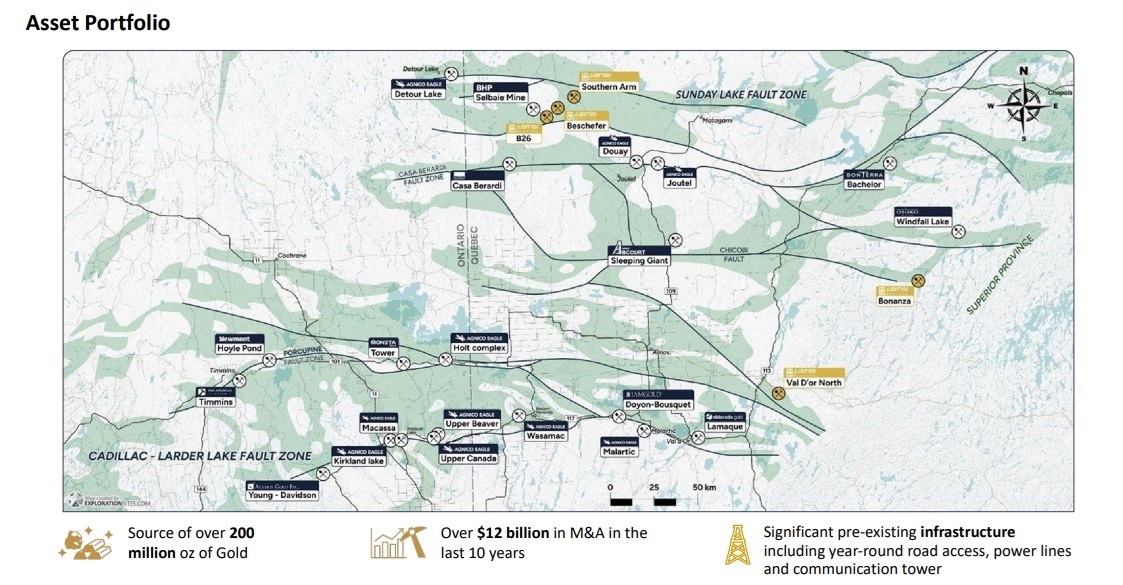

NIA's latest brand-new copper stock suggestion Abitibi Metals (CSE: AMQ) gained by 10.81% today to $0.41 per share. AMQ's current market cap is CAD$40.702 million with CAD$11.85 million in cash for an enterprise value of CAD$28.852 million or USD$21.39 million. AMQ's B26 project in Quebec is the #1 best copper project in the world for a valuation this low. AMQ raised a large amount of funding in multiple transactions early on after going public, which created a large overhang of shares. AMQ traded strong volume of 1.1 million shares today and this resistance will soon be gone.

At some point soon, AMQ will likely make a Power Nickel (TSXV: PNPN) type of breakout. As you may recall, we suggested PNPN at $0.225 per share prior to it rising to a high of $0.92 per share for a gain of 308.89%.

Solaris Resources (TSX: SLS) is moving its headquarters from Canada to Ecuador possibly to sell itself to Zijin Mining. If not for Trudeau's new "critical metals" law, there is a good chance Zijin Mining would have acquired SLS at a huge premium earlier this year.

We have never suggested SLS, but we have discussed it in regard to our #1 overall stock suggestion Augusta Gold (TSX: G) which has the same management/board/largest shareholder. It looks like Augusta Gold is about to get acquired first most likely before year-end. Look for Augusta Gold's share price to slowly trend upward to $2-$3 per share by December and from there it will likely sell for a large 50%-100% premium similar to Osisko Mining (TSX: OSK).

Borealis Mining (TSXV: BOGO) isn't going to get acquired like Augusta Gold (TSX: G), but BOGO already has all of the infrastructure for production. BOGO is currently drilling for oxides with an RC drill rig and has diamond drill core targeting their high-grade high-sulfidation Graben deposit in the lab with assays pending.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA was previously compensated by PNPN US$50,000 cash for a six-month marketing contract which has since expired. NIA was previously compensated by LFG Equities Corp. US$30,000 cash for a three-month AMQ marketing contract which has since expired. NIA has received compensation from BOGO of US$100,000 cash for a twelve-month marketing contract. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.