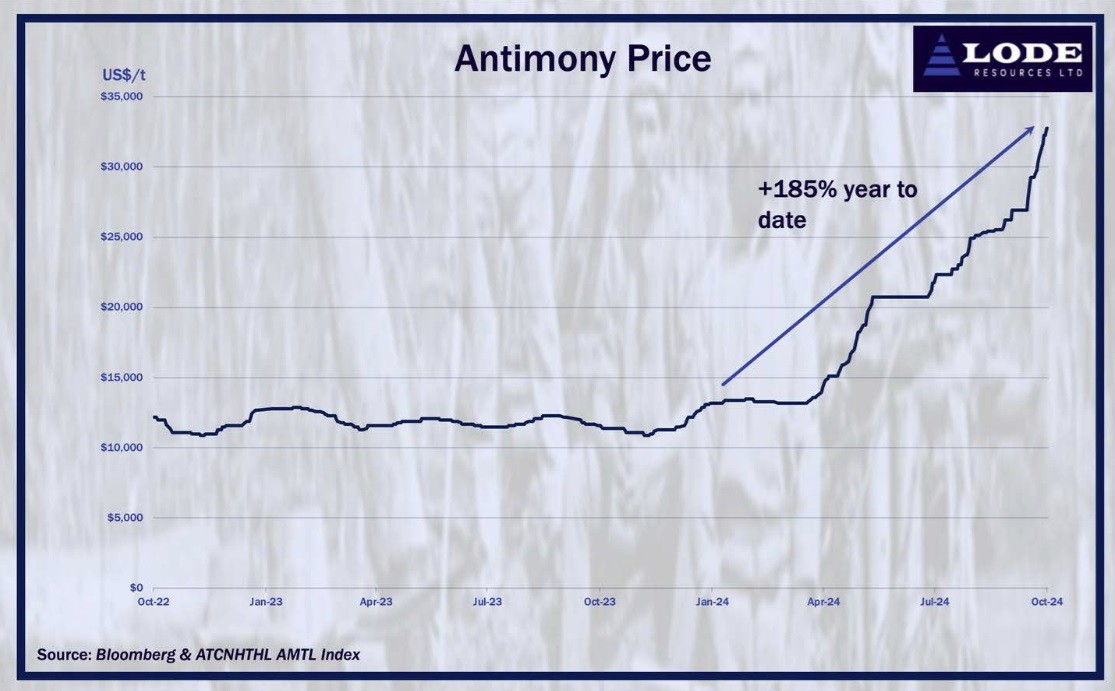

Antimony is used in the production of military-grade ammunition and explosives and prices are up by 200% in 2024 year-to-date.

Perpetua Resources (PPTA) has seen its market cap soar to $916 million in recent months.

United States Antimony (UAMY) has also been breaking out big.

Military Metals (CSE: MILI) has been acquiring antimony projects across Europe and Canada to capitalize and has a plan to bring new antimony supply onstream to protect the U.S. and other NATO countries.

With Trump likely to issue tariffs as soon as he enters office, it will create a trade war with China, and antimony prices are likely to continue going a lot higher. China accounts for 80%-90% of global antimony production and we must think ahead as to what Trump's Trade War will do to antimony prices in the upcoming months.

In Slovakia, Military Metals boasts two antimony projects, including one historically producing mine and one brownfield project with a large historical resource.

In Canada, Military Metals is sitting on a historical antimony/gold project that serviced the needs of the Allies in WWI, the West Gore past-producing antimony project in Nova Scotia.

Last week, MILI signed a letter of intent with Amador Mining LLC, to acquire the past-producing Last Chance aka Wall Canyon antimony-gold property located in Nye County Nevada.

The property is located 18km (11 miles) due west of the Round Mountain Gold Mine and is accessible by road NF-157 that runs west from Highway 376 into the Toiyabe National Forest. The nearest town is Tonopah. The elevation at the historical mineshaft on the property is just under 8,000 feet above sea level. Prospecting for gold in the area – the Jett Mining District, dates back to the 1870s, leading to the discovery of the Last Chance historical antimony mine. First recorded production of antimony was in 1915 with mining activity recorded throughout both World War One and Two and then in 1957-58, as well. Mostly gold-focused exploration work by the United States Geological Survey and Nevada Bureau of Mines during the 1980s further documented antimony and associated gold mineralization in the area, leading to the development of a small (historical) low-grade gold resource.

Historical mining and drill data indicate that antimony mineralization is both structurally and stratigraphically controlled, hosted in faults and receptive carbonate units, in quartz veins that crosscut gold-mineralized zones indicating that it is part of a younger mineralizing event. Dikes of serpentinized ultramafics are known nearby although this relationship may be more rheological versus metallogenic (exploiting the same structures), given what is known about the age and metallogenesis of epithermal gold deposits in the region.

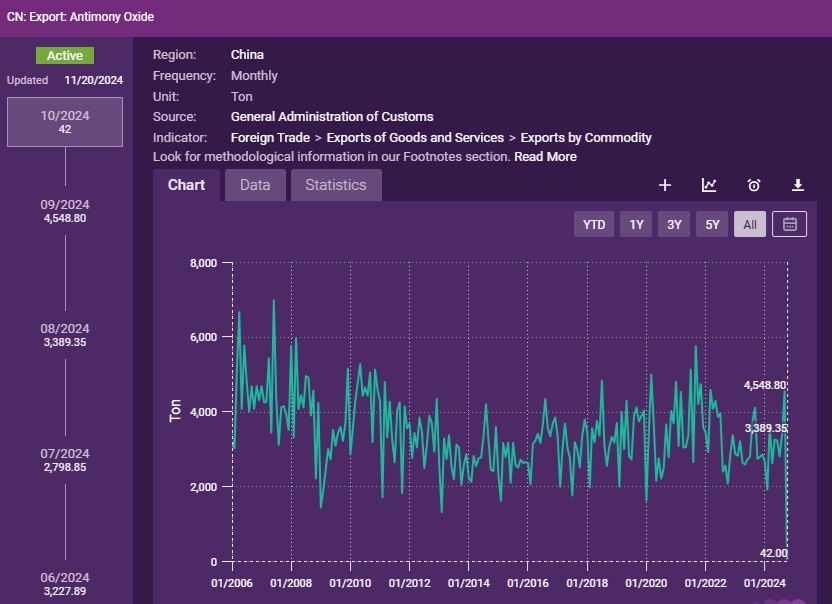

New data was just released for China antimony exports during the month of October 2024:

China antimony exports declined by 99.1% from 4,548.8 tons in September 2024 down to a new all-time low of 42 tons in October 2024. 80%-90% of all antimony production comes from China!

There is no uranium shortage. The real shortage is in antimony, and we must develop new sources of antimony in NATO countries. MILI has been rapidly acquiring antimony projects across Europe and North America. It is estimated that U.S. inventory of antimony oxide will likely be depleted within the next 6-8 weeks.

On November 15th, MILI closed on its acquisition of three brownfield properties in Slovakia, one tin and two antimony-gold, one of which is Tienesgrund, the other being MILI's flagship antimony-gold project, Trojárová.

From 1983 to 1995, Trojarová underwent extensive exploration both on the surface and underground. This included drilling 63 core holes, totaling 14,330 meters, and 1.7 kilometers of underground development that started in 1990. The underground work involved a 300-meter-long adit connected to a 700-meter drive in the footwall of the mineralized zone, with seven crosscuts for sampling. All of this work resulted in a comprehensive study with drill logs, analysis data, drill plans, maps, sections, deposit models, petrographic studies, metallurgical studies, and more. This research was compiled into a multi-volume report published by the Slovak Geological Institute in 1992.

The resource estimate at Trojarová was classified using the Slovak version of the Russian classification system, which is not directly comparable to Western systems like the CIM (Canadian Institute of Mining, Metallurgy & Petroleum) standards. According to the Slovak Geological Institute, the resource was classified as “P1” in this system. This is similar to the CIM’s “Inferred Mineral Resources,” which are based on limited geological evidence from sources like outcrops, trenches, pits, and drill holes.

MILI's flagship Canadian project, West Gore, once supplied Allied forces during WWI. Recently, the company expanded its holdings near this historic site.

Antimony is a key material for armor-piercing ammunition, night vision goggles, infrared sensors, and precision optics. Ongoing conflicts in Ukraine and the Middle East have put additional strain on antimony supply chains, as demand for ammunition and defense technologies rises. Antimony is a necessary material for the U.S. defense industrial base and is therefore critical to national security. The U.S. is reliant on Chinese imports to meet domestic demand for antimony!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from MILI of US$30,000 cash for a three-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.