We are fully aware of the fact that Altius Minerals (TSX: ALS) also owns a Beatty Gold District royalty of 1.5% covering the same areas of Orogen Royalties (TSXV: OGN)'s 1% NSR royalty: Silicon + Merlin (Expanded Silicon Gold Project). ALS is a $1 billion market cap company and its Beatty Gold District royalty only accounts for 26% of its enterprise value vs. OGN's Beatty Gold District royalty accounting for 75% of its enterprise value. The non-Beatty Gold District royalties of ALS (which make up 74% of its enterprise value) saw their revenue decline by 36.3% last quarter, so it isn't a surprise that ALS isn't performing as strongly as OGN.

Click here to read a tweet of somebody who attended PDAC 2024 in early March (attending PDAC would be a waste of our time since we learn a lot more reading the filings of companies). Trevor Hall of Mining Stock Daily tweeted, "The most shocking news of my PDAC was learning of the 16.6 Moz resource AngloGold Ashanti put out on the Bullfrog district in Nevada. Merlin deposit alone is at .99 g/t. This appears to be Nevada’s next tier 1 #gold camp."

Trevor Hall is right it is the next Tier 1 gold camp. If you read the replies to his tweet people mention ALS and OGN, but nobody is aware that Augusta Gold (TSX: G) exists.

Only NIA members are aware that Augusta Gold (TSX: G) exists.

ALS and OGN are much closer to their fair value than Augusta Gold (TSX: G).

Based on where ALS and OGN are trading today, Augusta Gold (TSX: G) deserves to be $5.87 per share and it will be very soon.

Remember, Expanded Silicon is still years away from construction. AngloGold Ashanti (AU) will begin constructing North Bullfrog directly adjacent to Augusta Gold (TSX: G)'s Bullfrog Project next year so at some point in the not-too-distant future Augusta Gold (TSX: G) will be the company receiving all of the hype that ALS and OGN are receiving today.

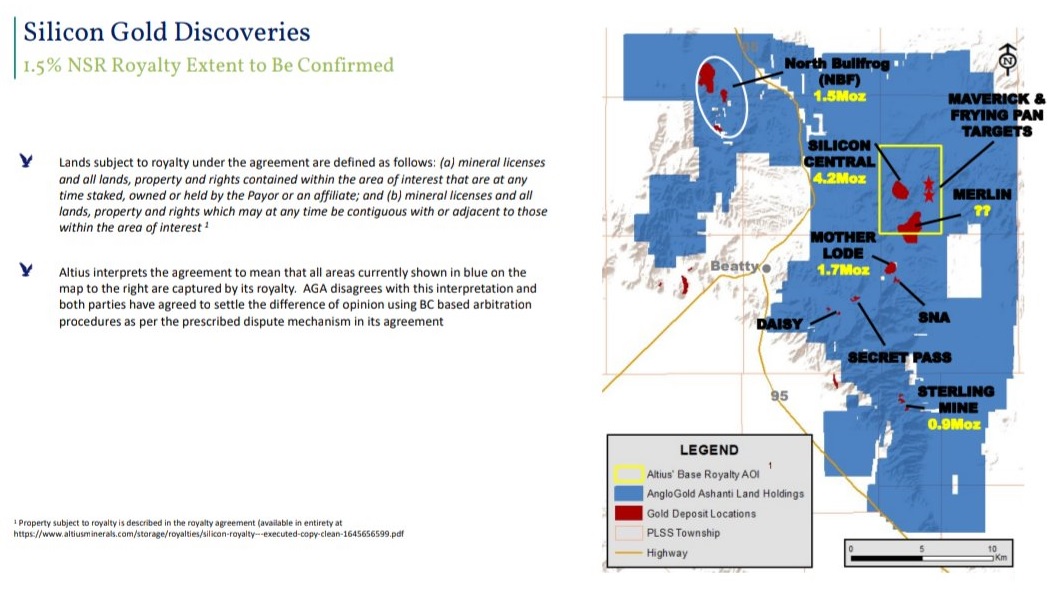

Here is a map from the presentation of ALS that somebody posted to Twitter. All of the red areas outside of the blue box are the gold deposits of Augusta Gold (TSX: G).

ALS and OGN will probably see their royalties increase in value by about 30% per year as we get closer to the construction of Expanded Silicon, but for their royalties to increase by more than 30% in value per year it means you would need to value Expanded Silicon higher than US$2.55 billion. Could Expanded Silicon be worth $3 billion, $4 billion, or $5 billion? Certainly.

But a valuation for Expanded Silicon of $2.55 billion already values Augusta Gold (TSX: G) at $5.87 per share. There is a 5X leverage effect based on where G is trading today.

If the market value of Expanded Silicon becomes $5 billion it means the fair value of Augusta Gold (TSX: G) goes into double digits.

The #1 way for a gold miner like AngloGold Ashanti (AU) to increase the long-term value of the company is by consolidating as many ounces of gold as possible into a single district that they own. The more ounces of gold that AU owns in the Beatty Gold District, the longer its Beatty Mine Life becomes and if they choose to with more gold AU can also produce more ounces annually.

A large portion of AU's gold including Motherlode isn't oxide gold and can't be extracted in an economical way. Augusta Gold (TSX: G) is 95%+ oxide gold.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.