One of the largest TSX Venture acquisitions in recent years was Kinross Gold (KGC)'s acquisition of Great Bear Resources for CAD$1.8 billion.

A few months later, Royal Gold (RGLD) acquired Great Bear Royalties for CAD$200 million, which held a 2% NSR royalty in Great Bear's Ontario Gold Project. Click here to read the press release.

Meaning a 1% NSR Royalty in Great Bear was worth CAD$100 million or USD$72.17 million.

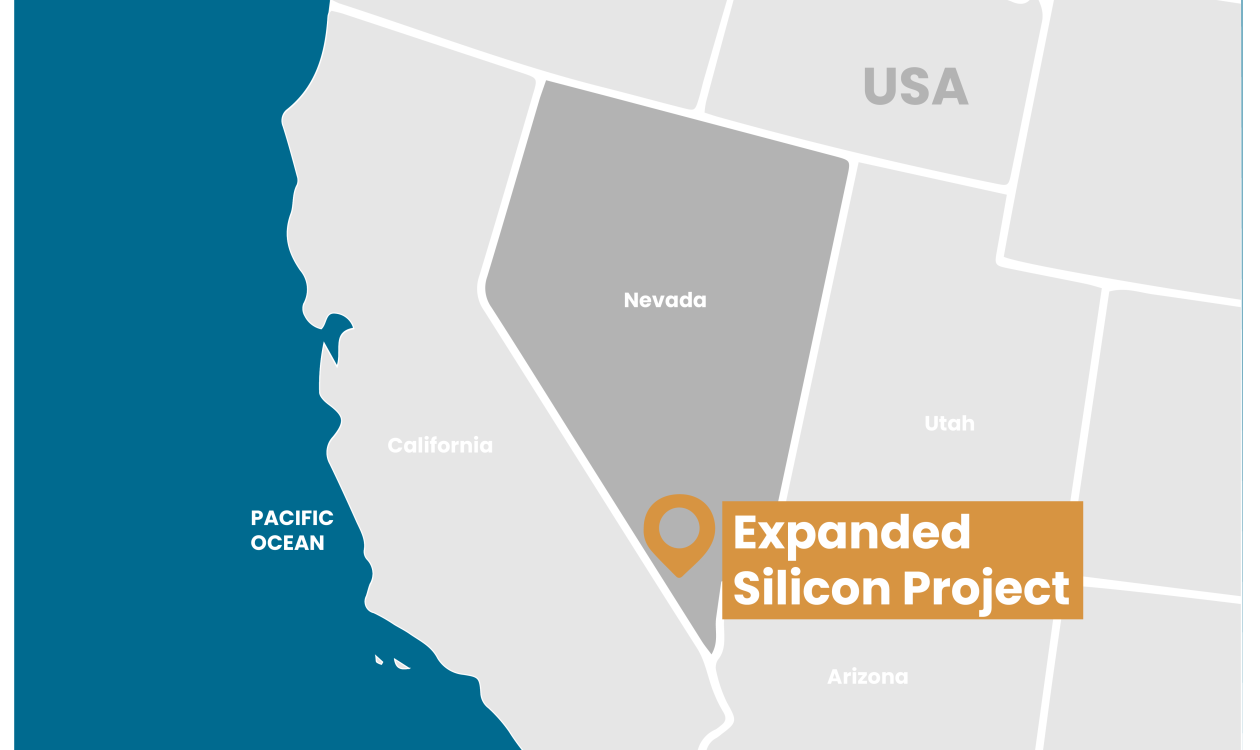

Triple Flag (TFPM) by acquiring Orogen Royalties (TSXV: OGN) at $2 per share after excluding the value of its revenue generating royalties is paying USD$250 million for a 1% NSR royalty in Expanded Silicon.

TFPM is saying Expanded Silicon is worth nearly 3.50x more than the Great Bear gold project.

If Expanded Silicon was held by a publicly traded gold explorer, it would be the #1 largest publicly traded gold exploration company in the world today.

This is how we know Augusta Gold (TSX: G) is worth $9 per share and if AngloGold Ashanti (AU) gets an opportunity to acquire for $6 per share it will be a great bargain.

In a district consolidation situation, all ounces are equal because of all the synergies.

Bre-X at its peak was worth $6 billion and even though Busang wasn't even real... every gold explorer located anywhere in Indonesia increased by 500%-5,000% in value.

Augusta Gold (TSX: G) is directly adjacent to Expanded Silicon.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 232,200 shares of G and may purchase more shares. This message is meant for informational and educational purposes only and does not provide investment advice.