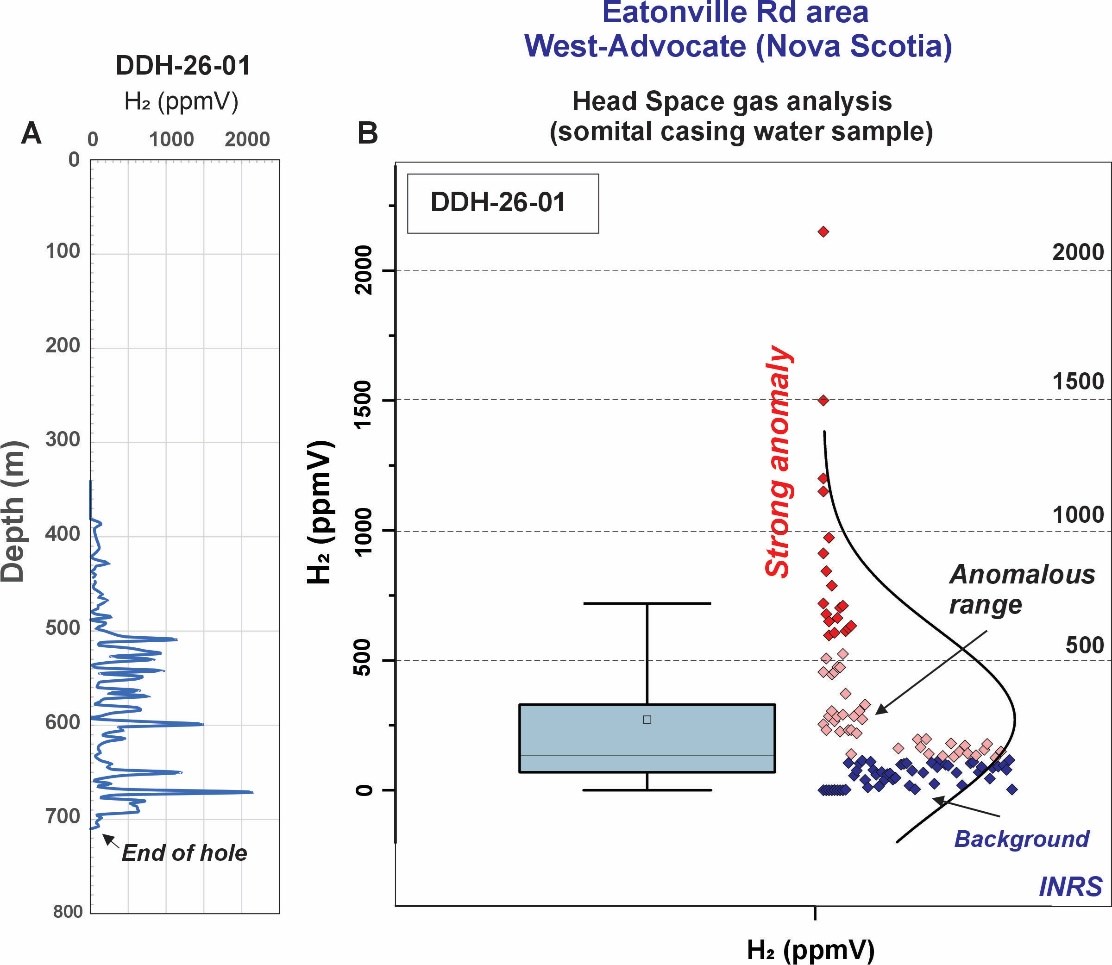

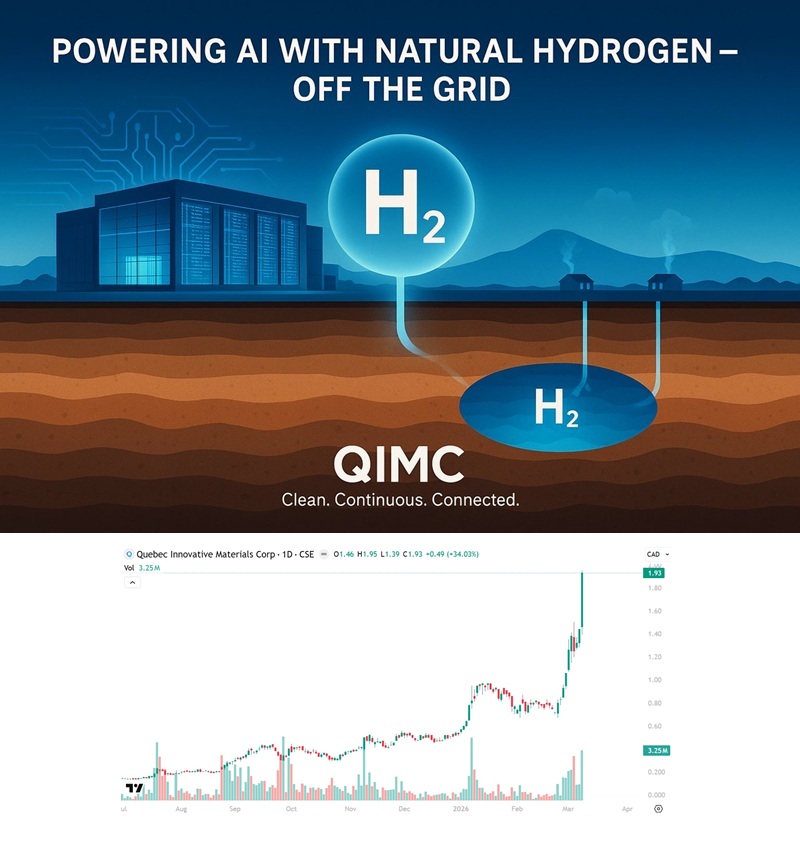

QIMC Completes 711 Metre Discovery Hole, Hydrogen System Confirmed at Depth

QIMC Completes 711 Metre Discovery Hole DDH-26-01 at West-Advocate, Nova Scotia: Hydrogen System Confirmed at…

CTGO’s Acquisition of DVS the Best in History?

What we meant to say earlier is: "Contango ORE (CTGO) shareholders are about to vote…

NIA Tuesday Morning Update: Huge Day Ahead

QI Materials (CSE: QIMC) still has a market cap of only CAD$248.02 million when Koloma…

Trio-Tech (TRT) Fair Value = $131.53 Per Share

Trio-Tech International (TRT)'s fair value is now $131.53 per share after Aehr Test Systems (AEHR)…

We Are Being Honest Unlike Kevin Bambrough

Hydrograph Clean Power (CSE: HG) continues to go up despite no revenue or any legit…

TRT Gains for Fourth Straight Day

This weekend, NIA explained Trio-Tech International (TRT) is the safest stock we have ever suggested…

Natural Hydrogen in Infancy Like Bitcoin in 2015, QIMC Soars 34.03% to New All-Time High

Over the weekend, NIA explained QI Materials (CSE: QIMC) is the highest risk stock we…

NIA Sunday Evening Update: Must Read Immediately

In NIA's opinion, the only investment better than owning a massive resource of gold and/or…

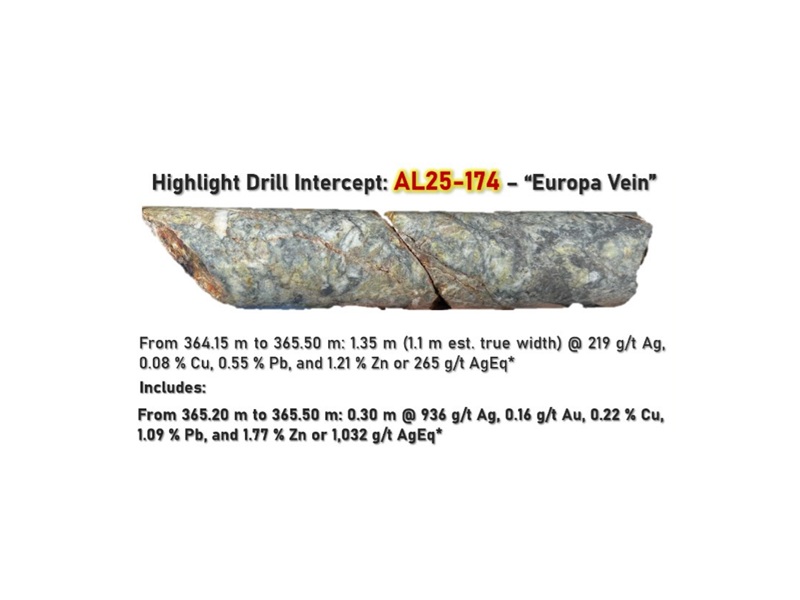

Highlander Silver NYSE Trading Begins on Wednesday

Highlander Silver (TSX: HSLV) will list on the NYSE American Exchange beginning on Wednesday under…

Will TRT Be $50+ Within Months?

Trio-Tech International (TRT) gained for its third straight day on Friday surging 4.79% to $5.47…