell for a profit in the future. Never make investment decisions based on anything NIA says. This message is meant for informational and educational purposes only and does not provide investment advice.