U.S. Listed Gold/Silver Mining Stocks have just entered into the Extreme Buying Opportunity Zone in recent days with the industry's median enterprise value/revenue ratio of 2.41 being one of its lowest multiples in history!

Over the long-term, U.S. Listed Gold/Silver Mining Stocks have averaged a median enterprise value/revenue ratio of 5.05.

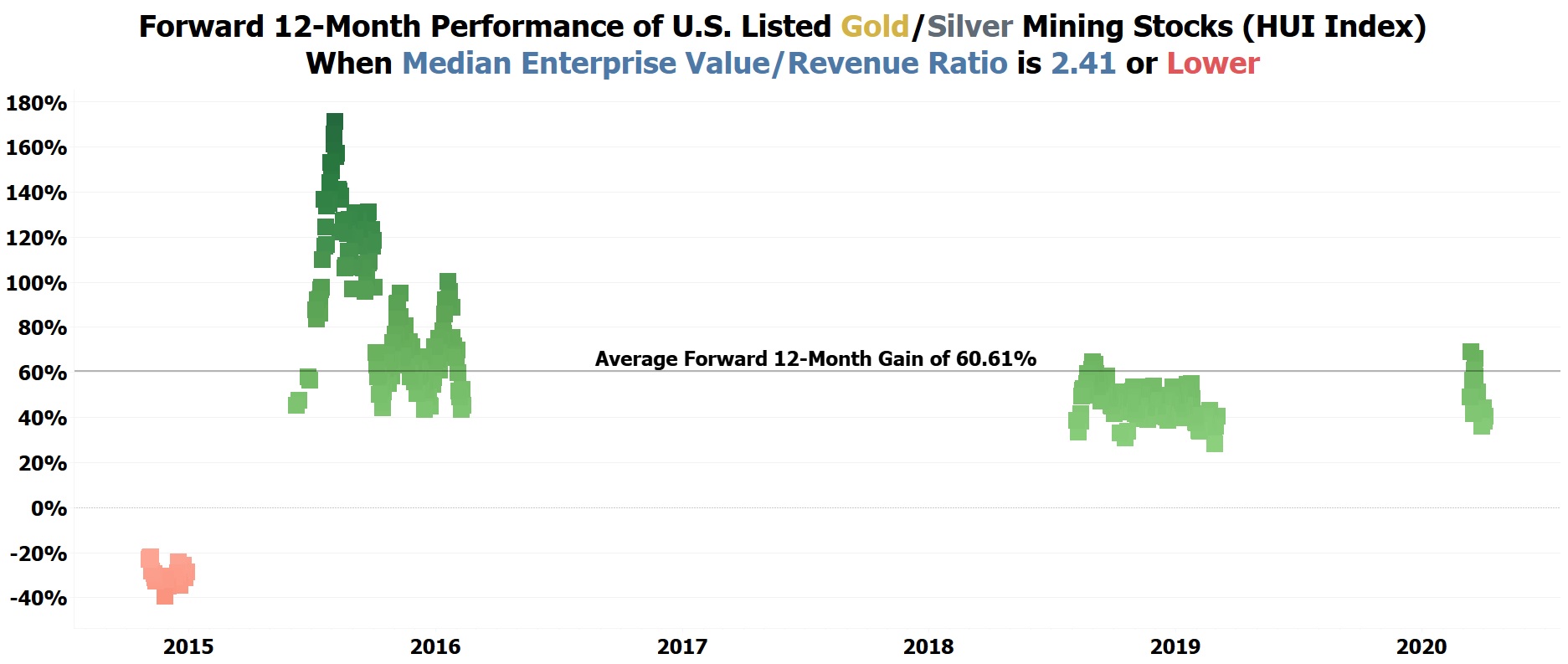

When the industry's median enterprise value/revenue ratio is at the current level of 2.41 or lower, U.S. Listed Gold/Silver Mining Stocks average a gain of 60.61% over the following 12-month period!

Augusta Gold (TSX: G) is likely to gain at least 5-10X more than the average Gold/Silver Mining Stock. G is set to become Nevada's next low-cost gold producer in 2023!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 174,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.