NIA's methods of analyzing gold and other precious/base metals and commodities have always been 100% unique from any other organization in the world, but they have consistently been proven to be the most accurate in the world.

One year ago, the whole world became extremely bullish on Crypto about eight months too late. On June 10, 2020, with Bitcoin in a bear market and trading for less than $9,800, NIA sent out an alert predicting that Millennials/Gen-Zers who were "receiving large stimulus and enhanced unemployment benefits but having nowhere to go shopping or on vacation to spend their newly printed money... with almost everything closed over the Great Covid Hoax of 2020" would begin "loading up on Bitcoin and other Cryptocurrencies" and "Voyager Digital from its current price of $0.60 per share is about to become the new Robinhood of the Cryptocurrency market."

In the hours following NIA's alert, VOYG gained by 45% to hit a new all-time high of $0.87 per share on record volume. Over the following five weeks, despite Bitcoin declining another 6% and dropping below $9,200, NIA sent more alerts about VOYG than any other company as it made an initial gain of 126.67% to hit a new all-time high on July 15, 2020, of $1.36 per share. VOYG would go onto gain by 6,200% from NIA's suggestion price to hit a high of $37.80 per share. On December 14th, NIA sent out an alert suggesting to sell VOYG short at $15.41 per share saying, "Consider selling Voyager Digital short. It looks like they have loaned $382.69 million of client funds to Celsius, which we previously warned you is a likely ponzi scheme." Since NIA's VOYG short suggestion it has declined by 38.74% to $9.44 per share.

On February 3rd with gold trading at $1,804 per oz, NIA sent out an alert entitled, 'Gold has 100% Chance of Gaining Over the Next 3, 6, and 12-Month Periods'. Over the last two weeks, gold has gained by $96 to settle this week at $1,900 per oz. By year-end 2022, everybody who was previously investing into Crypto, will begin investing into gold.

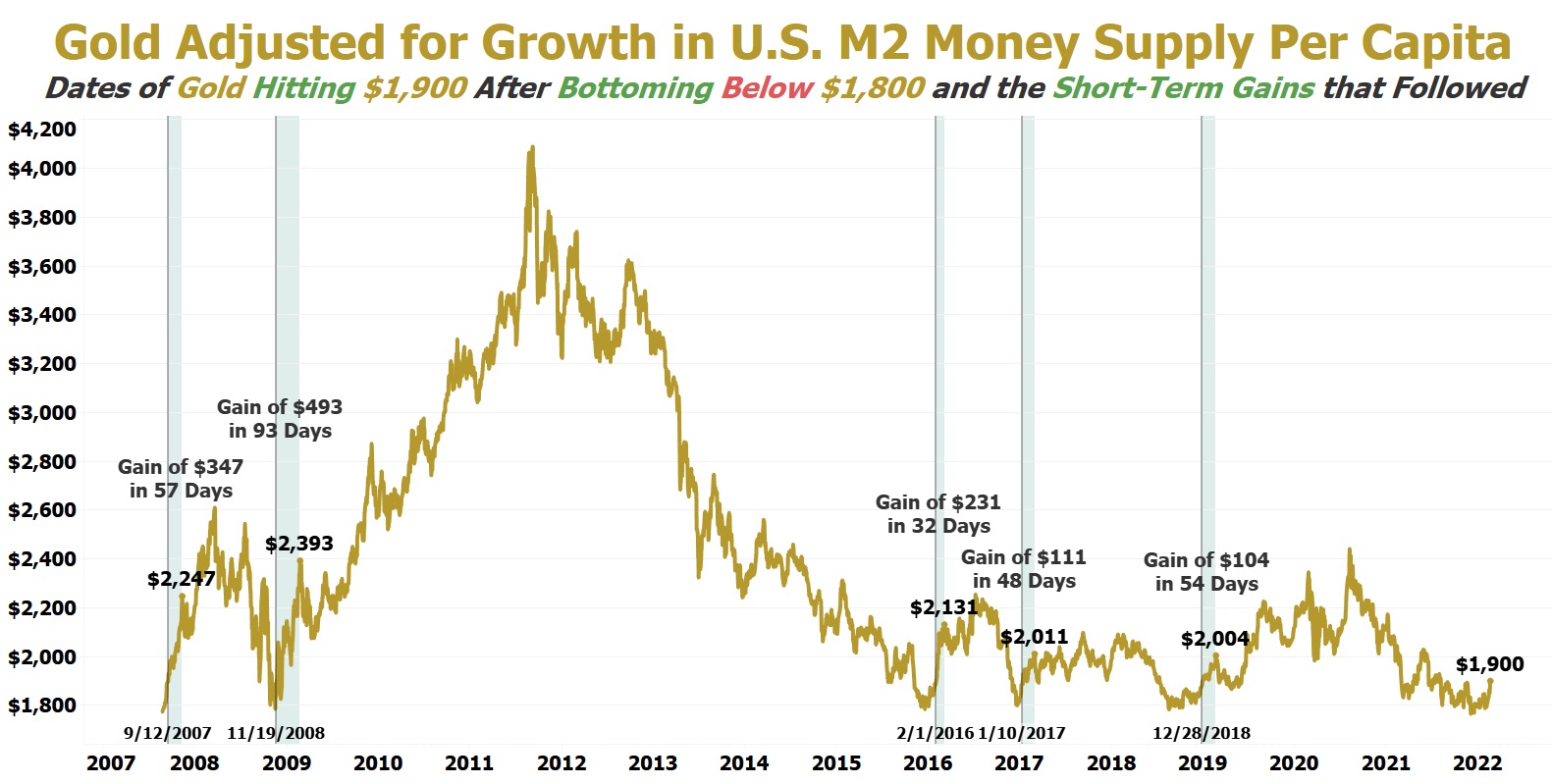

NIA has just created an exclusive brand new gold chart showing historical gold prices over the last 15 years adjusted for growth in U.S. M2 Money Supply Per Capita. Prior to gold bottoming on December 2, 2021, at $1,765 per oz, gold since 2007 bottomed on five previous occasions at prices slightly below $1,800 per oz. When gold bottoms below $1,800 per oz and returns to $1,900 per oz... gold's next short-term move is always significantly higher!

Gold's smallest rally after hitting $1,900 per oz began on December 28, 2018 when it gained by $104 to $2,004 per oz over the following 54 calendar days.

Gold's largest rally after hitting $1,900 per oz began on November 19, 2008 when it gained by $493 to $2,393 per oz over the following 93 calendar days.

After the Fed launched its last rate hike cycle on December 17, 2015, gold hit $1,900 per oz on February 1, 2016. Over the following 32 calendar days, gold gained by $231 to $2,131 per oz.

Over the last 15 years on an M2 Money Supply Per Capita Adjusted basis, when gold returns to $1,900 per oz after bottoming below $1,800 per oz, gold averages a gain of $257 to $2,157 per oz over the following 57 calendar days.

Gold is likely to hit a new all-time high of above $2,075 per oz at the end of March 2022. If gold hits a new all-time high next month while North Peak Resources (TSXV: NPR) announces a significant high-grade gold discovery at the Black Horse Gold Project in Nevada... we will almost definitely see NPR explode to above $15 per share next month. NPR's U.S. OTC symbol is BTLLF.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 201,000 shares of NPR in the open market and intends to buy more shares. NIA was compensated by VOYG USD$60,000 cash for a one-year marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.