MGG Owns a David Lowell Property

On April 10th, NIA sent out an alert entitled, 'World’s Greatest Explorer David Lowell Trained…

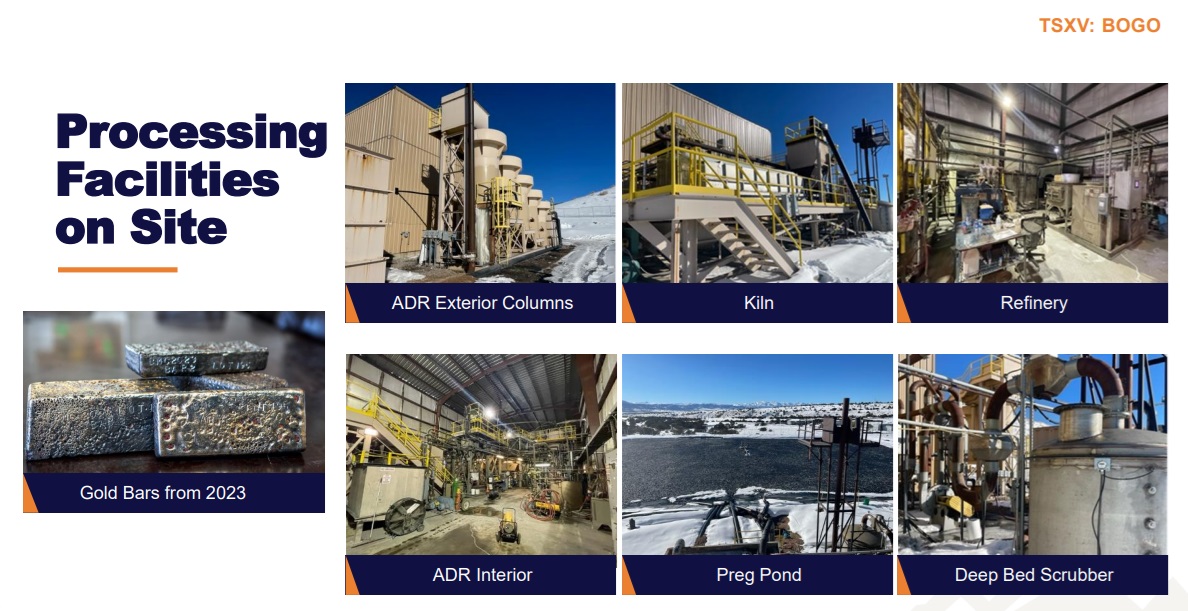

Borealis Mining (TSXV: BOGO) Gold Production Begins Monday

Borealis Mining (TSXV: BOGO) will be launching gold production on Monday from its Borealis Mine…

HSLV Hits New All-Time High Up 81.43% Since NIA’s February 12th Suggestion

Highlander Silver (TSX: HSLV) gained by 4.53% today to a new all-time high of $2.54…

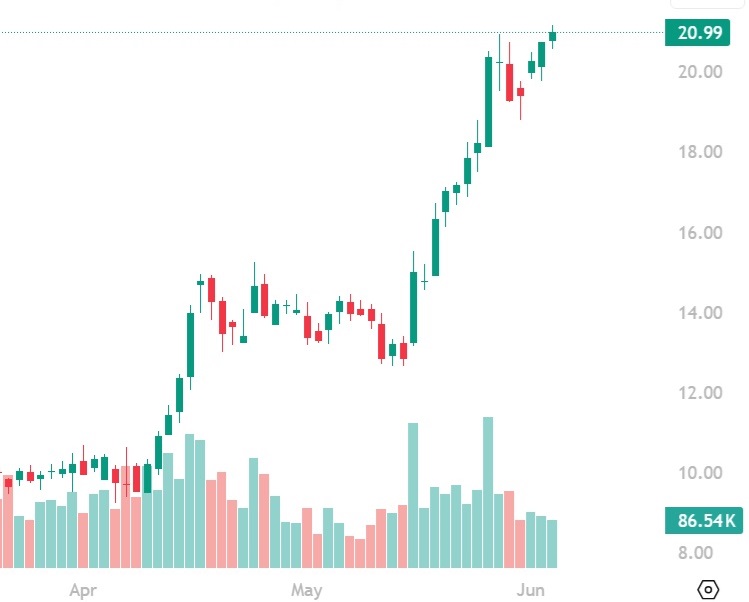

CTGO Up 63.35% Since Release of NIA’s Report

Contango ORE (CTGO) gained by 1.21% today to $20.99 per share and is so far…

First Majestic Silver (AG) Up for 4th Straight Day

First Majestic Silver (AG) is up today for its 4th straight trading day. The CEO…

HSLV Hits New All-Time High Up 73.57% Since NIA’s February 12th Suggestion

Highlander Silver (TSX: HSLV) gained by 7.05% today to a new all-time high of $2.43…

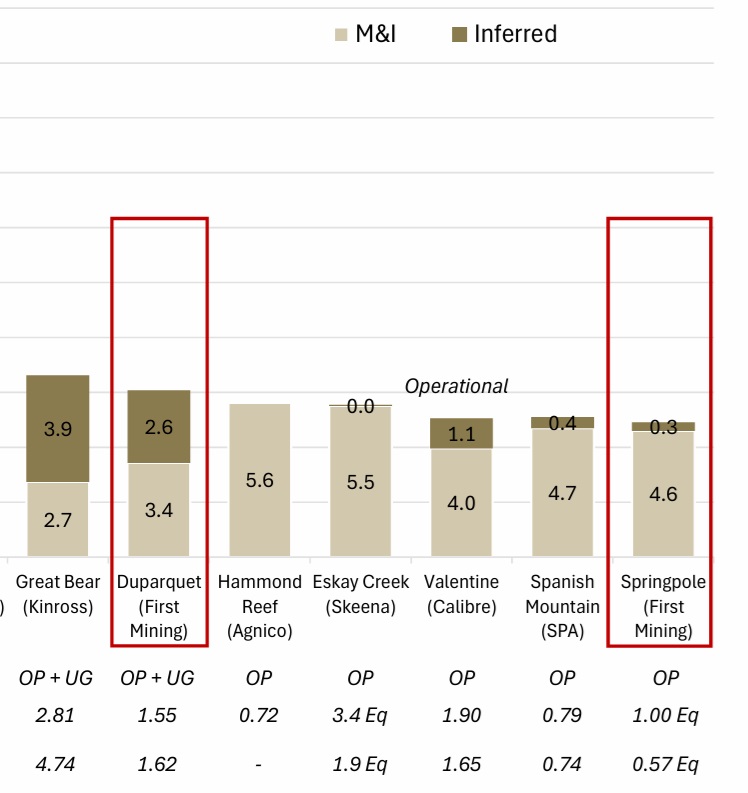

First Mining Gold (TSX: FF) Valued at 1/12th of Skeena Resources (SKE)

Skeena Resources (SKE) gained by 5.60% today to a new all-time high of $14.33 per…

CTGO Up 61.25% Since Release of NIA’s Report

Contango ORE (CTGO) gained by 2.32% today to $20.74 per share and is so far…

Canadian Govt Leaders Support Approval of First Mining Gold (TSX: FF)’s Springpole Gold Project

Many Canadian government leaders support First Mining Gold (TSX: FF)'s Springpole Gold Project. One of…

First Mining Gold (TSX: FF) Gains by 9.68% to $0.17 Per Share

First Mining Gold (TSX: FF) gained by 9.68% today to $0.17 per share. Between December…