TRT: Possible Rivian R2 Connection

If you read Trio-Tech International (TRT)'s press release from Wednesday, we know that TRT developed…

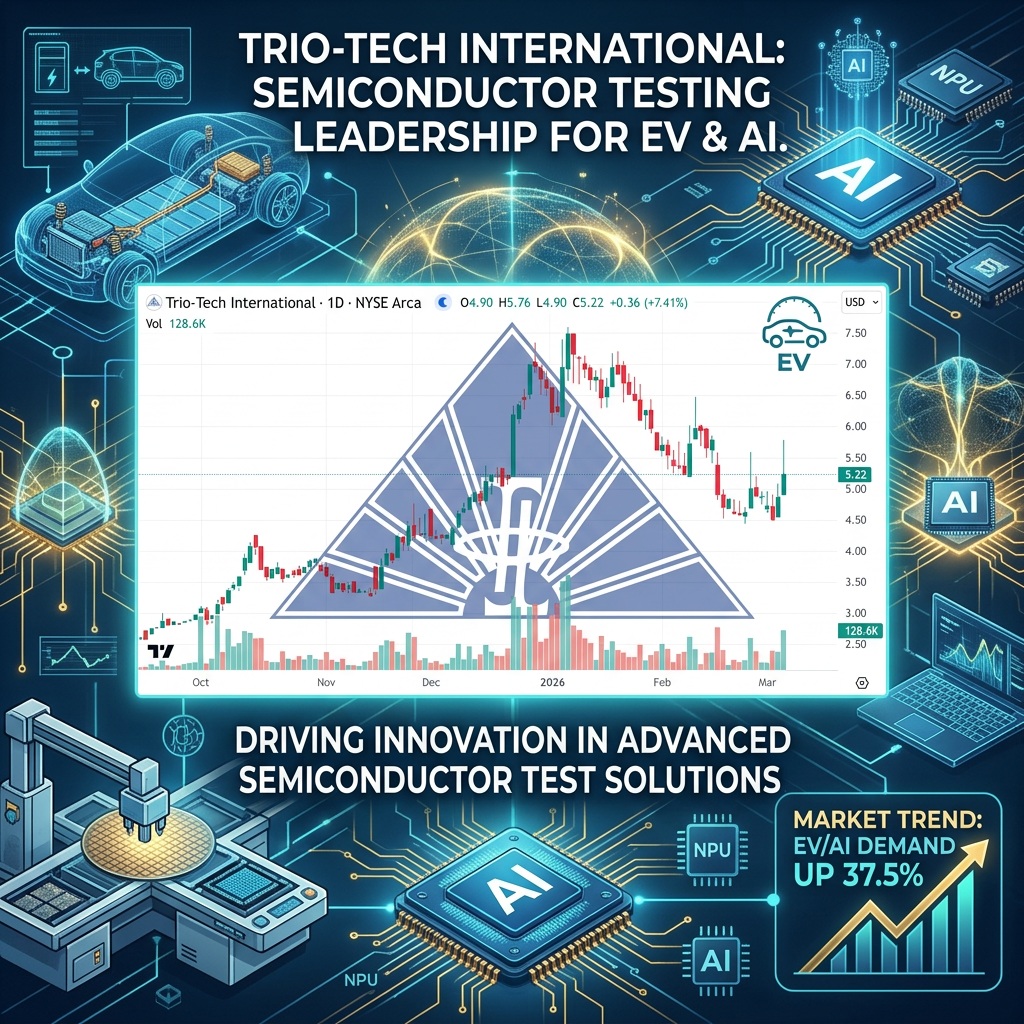

TRT Gains 7.41% to $5.22 and Has 100% Chance of Going Much Higher

Trio-Tech International (TRT) gained by 7.41% today to $5.22 per share and has a 100%…

The Safest Stocks in Today’s Market

In NIA's opinion, Trio-Tech International (TRT) is the safest stock in the market with a…

Going “All-In” on Trio-Tech International (TRT)?

We currently have the biggest stock market bubble in world history, and Trio-Tech International (TRT)…

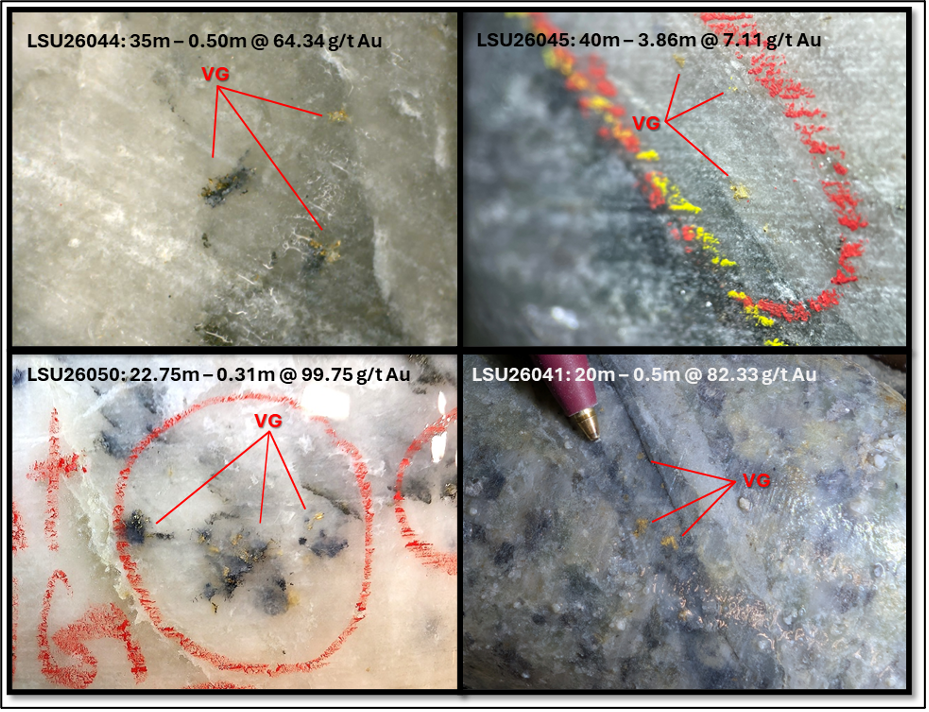

NIA’s #2 Overall Pick Wins $2.5M Automotive Semiconductor Order

Trio-Tech International Secures Production Burn-In Order from a Leading Integrated Device Manufacturer, Strengthening its Automotive…

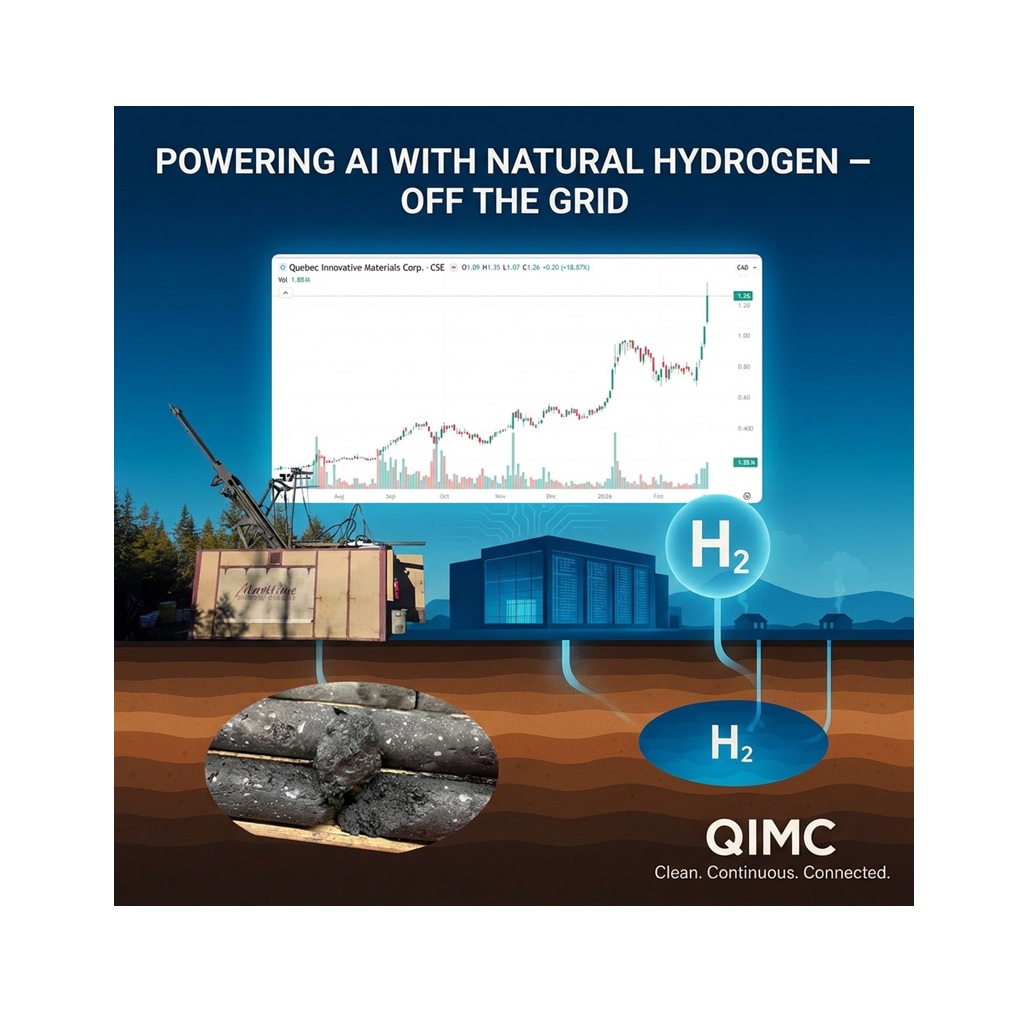

QIMC Soars 9.52% to New All-Time High of $1.38, Intersects Third Hydrogen-Bearing Structural Zone

QI Materials (CSE: QIMC) is the biggest discovery of our careers and surged by 9.52%…

Kevin Bambrough’s Ability to Trick Low IQ Investors

When Tesla (TSLA) had its IPO on June 29, 2010, at a split-adjusted $1.13 per…

QIMC Soars to New All-Time High as Natural Hydrogen Momentum Builds

QI Materials (CSE: QIMC) surged by 18.87% today to a new all-time high of $1.26…

Will Capybara Research Be Proven Wrong About Hydrograph Clean Power?

We have no idea who Capybara Research is, but they seem to be always right.…

NIA’s Biggest Week Ever Is Ahead

Perpetua Resources (PPTA) closed Friday at a new all-time high of $36.86 per share with…