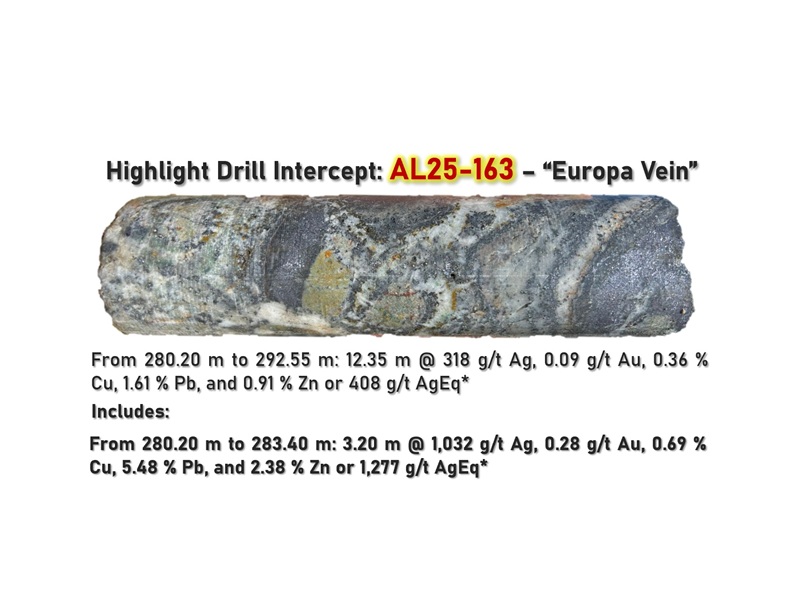

MGG Hits 1,277 g/t AgEq in 250m Step-Out at Alamos

Minaurum Drills High-Grade Silver in 250 m Step-Out at Alamos Silver Project: 12.35 m of…

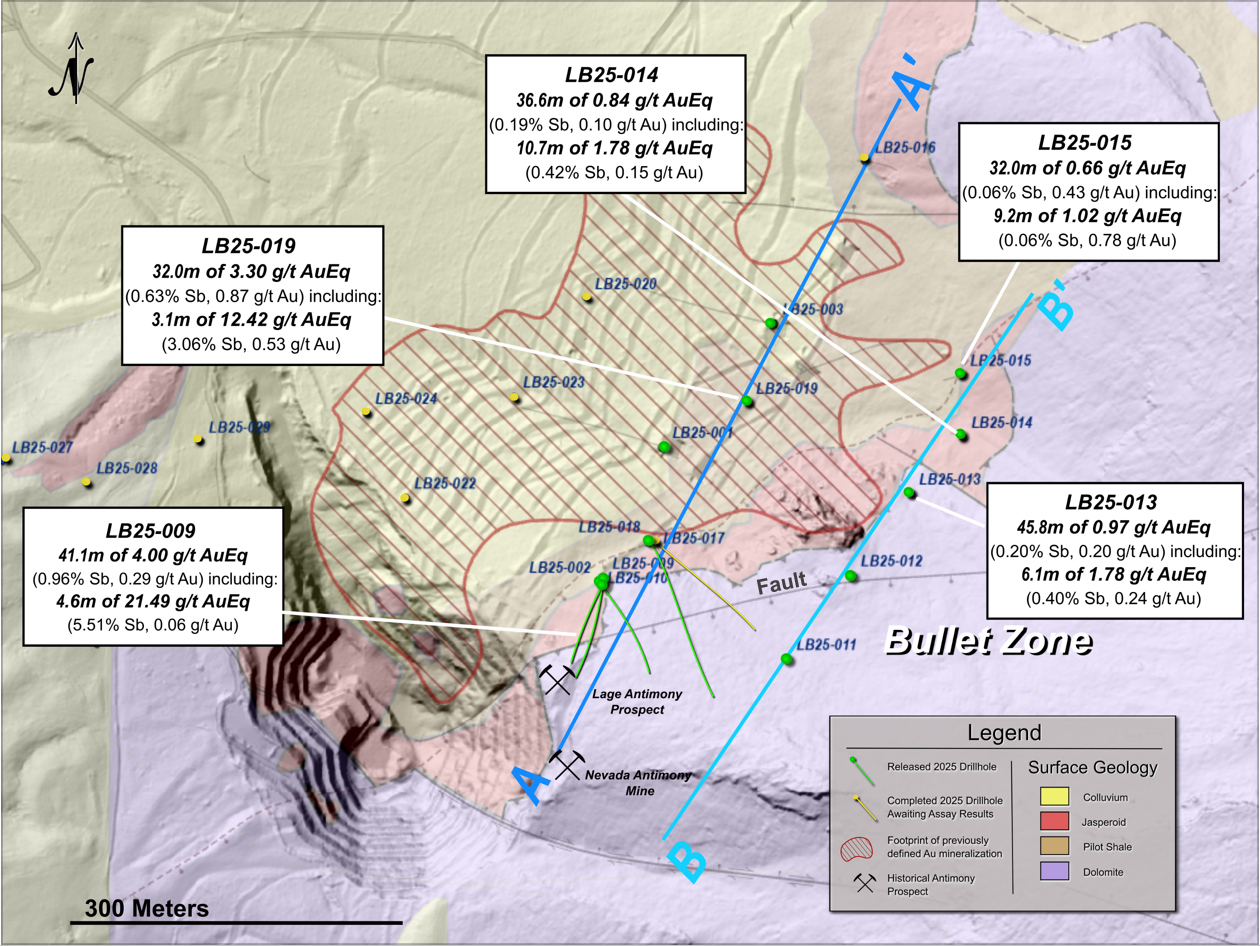

NevGold Hits 12.42 g/t AuEq Oxide Gold-Antimony in Nevada

NevGold – Limousine Butte Gold-Antimony Drill Results NevGold Intercepts 12.42 g/t AuEq Oxide Gold-Antimony at…

Vizsla Silver Smart to Diversify into Pacifica Silver

Yesterday morning, NIA announced Pacifica Silver Corp. (CSE: PSIL) as its latest brand-new stock suggestion.…

New NIA Silver Stock Suggestion: Pacifica Silver

NIA is excited to announce a brand-new silver stock suggestion Pacifica Silver Corp. (CSE: PSIL)…

$396 Billion Into Stocks… $4 Billion Into Gold & Silver

Over the past decade, investor capital has flowed in the exact opposite direction of performance.…

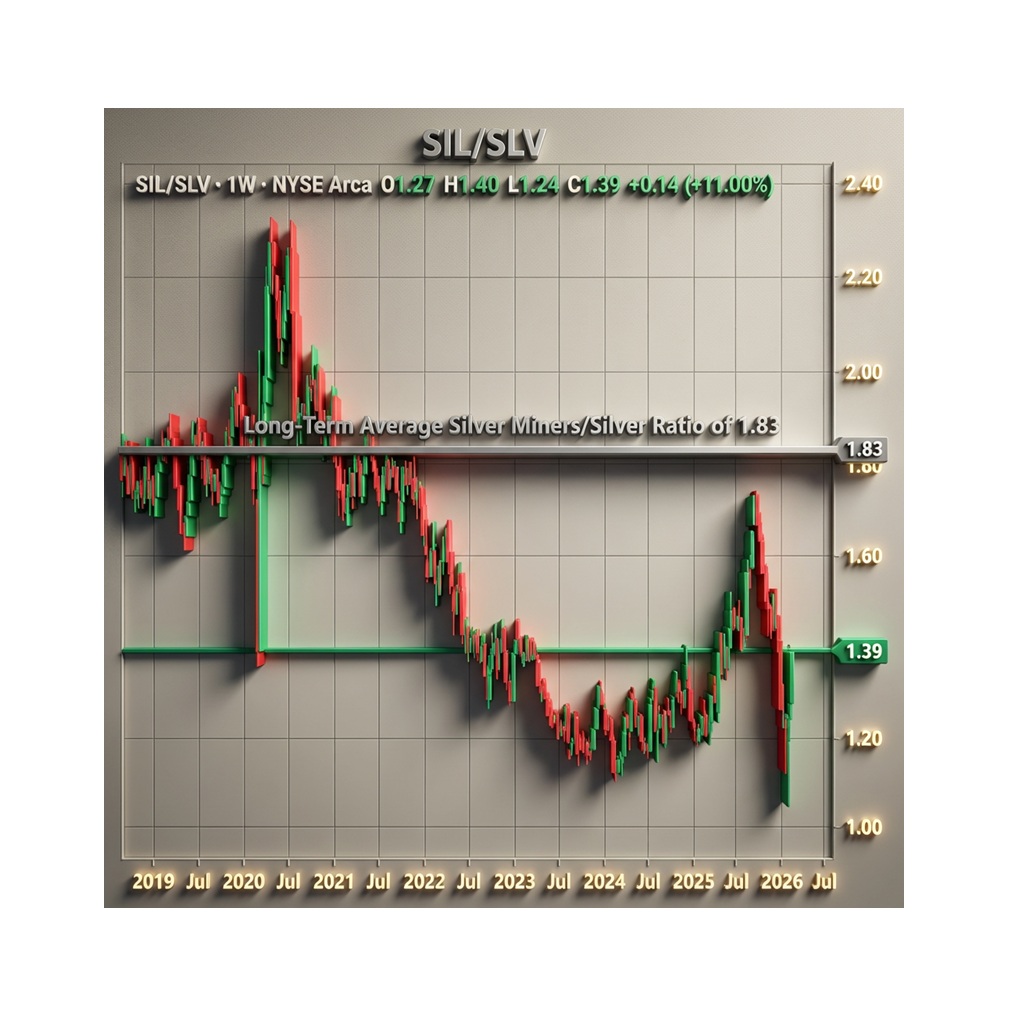

The SIL/SLV Ratio Just Flashed a Major Buy Signal

When silver plunged by 26% to $85.31 per oz on January 30th, NIA highlighted the…

Mike Alfred’s ASST Crashes Another 40% Does Reverse Split

NIA pointed out this past weekend how social media influencer Mike Alfred was trying to…

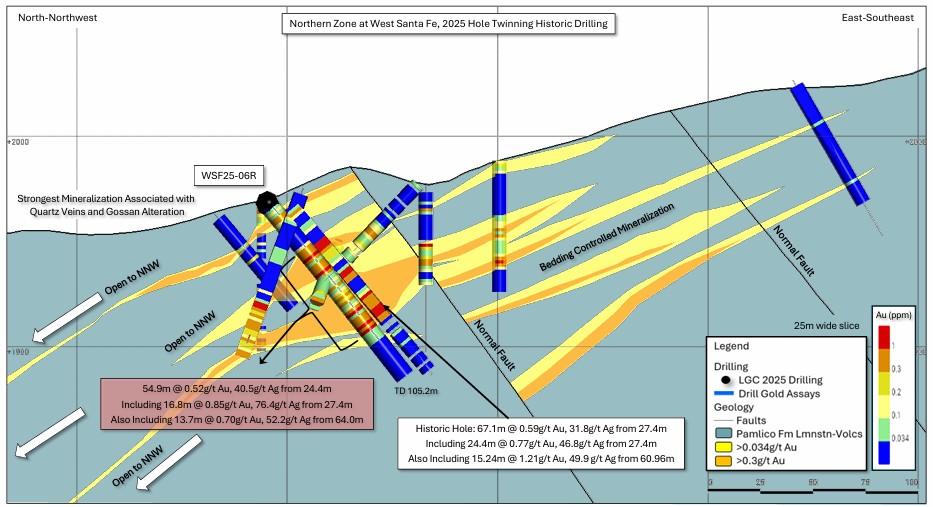

Lahontan Maiden Drilling Confirms Shallow Oxide Gold at West Santa Fe

55m of Oxide Gold at West Santa Fe Only 13km From LG's Flagship Santa Fe…

Eric Sprott’s $40M Bet Is Paying Off Already

Highlander Silver (TSX: HSLV) gained by 4.02% today to $7.76 per share vs. Hycroft Mining…

QIMC Initiates Phase 1 Drilling in West Advocate, Nova Scotia

QIMC Initiates Phase 1 Drilling in West Advocate, Nova Scotia Following Receipt of Regulatory Approval…