Coal stocks are about to become the #1 focus of investors on Wall Street for the very first time in over a decade! We have a feeling that Morien Resources (TSXV: MOX) will end 2021 at a price that far exceeds NIA's highest expectations. All of NIA's estimates of MOX's fair value have been using very conservative numbers.

The following Reuters article was published one hour ago:

China energy crunch triggers alarm, pleas for more coal

SHANGHAI, Sept 28 (Reuters) - As a severe power crunch roils China’s northeastern industrial heartland, senior officials face mounting pressure from alarmed citizens to ramp up coal imports thick and fast in order to keep lights on, factories open and even water supplies flowing.

With electricity shortages sparked by scant coal supply crippling large sections of industry here, the governor of Jilin province, one of the hardest hit in the world's no.2 economy, called for a surge in coal imports, while a power company association said supply was being expanded "at any cost".

News organizations and social media carried reports and posts saying the lack of power in the northeast had shut down traffic lights, residential elevators and 3G mobile phone coverage as well as triggering factory shutdowns. A utility in Jilin even warned power shortages could disrupt water supplies at any time, before apologizing for causing alarm.

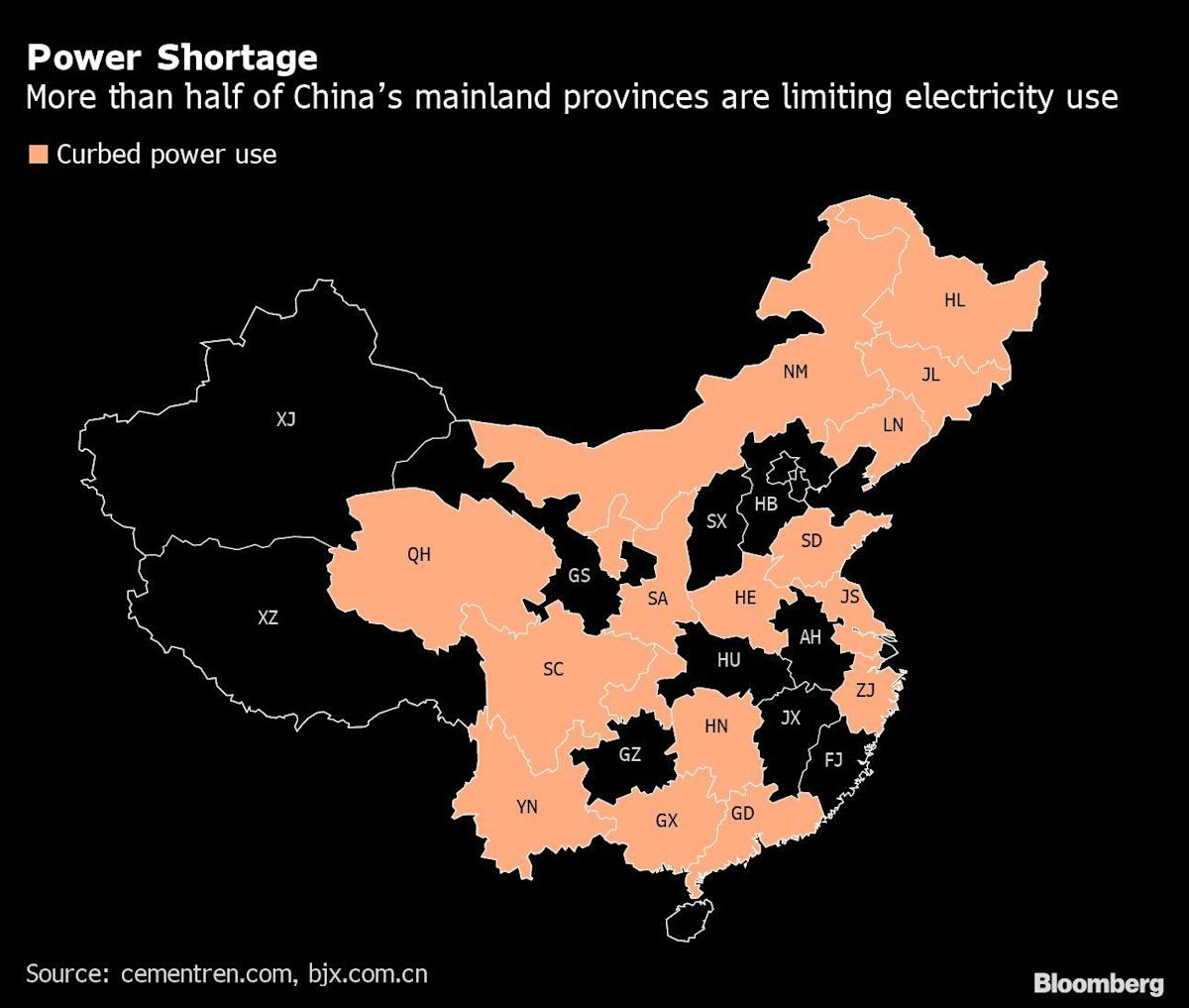

Cities such as Shenyang and Dalian - home to more than 13 million people - have been affected, with disruption at factories owned by suppliers to global companies like Apple and Tesla. Jilin is one of more than 10 provinces that have been forced to ration power here as generators feel the heat of soaring coal prices that they can't pass on to consumers.

Goldman Sachs estimated that as much as 44% of China’s industrial activity has been affected by power shortages, potentially causing a 1-percentage point decline in annualized GDP growth in the third quarter, and a 2-percentage point drop from October to December.

It said in a note published on Tuesday that it was cutting its 2021 GDP growth forecast for China to 7.8%, from the previous 8.2%.The power crunch has taken hold here as a shortage of coal supplies, toughening greenhouse gas emissions standards and strong demand from industry have pushed coal prices to peaks - China's thermal coal futures climbed 7% by 0500GMT on Tuesday to a record 1,324 yuan ($204.76) per tonne.

Rationing has been implemented during peak hours in many parts of northeastern China since last week, triggering state media reports of power supply disruptions in many cities and stoking concern among the country’s avid social media users.

As some shops in the northeast operated by candlelight and malls shut early, posts on China’s Twitter-like Weibo service expressed concern about water after a public utility in Jilin warned users that power shortages could hit supplies at any time.

Jilin governor Han urged companies to fulfil their “social responsibilities” and “overcome the difficulties” caused by coal price rises.

The China Electricity Council, which represents the country’s power suppliers, said in a note on Monday that coal-fired power companies were now “expanding their procurement channels at any cost” in order to guarantee winter heat and electricity supplies.

Coal traders noted finding fresh import sources may be easier said than done.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. This message is meant for informational and educational purposes only and does not provide investment advice.