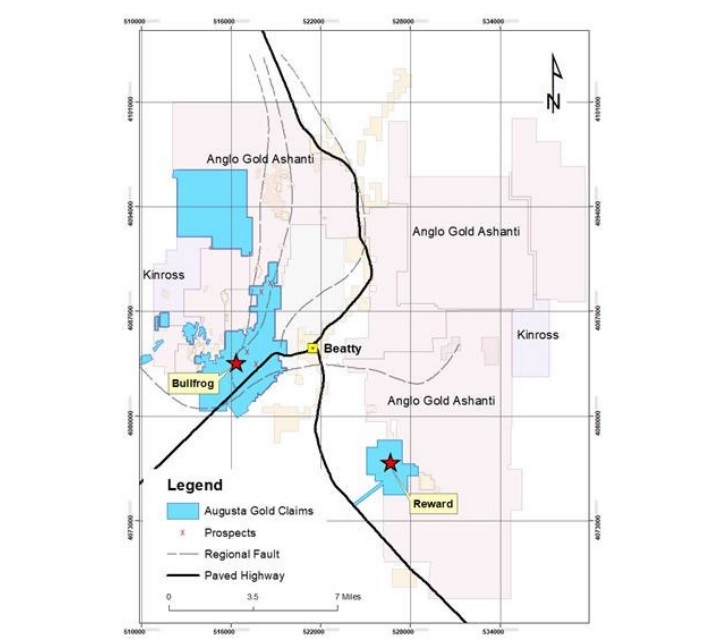

Augusta Gold Corp. (TSX: G) or (OTCQB: AUGG) is at the forefront of the Beatty Gold District in Nevada, alongside AngloGold Ashanti (NYSE: AU), one of the largest gold producers in the world. Together, they are shaping what could become North America’s most prolific new gold mining region.

AngloGold Ashanti has poured over $700 million into consolidating the Beatty District, including the Silicon, Merlin, and North Bullfrog projects. Their current 20.7 million ounce resource base includes:

While AngloGold awaits permits, Augusta Gold already has a fully permitted project – the Reward Mine – ready to begin construction in 2025. With its strategic location and low-cost development plan, Reward could become the district’s first new gold producer in decades.

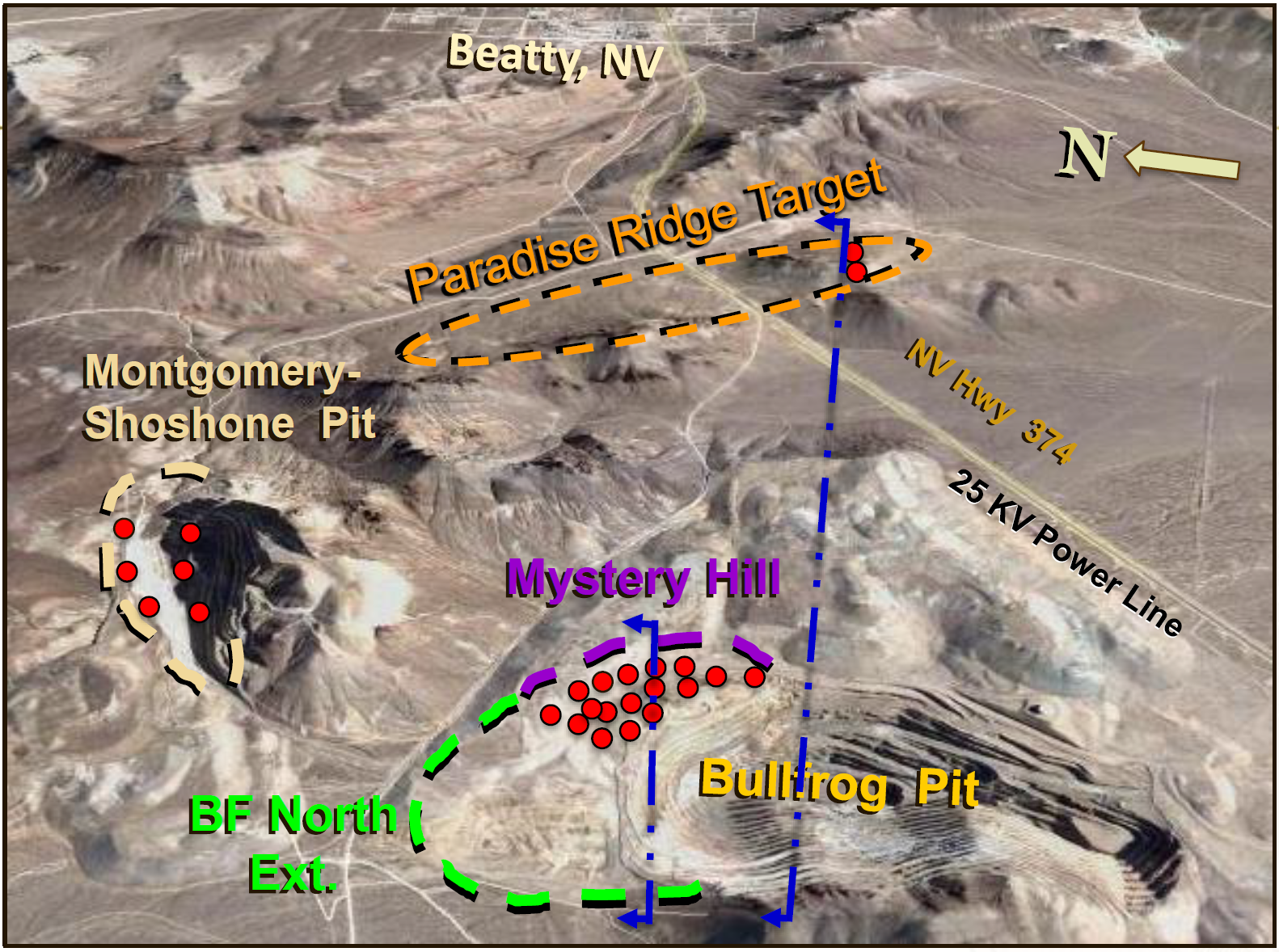

Located just 4 miles from Beatty, Nevada, the Bullfrog Project is Augusta’s flagship asset, previously owned by Barrick Gold. Now in Augusta’s hands, Bullfrog is advancing rapidly.

Augusta’s proximity to AngloGold’s assets opens the door for future collaboration, infrastructure sharing, or acquisition. Notably, the Sterling Mine (owned by AngloGold) could process Reward ore, offering rapid monetization potential.

Led by Donald Taylor (award-winning geologist behind the $2.1B Arizona Mining deal), Augusta’s leadership includes mining legend Richard Warke, and former U.S. House Speaker John Boehner, adding regulatory insight and global exposure.

If AngloGold does not move on Augusta Gold, Kinross Gold (active in Nevada) could be a logical acquirer. Kinross’s expertise in heap-leach operations aligns perfectly with Augusta’s projects.

With permits in place, construction ready to begin, and a district poised for multi-decade gold production, Augusta Gold (TSX: G) offers investors rare leverage to the next great U.S. gold boom.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 232,200 shares of G and may purchase more shares. This message is meant for informational and educational purposes only and does not provide investment advice.