Yesterday, Business Insider published an article about what a smaller repackaged Build Back Better Bill will look like.

The article said, "Democrats increasingly view the Build Back Better bill as their last chance to enact sweeping measures to mitigate the heating of the planet." It explained, "Much of the legislation is devoted to a series of tax credits and incentives meant to smooth the transition from fossil fuels to cleaner energy sources like wind and solar power." According to Business Insider, "Manchin appears to favor that chunk of the bill over the rest."

Manchin was quoted as saying, "The climate thing is one that we probably can come to an agreement much easier than anything else, there's a lot of good things in there."

We've been studying this for weeks to try to determine what stocks will benefit most from a smaller Build Back Better Bill being approved.

Perhaps the only stock that will benefit more than Broadwind (BWEN) from a smaller Build Back Better Bill being approved is a company called First Tellurium (CSE: FTEL).

On December 16, 2021, S&P Global published a report, "First Solar's growth plans hinge on opaque market for tellurium". Click here to read this report.

According to S&P Global, "First Solar Inc.'s plan to double its manufacturing capacity and chip away at Beijing's dominance of the solar market depends on a rare critical mineral produced largely in China."

The report explains, "The Biden administration has held up First Solar as a model for domestic manufacturing, and the U.S. Government Accountability Office said in a November report that the company's cadmium telluride solar modules could help cut the industry's production costs. However, the technology's reliance on tellurium, a semiconductor typically produced as a byproduct of copper refining, raises concerns about raw material shortages."

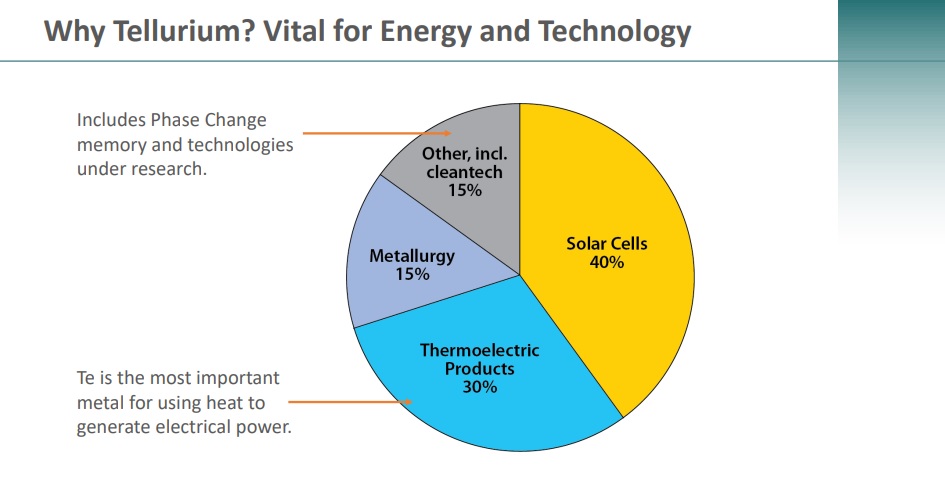

FTEL is the only publicly traded company focused on the exploration of high-grade North American tellurium deposits.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from FTEL of USD$100,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.