The Cryptocurrency ecosystem is made up of ponzi schemes, built on ponzi schemes, built on ponzi schemes - and everybody thinks they are smart enough to dump before it all collapses.

Tether is obviously the most significant Crypto ponzi scheme of all, because Tether is the central bank to the Crypto ecosystem and no better than the Federal Reserve. In 2017, it took only $2 billion in newly printed USDT to drive Bitcoin to $20,000. In 2021, it took over $70 billion in newly printed USDT to drive Bitcoin to a high of $69,000. There is no proof that any real dollars back USDT. The most valuable asset we know for sure that Bitfinex/Tether owns is $9.2 billion worth of Bitcoin, but this Bitcoin most likely belongs to Bitfinex clients like Celsius Network, who "borrowed" it from account holders to gamble with on altcoins.

Celsius Network, Blockfi, and similar Defi High Yield programs promise 8-15% in yield to people who "stake" their Crypto with them, but nobody ever asks how this yield is earned. Celsius and Blockfi have hundreds of employees that they pay while also spending big on marketing campaigns and referral programs. They rely on continuously raising venture capital funding and/or receiving bailouts from Tether to keep their ponzi schemes afloat. The yields that they offer cause Crypto investors to keep their funds within the Crypto ecosystem, which helps prevent the Tether peg to the USD from breaking.

Investors who are rightly skeptical about depositing Crypto onto Celsius Network/Blockfi, consider brokerage firms like Voyager Digital (TSX: VOYG) to be a risk-free alternative to earn similar amounts of yield, not knowing that VOYG has loaned $382.69 million in client crypto assets to a firm that all evidence suggests is Celsius Network and another $514.189 million to an unnamed firm in the British Virgin Islands.

Publicly traded Bitcoin mining companies like Marathon Patent (MARA) and Riot Blockchain (RIOT) rely on continuously raising money in private placements and ATM offerings so that they can "hodl" all of the Bitcoin that they mine. They almost never sell any of their newly mined Bitcoin to pay operating expenditures, which keeps the supply of Bitcoin on the market artificially low.

The Japanese court appointed trustee for the failed Bitcoin exchange Mt Gox has purposely slow walked the return of 150,000 Bitcoin to Mt Gox customers for many years. When the trustee sold off 50,000 of the 200,000 recovered Bitcoin in December 2017 it caused the Bitcoin market to crash. The trustee is supposedly about the return the remaining 150,000 BTC to Mt Gox victims.

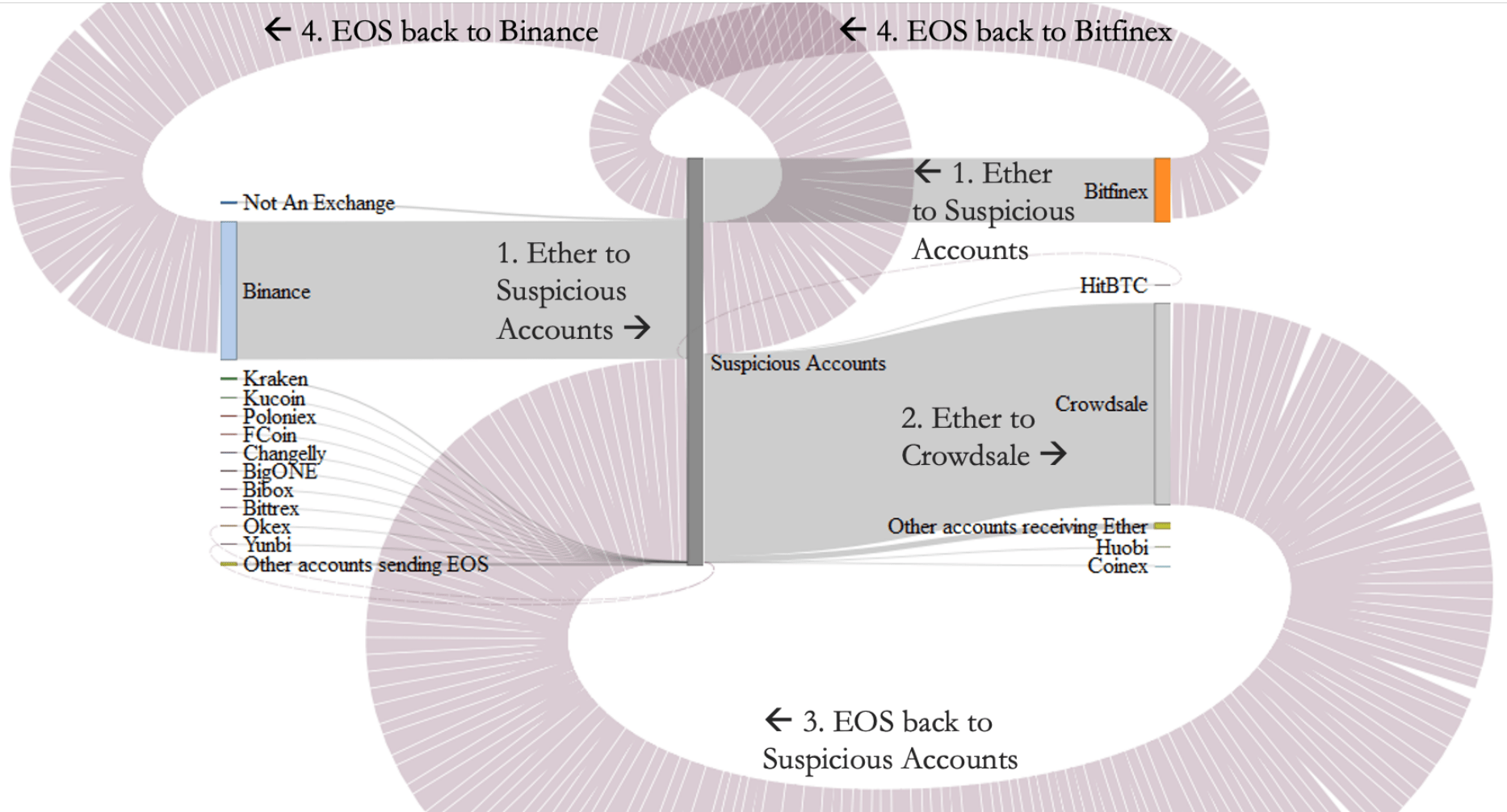

The 2017/2018 year-long initial coin offering (ICO) of EOS relied on Block.one recycling $814.6 million in Ethereum to continuously create artificial demand for their newly minted EOS tokens. They quickly and repeatedly sold their EOS for Ether on Bitfinex before using the proceeds to buy more EOS in the crowd sale. By creating the false impression of demand for the EOS token, it artificially boosted the price of EOS and enticed others to buy EOS using ETH of their own. The newly minted EOS created $3.2 billion in Crypto market cap out of thin air while removing 7.21 million Ethereum from the market that is today worth $27.1 billion.

Block.one is attempting to launder $9 billion of ill-gotten Ethereum gains from the EOS crowd sale through a SPAC called Far Peak Acquisition, which is merging with a Crypto exchange called Bullish that doesn't actually exist but will have a post-merger $9 billion market cap because it is backed by $9 billion in "funding", which is really $9 billion worth of ill-gotten Ethereum that Block.one received from EOS investors. If Bullish already has $9 billion in legitimate funding, why would they bother raising $500 million in a SPAC merger? They plan to dump the shares of the phony Crypto exchange on shareholders who will be stuck with the ill-gotten tokens!

Billions of dollars of newly created NFTs are being sold on the centralized exchange OpenSea, not because of "art" but because of the roadmaps that the project creators publish with promises that they will never follow through with such as promises to release a video game in nine months or the payment of royalties based on future NFT sales or even the ability to breed new NFTs. These NFTs create artificial demand for Ethereum and are responsible for the majority of Ethereum transactions, giving it the appearance of growing user adoption, but it is really just speculation from investors trying to buy the next CryptoPunks and 99.9% of the time it ends in a rug pull. Any NFT with a roadmap is an unregistered security and has nothing to do with art.

At this time last year, we were suggesting Crypto stocks like VOYG and CWRK that made tremendous gains of 2,793-6,225%. We like Crypto and Blockchain technology, but won't be buying back into the market until all of the ponzi schemes collapse.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA was compensated by VOYG USD$60,000 cash for a one-year marketing contract which has since expired. NIA has received compensation from CWRK of USD$30,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.