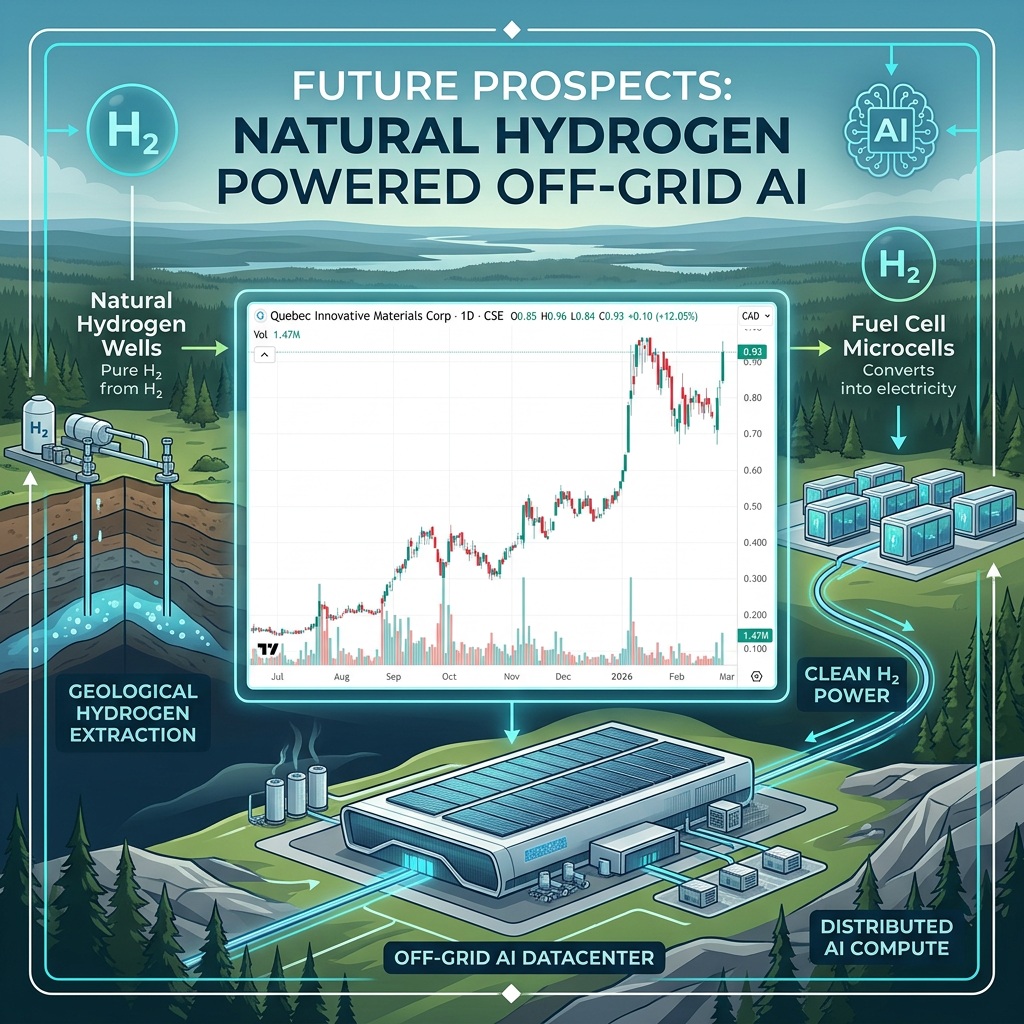

Is Natural Hydrogen the Real Boom Not Graphene?

QI Materials (CSE: QIMC) gained by 12.05% today to $0.93 per share and its chart…

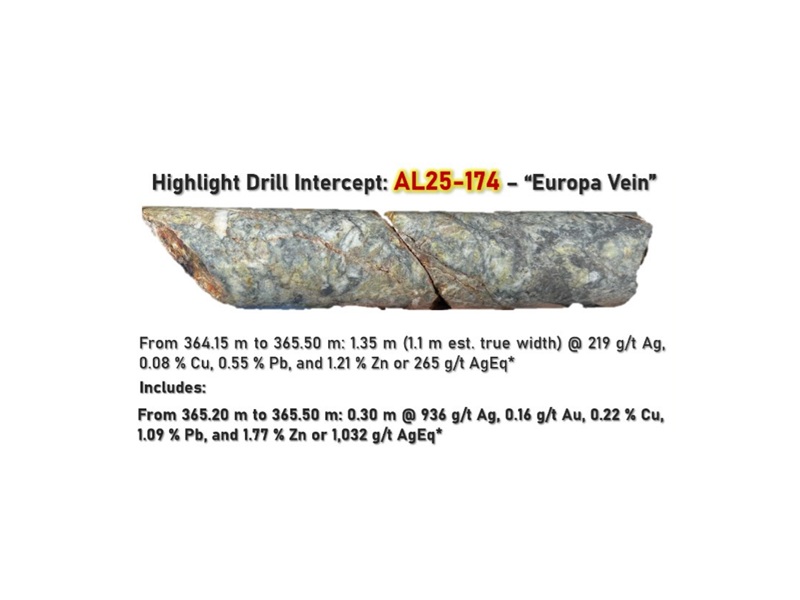

Minaurum Silver Hits 1,032 g/t AgEq and Adds 6th Rig: MGG Soars 11.76%!

Two days ago, NIA sent out an alert saying, "Minaurum Silver (TSXV: MGG) is the…

QIMC Is Our Version of “Speculative” Stock

QI Materials (CSE: QIMC) is our version of a "speculative stock" similar to what Hydrograph…

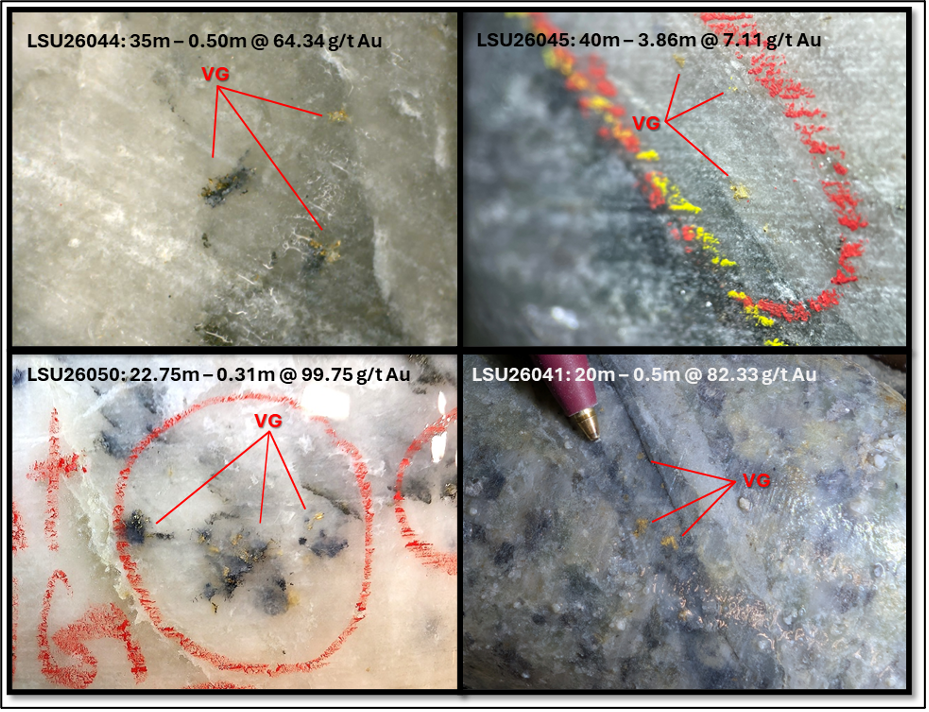

CTGO Strikes 60.22 g/t Gold Over 5.92 meters

NIA's President added 1,000 CTGO shares to his position last week. This is the most…

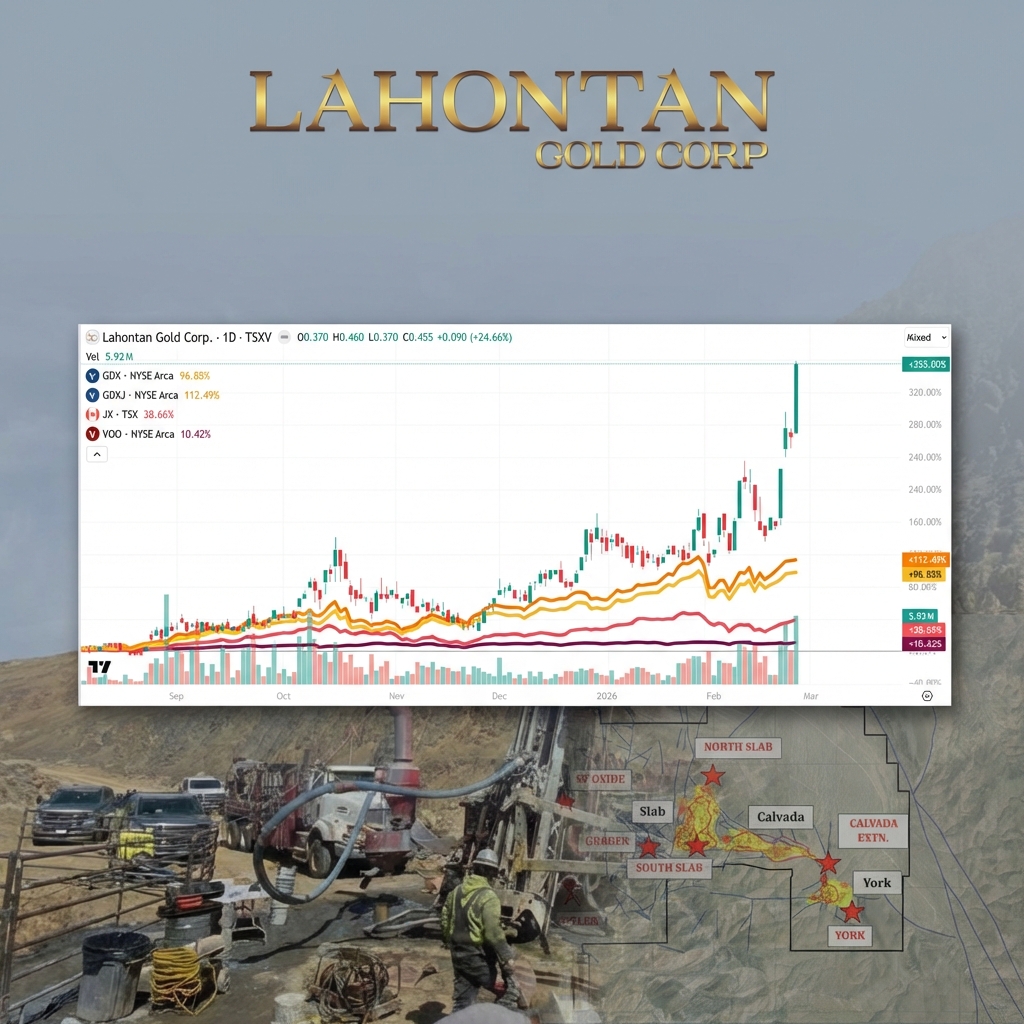

Lahontan Gold Gains 24.66% to New All-Time High of $0.455!

On the morning of February 3rd with Lahontan Gold (TSXV: LG) at $0.225 per share,…

Trio-Tech (TRT) Among Fastest Growing Companies in World

Yesterday afternoon, NIA sent out an alert saying, "Aehr Test Systems (AEHR) has just hit…

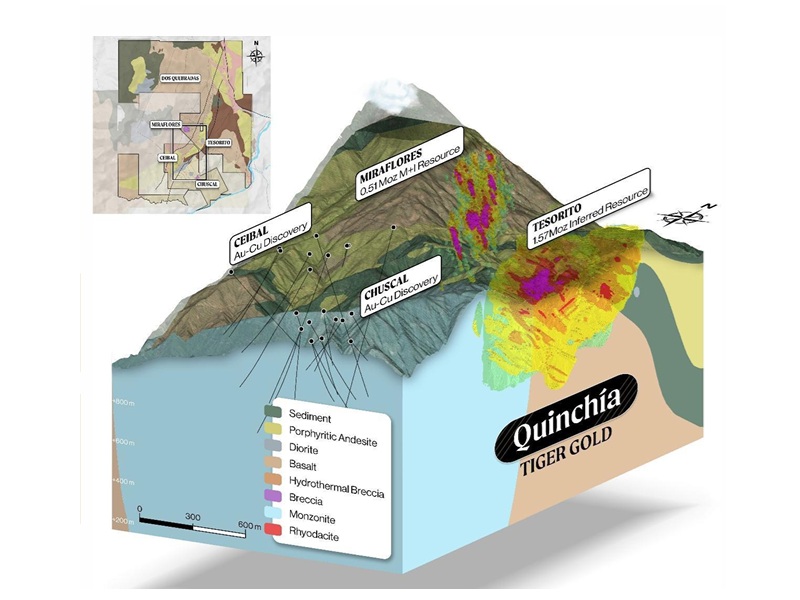

A 2+ Million Oz Gold Story for Under $60M

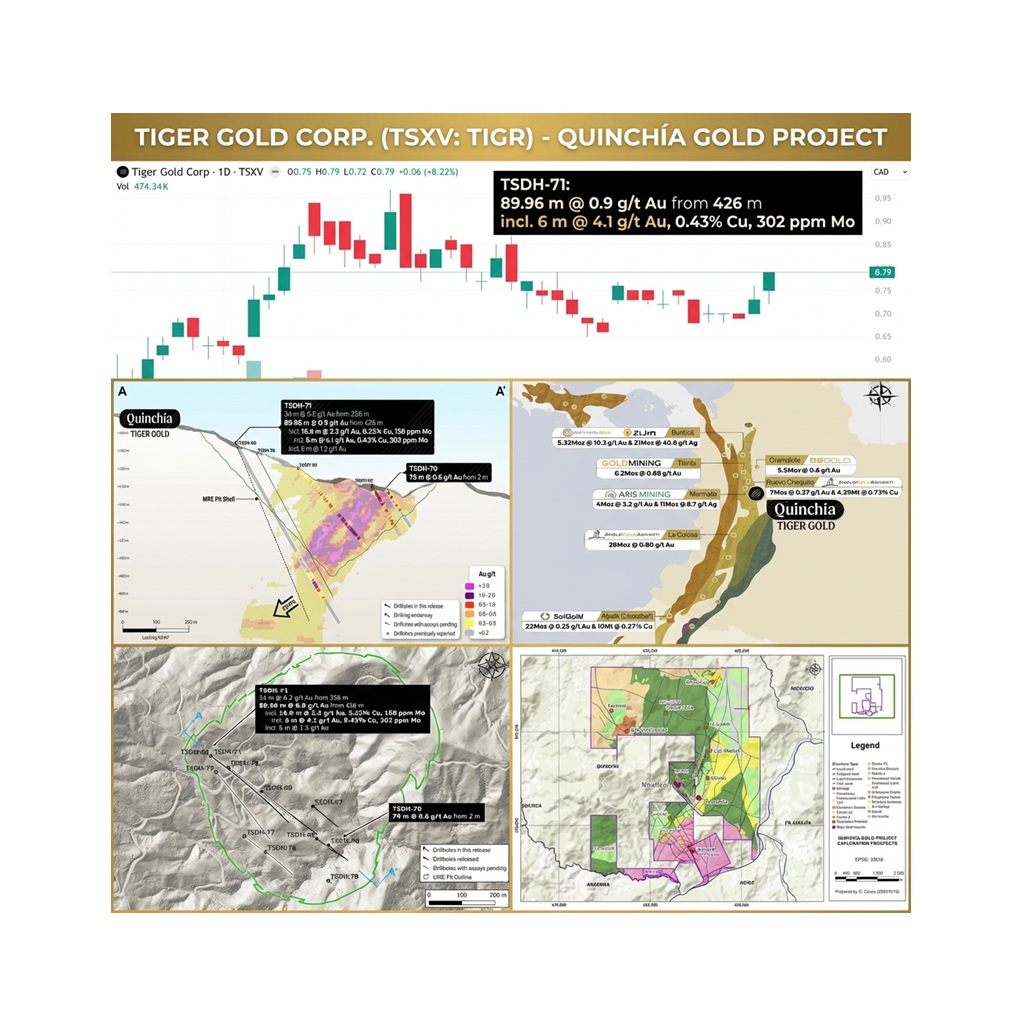

Tiger Gold (TSXV: TIGR) is advancing its flagship Quinchía Gold Project in Colombia's prolific Mid-Cauca…

Tiger Gold (TSXV: TIGR) Gains 8.22% to $0.79 Per Share

NIA's latest brand-new stock suggestion Tiger Gold (TSXV: TIGR) gained by 8.22% today to close…

Important NIA Update on QIMC, Tiger Gold, NevGold, Minaurum, Titan Mining, and Trio-Tech

Usually the CEO of QI Materials (CSE: QIMC) tells us the night before if a…

QIMC Intersects 40m Hydrogen Fault Corridor at 142m Depth

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth Feb 24,…