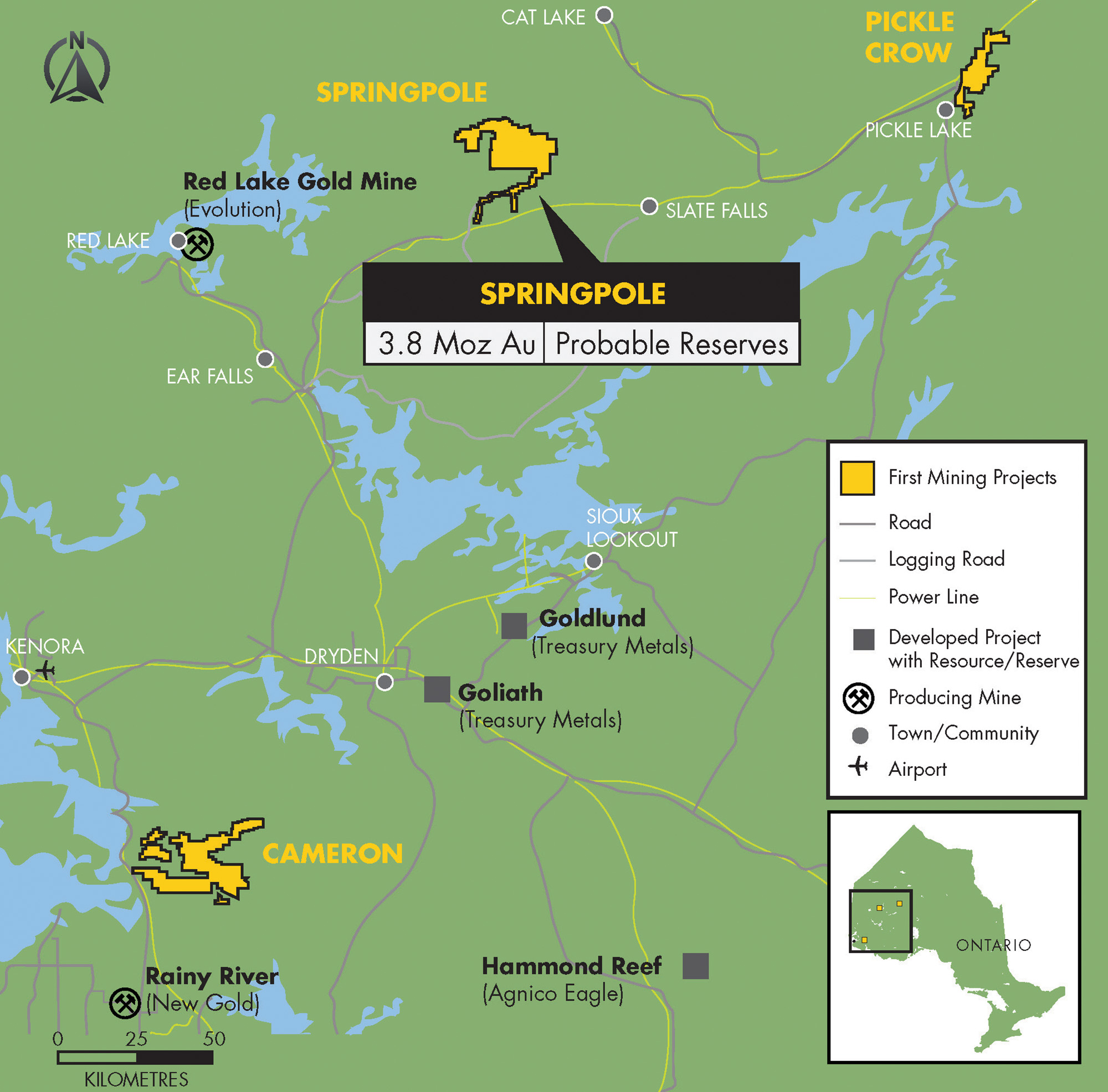

First Mining Gold (TSX: FF) or FFMGF recently filed a pre-feasibility study for its 100% owned Springpole Gold Project in Ontario and it showed that Springpole has a probable reserve of 121.6 million tonnes grading 0.97 g/t gold and 5.23 g/t silver for 3.8 million oz of contained gold and 20.5 million oz of contained silver.

Based on a gold price of US$1,600 per oz, Springpole has an after-tax net present value (NPV) using a 5% discount rate of US$995 million. Initial CAPEX is US$718 million. When gold returns to US$2,000 per oz the NPV increases to US$1.599 billion. At $2,000 per oz gold, the NPV becomes 2.23X higher than initial CAPEX.

Springpole is 1 of 5 undeveloped gold projects in North America with a total measured & indicated gold resource of 4 million oz+ and projected annual gold production of more than 300,000 oz! 3 of the 5 other undeveloped gold projects of this scale are already owned by major multi-billion dollar market cap gold producers!

FF's Founder and Chairman Keith N. Neumeyer happens to be the CEO of a multi-billion dollar precious metals producer First Majestic Silver (TSX: FR) so he knows that the world's largest mining companies are looking for projects with massive scale!

If you subtract the value of FF's many other assets from its current market cap, FF's flagship Springpole Gold Project is receiving very little value for its probable gold reserve on a per oz basis!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from FF of USD$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.