NIA's report that we sent out a few hours ago was strictly focused on showing you why gold has almost no risk of declining in 2022, despite every major bank, every social media influencer, and every CNBC guest being extremely bearish on gold for 2022 making it the world's #1 most hated asset.

We did not discuss gold's upside potential for 2022:

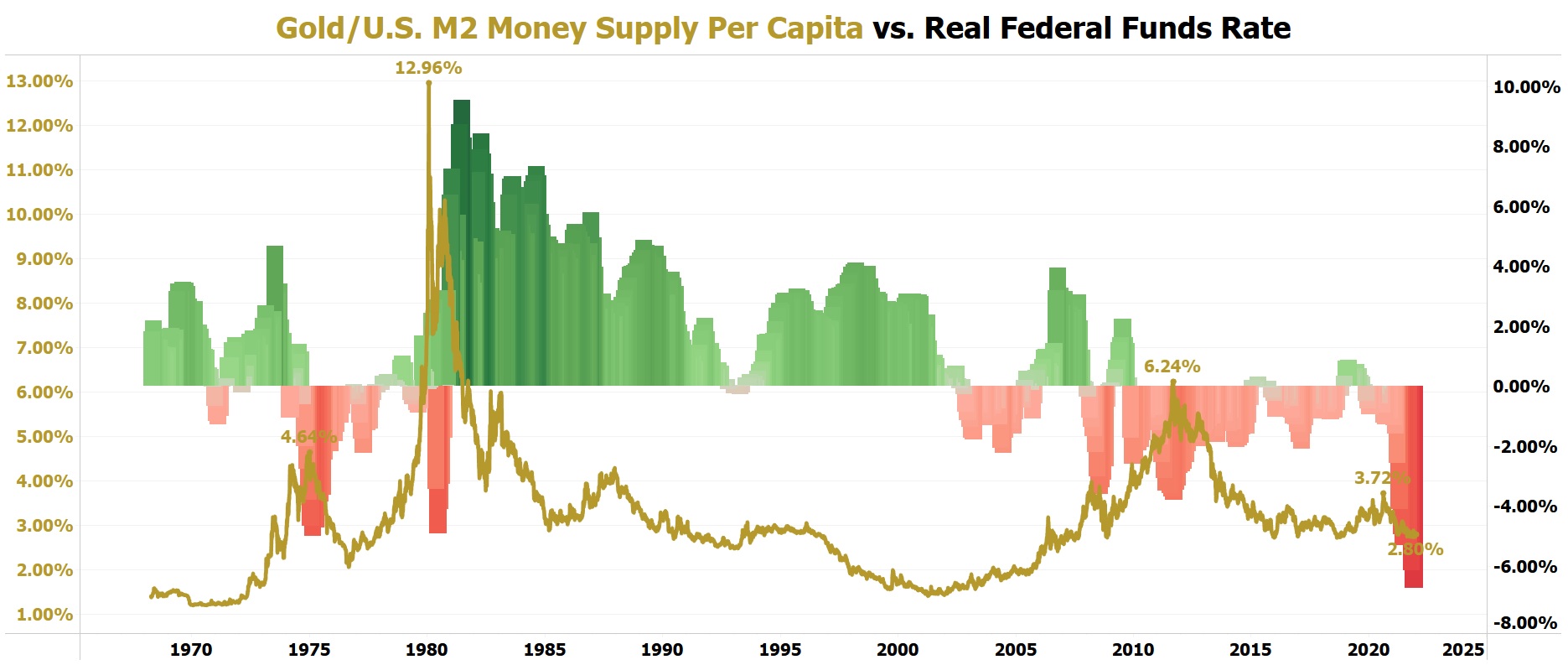

On January 21, 1980, when gold closed at $850 per oz, U.S. M2 Money Supply Per Capita was $6,560. Gold was priced at 12.96% of U.S. M2 Money Supply Per Capita. Based on current U.S. M2 Money Supply Per Capita of $64,575, a return for gold to its all-time high valuation equal to 12.96% of U.S. M2 Money Supply Per Capita would value gold today at $8,368.92 per oz.

On September 6, 2011, when gold closed at $1,895 per oz, U.S. M2 Money Supply Per Capita was $30,392. Gold was priced at 6.24% of U.S. M2 Money Supply Per Capita. Based on current U.S. M2 Money Supply Per Capita of $64,575, a return for gold to its most recent secular bull market high equal to 6.24% of U.S. M2 Money Supply Per Capita would value gold today at $4,029.48 per oz.

On December 30, 1974, when gold closed at $195 per oz, U.S. M2 Money Supply Per Capita was $4,205. Gold was priced at 4.64% of U.S. M2 Money Supply Per Capita. Based on current U.S. M2 Money Supply Per Capita of $64,575, a return for gold to its mid-1970s cyclical bull market high equal to 4.64% of U.S. M2 Money Supply Per Capita would value gold today at $2,996.28 per oz.

On August 6, 2020, when gold closed at $2,067 per oz, U.S. M2 Money Supply Per Capita was $55,534. Gold was priced at 3.72% of U.S. M2 Money Supply Per Capita. Based on current U.S. M2 Money Supply Per Capita of $64,575, a return for gold to its most recent short-term peak equal to 3.72% of U.S. M2 Money Supply Per Capita would value gold today at $2,402.19 per oz.

The #1 way to capitalize on rising gold prices in 2022 is with North Peak Resources (TSXV: NPR). Tomorrow morning, NPR will reopen for trading for the first time this week. NPR is getting ready to make its largest short-term rally in history.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 200,000 shares of NPR in the open market. This message is meant for informational and educational purposes only and does not provide investment advice.