Braveheart Resources (TSXV: BHT) is currently laser focused on achieving re-permitting of the Bull River Mine with a planned ultimate restart of mining and milling operations at the mine in the foreseeable future. However, the company has always made it clear that they are constantly on the look out for opportunities to rapidly increase shareholder value through the acquisition of additional advanced-stage projects similar to the Bull River Mine.

Within the next 30 days, we expect BHT to close on an acquisition that will give BHT 100% ownership of a massive advanced-stage exploration project in Ontario containing four large deposits of base/precious metals with two having HUGE resources. One of these deposits is a major past producing underground mine with very valuable pre-existing underground infrastructure already in place!

BHT has negotiated an amazing deal for this high quality project that we have very good reason to believe will increase shareholder value in a meaningful way! BHT is paying only CAD$300,000 cash plus 13.5 million BHT shares while giving a 2% NSR royalty to the current owner (half of the royalty can be repurchased by BHT at any time in the future for CAD$1 million). The current owner is selling the project to BHT at such a low price because they believe the 13.5 million BHT shares they are receiving will soon become extremely valuable due to the Bull River Mine being rapidly advanced towards near-term production!

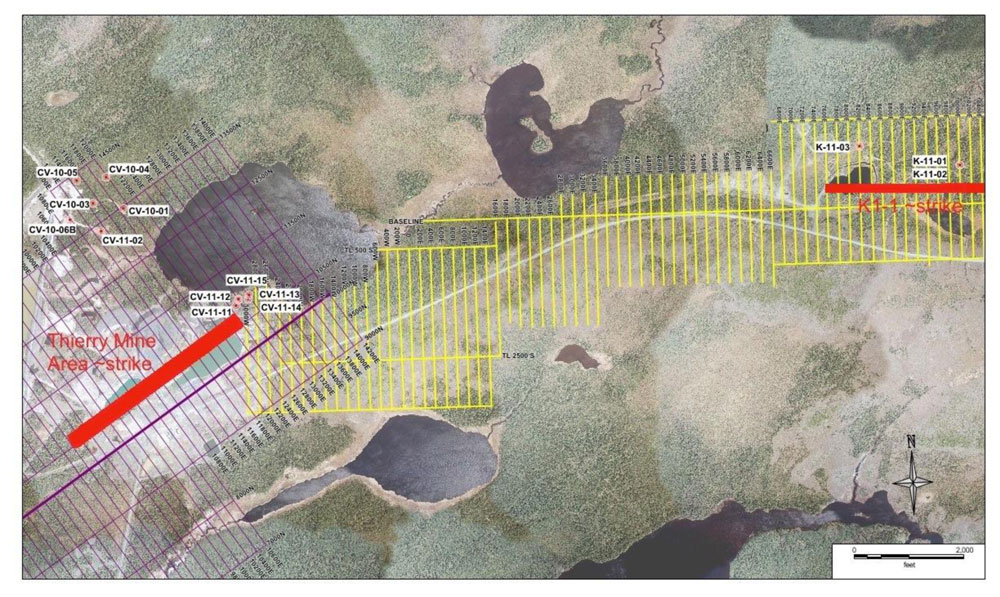

The massive 4,700 hectare project being acquired is called the Thierry Mine Project located 15 km west of Pickle Lake, Ontario and is accessible year-round by paved and all-weather roads.

The largest deposit at Thierry is called the K1-1 open pit and a 2012 resource estimate said that the K1-1 open pit has an inferred resource of 53,614,000 tonnes grading 0.38% copper, 0.10% nickel, 0.14 g/t palladium, 0.03 g/t gold, 0.05 g/t platinum, and 1.83 g/t silver. The K1-1 open pit contains an inferred 449.15 million lbs of copper, 118.2 million lbs of nickel, 241,322 oz of palladium, 51,712 oz of gold, 86,186 oz of platinum, and 3,154,424 oz of silver. Based on current metals prices the total in-ground value of the K1-1 open pit's inferred resource is USD$2.916 billion! Of this amount, copper accounts for 45.91%, nickel accounts for 26.98%, palladium accounts for 17.98%, while gold/platinum/silver account for 9.13%.

The past producing Thierry Underground Mine is located 3km across from the K1-1 open pit. A 2012 resource estimate said that the Thierry Underground Mine has a measured & indicated resource of 8,815,000 tonnes grading 1.66% copper, 0.19% nickel, 0.13 g/t palladium, 0.05 g/t gold, 0.04 g/t platinum, and 4 g/t silver. The Thierry Underground Mine contains a measured & indicated 322.6 million lbs of copper, 36.92 million lbs of nickel, 36,843 oz of palladium, 14,170 oz of gold, 11,336 oz of platinum, and 1,133,634 oz of silver. Based on current metals prices the total in-ground value of the Thierry Underground Mine's measured & indicated resource is USD$1.356 billion. Of this amount, copper accounts for 70.9%, nickel accounts for 18.12%, palladium accounts for 5.9%, while gold/platinum/silver account for 5.08%.

The current owner of the Thierry Mine Project last actively explored the project during the year 2011. Its market cap during the year 2011 ranged from CAD$15 million up to CAD$27 million, which was entirely for the Thierry Mine Project. After BHT closes on the acquisition of the Thierry Mine Project, we expect BHT to hire an independent firm to verify the most recent resource estimate from 2012 for the purpose of BHT filing a new up-to-date 43-101 compliant resource estimate. With base/precious metals beginning to boom like in 2011, imagine what BHT's market cap/enterprise value could soon rise to as they begin to advance the Thierry Mine Project while simultaneously bringing the Bull River Mine into production!

A few days ago, BHT announced that the debenture holders who they owe CAD$6 million have decided to do an early conversion on the first 40% of the convertible debenture debt, by converting CAD$2.4 million in debt to 12 million BHT shares at the conversion price of $0.20 per share, which clearly shows that they expect BHT to soon be trading for well above $0.20 per share - otherwise they had no other reason to convert at this time! The CAD$3.6 million in remaining convertible debenture debt can be converted to BHT shares beginning on January 21, 2023 at an even higher price of $0.30 per share!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from BHT of USD$30,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.