Lead, South Dakota--(Newsfile Corp. - April 30, 2024) - Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is pleased to release its S-K 1300 Initial Assessment ("Initial Assessment or Report") for the Richmond Hill Gold Project ("Richmond Hill") in South Dakota. The maiden resource in the Report was derived from a historical database containing 69,401 gold assays from more than 900 drill holes, including 57 drill holes from Dakota Gold's current drill program. The Report includes drilling that was completed prior to October 5, 2023, and has been published on the Company's website and filed by the Company with the Securities and Exchange Commission on EDGAR as an exhibit to its Current Report on Form 8-K dated April 30, 2024. The Report was prepared by an independent group of Qualified Persons under AKF Mining Services Inc., which has reviewed and approved the contents of this news release.

Highlights:

Indicated Resource of 51.83 million tonnes (Mt) at 0.80 grams per tonne gold (g/t Au) for 1.33 million ounces and Inferred Resource of 58.06 million tonnes (Mt) at 0.61 grams per tonne gold (g/t Au) for 1.13 million ounces (see Table 1).

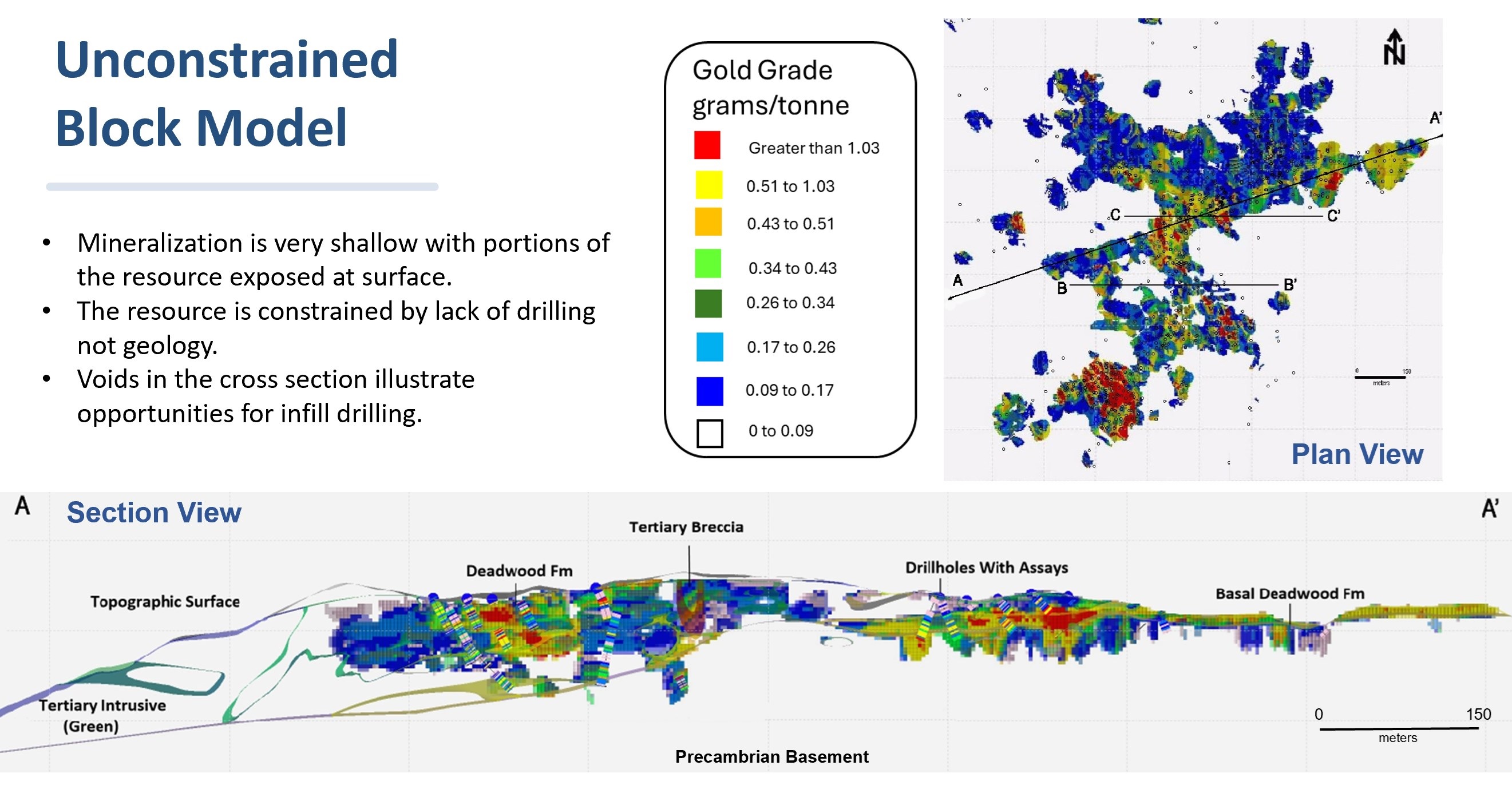

Mineralization is very shallow with portions of the resource exposed at surface.

High-grade potential - Drilling completed post Report cut off (not included in maiden resource but previously press released) includes: 22.9 meters of 1.99 g/t Au; 42.8 meters of 1.71 g/t Au; and 60.9 meters of 1.68 g/t Au.

Growth potential - The resource is open in all directions and has potential for improvement with additional drilling, metallurgical work to improve recoveries, and incorporation of silver in the resource.

Resource timeline - The multi-million-ounce maiden resource was outlined in less than 20 months from Dakota Gold's first hole in March 2022. Updated S-K 1300 Assessment planned for mid-2025.

Jonathan Awde, President, CEO and Director of Dakota Gold, said, "We are very pleased with the results of our maiden resource for Richmond Hill which was delivered in less than two years from the first drill hole. The mineralization is consistent, near surface with portions of the resource exposed at surface, and contains significant oxide mineralization. Richmond Hill benefits from being on private land and close to well established infrastructure. There is significant opportunity for improvement and expansion of the resource with additional work to position Richmond Hill as a high-quality, advanced-stage exploration asset in the US."

James Berry, VP of Exploration, said, "The initial drill program at Richmond Hill confirmed historical drilling and demonstrated that the mineralization is more extensive than we anticipated. We have been conservative in our methodology and are confident that the resource will expand with additional exploration and infill drilling. With inclusion of the significant silver component, and optimization of recoveries, we think the future of Richmond Hill is exceptional and a great beginning for our assets in the Homestake Gold District!"

Details of the maiden resource will be presented in a webcast conference call on Tuesday, April 30, 2024 at 11am Eastern / 9am Mountain / 8am Pacific.

Webcast Registration: https://services.choruscall.ca/links/dakotagold2024rhres.html

USA/Canada Toll Free: 1-800-319-4610

International Toll: +1-604-638-5340

Maiden Resource of 1.33 M oz of Indicated and 1.13 M oz of Inferred Gold

Table 1: Richmond Hill Conceptual Pit-Constrained Maiden Resource Estimate at Variable Cutoff Grades

|

REDOX |

CLASSIFICATION |

AU G/T |

TONNES |

OUNCES AU |

|

Oxide |

Indicated |

0.65 |

14,979,000 |

314,000 |

|

Mixed |

Indicated |

0.74 |

22,849,000 |

547,000 |

|

Hypogene |

Indicated |

1.04 |

14,001,000 |

469,000 |

|

TOTAL |

Indicated |

0.80 |

51,829,000 |

1,330,000 |

|

|

|

|

|

|

|

Oxide |

Inferred |

0.49 |

27,437,000 |

429,000 |

|

Mixed |

Inferred |

0.63 |

19,957,000 |

407,000 |

|

Hypogene |

Inferred |

0.86 |

10,668,000 |

296,000 |

|

TOTAL |

Inferred |

0.61 |

58,062,000 |

1,132,000 |

See S-K 1300 Initial Assessment Table 1.1

Notes:

Mineral resources are not mineral reserves and do not have demonstrated economic viability.

There is no certainty that all or any part of the estimated mineral resources will be converted into mineral reserves.

Pit-constrained resources are stated at a range of cutoff gold grades depending on oxide state.

Oxide recovery = 87%, mixed recovery = 65%, hypogene recovery = 42%.

Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

Mineral resource tonnage and grades are reported as undiluted.

MRE is current as of October 5, 2023.

Pit-Constrained at $1,900/oz; Royalty = 3.8%; Mill & G&A Cost = $8.00; Mine Cost = $1.80.

Cutoff grade Au g/t: Oxide 0.21 g/t, Mixed 0.29 g/t, Hypogene 0.44 g/t

Pit slope at 50 degrees

Resource Growth Potential

The resource is open in all directions and has potential for expansion with additional drilling. In addition, a significant number of mineralized drill intercepts remain outside of the declared resource due to the conservative methodology, which we believe could be converted to resource with additional infill drilling.

About Dakota Gold Corp.

Dakota Gold (NYSE American: DC) is a South Dakota-based responsible gold exploration and development company with a specific focus on revitalizing the Homestake District in Lead, South Dakota. Dakota Gold has high-caliber gold mineral properties covering over 48 thousand acres surrounding the historic Homestake Mine.

The Dakota Gold team is focused on new gold discoveries and opportunities that build on the legacy of the Homestake District and its 145 years of gold mining history.

Subscribe to Dakota Gold's e-mail list at www.dakotagoldcorp.com to receive the latest news and other Company updates.

Shareholder and Investor Inquiries

For more information, please contact:

Jonathan Awde, President and Chief Executive Officer

Tel: +1 604-761-5251

Email: JAwde@dakotagoldcorp.com

Qualified Persons

The Report was prepared by an independent group of Qualified Persons under AKF Mining Services Inc., which has reviewed and approved the contents of this news release.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this press release, the words "plan," "target," "anticipate," "believe," "estimate," "intend," "potential," "will" and "expect" and similar expressions are intended to identify such forward-looking statements. Any express or implied statements contained in this announcement that are not statements of historical fact may be deemed to be forward-looking statements, including, without limitation: our expectations regarding the drilling to be completed in 2024 and 2025; our expectations for the improvement and growth of the mineral resources; the high grade potential of the drilling completed after the effective date of the Initial Assessment; and the timing for an updated S-K assessment to be released in 2025. These forward-looking statements are based on assumptions and expectations that may not be realized and are inherently subject to numerous risks and uncertainties, which could cause actual results to differ materially from these statements. These risks and uncertainties include, among others: the execution and timing of our planned exploration activities; our use and evaluation of historic data; our ability to achieve our strategic goals; the state of the economy and financial markets generally and the effect on our industry; and the market for our common stock. The foregoing list is not exhaustive. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as updated by annual, quarterly and current reports that we file with the SEC, which are available at www.sec.gov. We caution investors not to place undue reliance on the forward-looking statements contained in this communication. These statements speak only as of the date of this communication, and we undertake no obligation to update or revise these statements, whether as a result of new information, future events or otherwise, except as may be required by law. We do not give any assurance that we will achieve our expectations.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from DC of US$30,000 cash for a three-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.