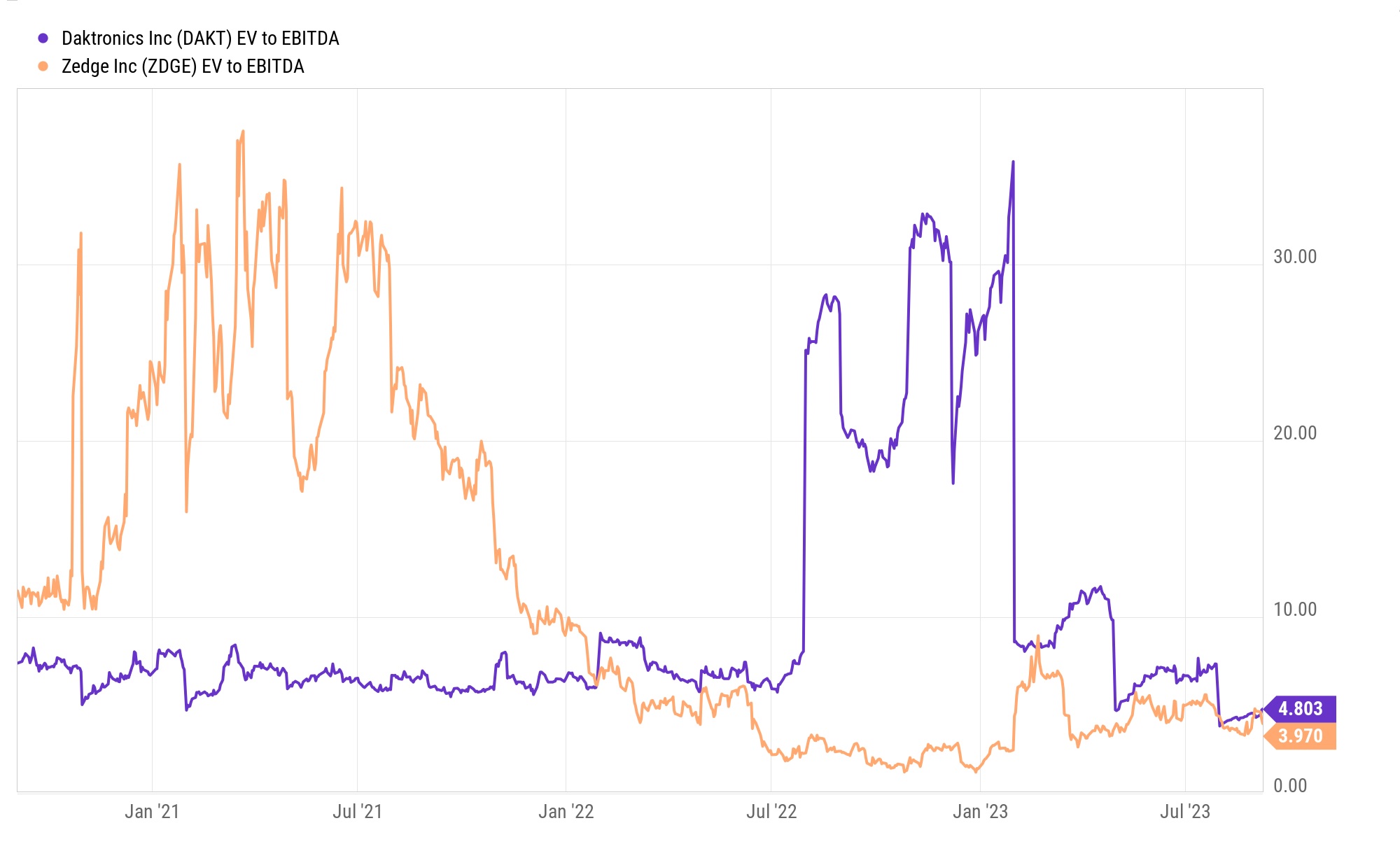

Daktronics (DAKT) and Zedge (ZDGE) both traded with enterprise value/EBITDA ratios of above 30 during the last 24 months.

DAKT is now trading with an enterprise value/EBITDA ratio of 4.803.

ZDGE is now trading with an enterprise value/EBITDA ratio of 3.97.

It is very unlikely that DAKT and ZDGE will become more undervalued than they already are today.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. This message is meant for informational and educational purposes only and does not provide investment advice.