Samsung has not only acquired an 8.7% stake in Canada Nickel Company (TSXV: CNC), but they received a right to purchase a 10% equity interest in the Crawford project for only US$100.5 million upon a final construction decision valuing the project at US$1.005 billion. Will this deal that CNC signed with Samsung upset Agnico Eagle Mines, which just acquired a larger 12% stake in CNC weeks ago? Agnico Eagle Mines purchased a larger stake in CNC, but they didn't receive a right to purchase a 10% equity interest in the Crawford project at a valuation of only US$1.005 billion! The Feasibility Study for Crawford shows a Net Present Value of US$2.5 billion and that's not including projected Carbon Capture and Storage tax credits, which increase its Net Present Value to US$2.6 billion!

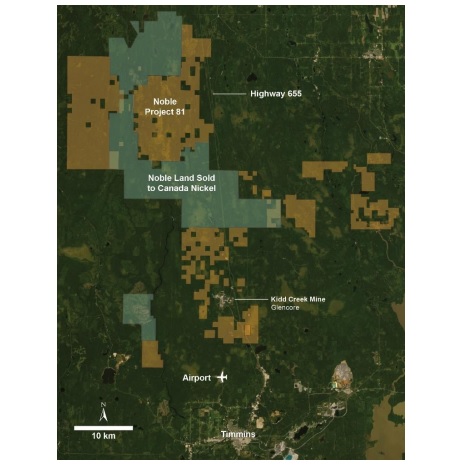

CNC's Crawford Net Present Value of US$2.5-$2.6 billion isn't including Noble Mineral Exploration (TSXV: NOB)'s Mann Northwest/Mann Central with CNC set to release drilling results within weeks!

After Texas Gulf Sulphur Company's discovery of Kidd Creek, not only did Texas Gulf Sulphur Company rise from $30 per share up to over $100 per share but there were many lower market cap stocks that made much larger gains than Texas Gulf Sulphur Company including Viola MacMillan's Windfall Oils and Mines, which rose from $0.56 per share on July 3, 1964, up to $4.70 per share on July 13, 1964, and touching $5.60 per share at one point, simply because they owned properties near Kidd Creek that were once optioned to Texas Gulf Sulphur Company.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from NOB of US$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.