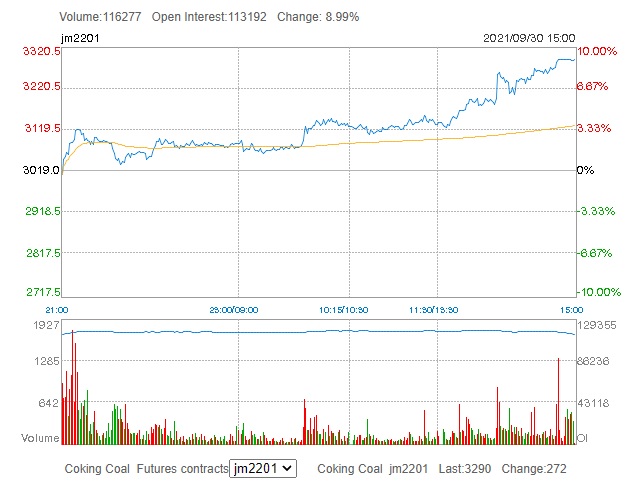

Chinese coking coal futures gained by their 9% upper limit today to finish at a new all-time high of 3,290 yuan (US$509.16) per tonne!

At 10:45PMEDT last night, NIA sent out an urgent update about how Chinese coking coal futures had just hit a new all-time high of 3,130 yuan (US$483.60) per tonne. At that point, Chinese coking coal was only up by 3.67% for the day. Chinese coking coal gained another 5.11% while we were sleeping!

There is no other company that this is more bullish for than Morien Resources (TSXV: MOX). MOX exploded by 17.65% on Wednesday morning to hit an intraday high of $0.60 per share, which was followed by a healthy profit taking dip of 10% from MOX's high of day. MOX only closed up by 5.88% to $0.54 per share, which was a best case scenario because the weak hands are already gone!

We see no meaningful resistance between yesterday's closing price of $0.54 per share and MOX's all-time high of $0.77 per share. We will likely hit new all-time highs as soon as tomorrow, but if we don't tomorrow we almost certainly will hit new record highs on Monday!

This upcoming weekend, investors who in recent weeks were playing either tech stocks, uranium stocks, or cryptocurrencies... will now be searching likely crazy for the highest quality coal stocks that are likely to make the largest percentage gains throughout next week and the entire month of October! These investors will strongly prefer coking coal stocks over thermal coal stocks, because coking coal has been gaining much faster than thermal and coking coal is much more expensive than thermal. However, having some exposure to thermal is also very important because China is facing its worst power crisis in history due to its most severe thermal coal shortage of all time!

MOX represents a perfect scenario because Donkin will be exporting its coal to China as a coking coal to receive the highest possible sales price, but Donkin's coal is a rare type of coking coal that is also perfectly suitable to be used as thermal! Donkin's coal will see stronger demand from China than any other North American produced coal, because China desperately needs more coking coal to produce steel, but if their power plants run out of thermal coal (a very possible scenario during the winter) producing steel will become the least of China's concerns!

China by maximizing its imports of Donkin's coal will have the flexibility to redirect this coking coal to its power plants and prevent severe blackouts to keep lights on and water flowing!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. This message is meant for informational and educational purposes only and does not provide investment advice.