NIA's #1 stock suggestion for 2020, Ascot Resources (TSX: AOT), finished the month of November by closing at $0.55 per share on six straight trading days on total six-day volume of only 219,700 shares. So far during just the first two trading days of December, AOT has gained by $0.06 or 10.9% to $0.61 per share on total two-day volume of 948,500 shares! AOT closed Tuesday above its 100-day moving average for the first time since February 1, 2019!

The fact that AOT closed above its 100-day moving average for the first time in 10 months and it did so on volume that was more than quadruple its trailing twelve month daily average, is tremendously bullish! The last time that AOT closed above its 100-day moving average after closing below it for 6+ months was on November 23, 2018. Back then, AOT continued to rally over the following three weeks to reach a high on December 13, 2018 of $1.44 per share, which was 51.58% above its then 100-day moving average of $0.95 per share!

AOT's biggest catalysts in history are coming over the next few weeks and we believe it could easily rally again to a level that is 51.58% above its current 100-day moving average of $0.60 per share, which would take AOT to $0.91 per share! AOT has 232.48 million shares outstanding for a market cap at $0.61 per share of only CAD$141.81 million or USD$106.72 million.

Back on July 11, 2016, AOT announced that Eric Sprott was investing CAD$20 million into the company in a private placement at $1.15 per share. AOT had closed the previous trading day at $1.25 per share and exploded by $0.25 or 20% in a single day to $1.50 per share. Three days later on July 14, 2016, AOT exploded by another $0.45 or 30% in a single day to $1.95 per share. After closing August 2, 2016 at $1.83 per share, AOT exploded by $0.62 or 33.88% in three days to close August 5, 2016 at $2.45 per share. On September 9, 2016, AOT hit an all-time high of $2.83 per share where it had a market cap of CAD$383.89 million or USD$295.3 million!

Despite rising as much as 146% in value following his purchase, Sprott never sold a single AOT share. In December 2016, Sprott actually added 1,175,000 shares to his position at $1.70 per share. In January of this year, Sprott increased his AOT position by an additional 2.12 million shares! (Almost nobody is aware of this but we will explain how we know this in our next AOT update!)

Sprott saw potential for AOT to build a high grade gold resource to take advantage of the Premier Gold Mine's existing infrastructure and bring the mine back into production a lot sooner. In 2017, AOT's board appointed Derek White as its new CEO due to his experience at building large, high-grade underground resources and successfully bringing mines into production. Derek White took his last company Quadra FNX Mining Ltd. from a $100 million market cap to a valuation of $3 billion before selling it to KGHM International. Afterwards, KGHM International hired Derek White to become its new President & CEO where he remained from 2012 through 2015. (KGHM International is the #1 largest European copper miner.)

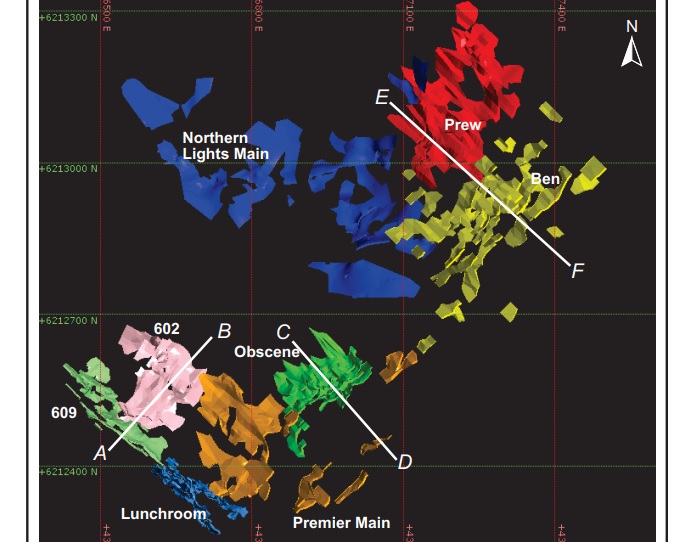

When AOT hit a record high market cap on September 9, 2016 of USD$295.3 million, its Premier Gold Mine had a resource of 4.634 million gold equivalent oz, but its grades were very low at 0.834 g/t. Despite its very low grades in 2016, AOT reached a valuation of $63.72 per oz of gold equivalent.

After Derek White and other former top executives of Quadra FNX took over AOT's management team in 2017, they had a goal of building a high grade resource for the Premier Gold Mine of between 2 to 3 million oz of gold. Already, they have accomplished this goal and are on track to release a feasibility study for the Premier Gold Mine in 1Q 2020 that will likely give AOT a huge proven & probable gold reserve. Today, AOT's Premier Gold Mine has a very high grade resource of 3 million gold equivalent oz with an average grade of 7.56 g/t.

Currently, 50% of AOT's high grade gold resource is measured & indicated vs. 50% inferred. Later this month after AOT's resource updates, we expect to see approximately 750,000 oz of AOT's inferred gold resource get upgraded to measured & indicated. If NIA is right, approximately 75% of AOT's gold resource will be measured & indicated!

If AOT finishes 2019 with a measured & indicated resource of approximately 2.25 million gold equivalent oz, there's an excellent chance that AOT's 1Q 2020 feasibility study will show a proven & probable reserve of approximately 1.5 million oz! Imagine what will happen to AOT's market cap over the next few months if it goes from having no proven & probable gold, to proven & probable gold reserves being AOT's largest resource category! Think!

NIA's President has purchased 150,000 shares of AOT in the open market. Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. Never make investment decisions based on anything NIA says. This message is meant for informational and educational purposes only and does not provide investment advice.