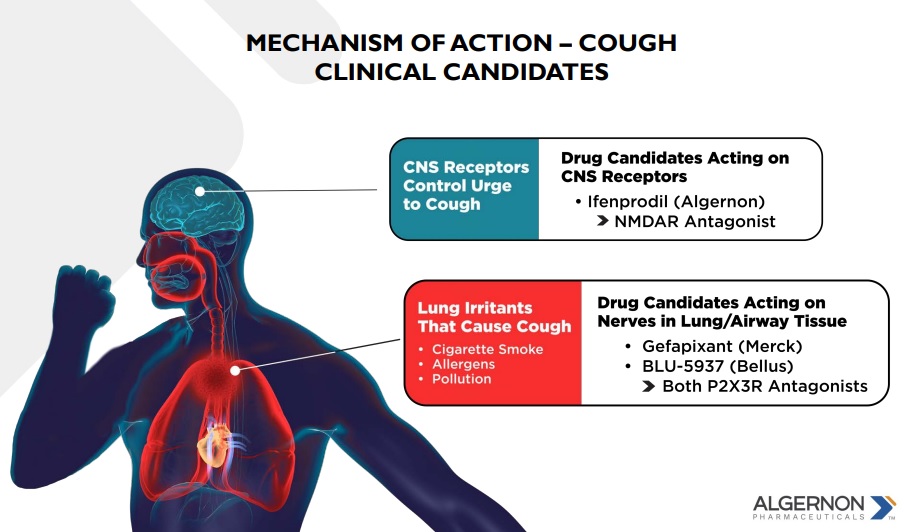

Merck (MRK) has a drug under development for refractory chronic cough called Gefapixant that many people expected to receive FDA approval in 2022, but on January 24th the FDA rejected Gefapixant due to concerns about the drug's efficacy. Since the FDA's rejection of Gefapixant on January 24th, shares of NASDAQ listed BELLUS Health (BLU) have increased by 104.5% to a current market cap of US$1.43 billion. BLU is focused entirely on the development its own refractory chronic cough drug called BLU-5937, which is similar to MRK's Gefapixant being that they are both P2X3 receptor antagonists that act on nerves in the lung/airway tissue.

Algernon Pharmaceutical (CSE: AGN)'s Ifenprodil is a totally different type of chronic cough drug compared to what BLU and MRK have developed.

AGN's Ifenprodil is an inhibitor of the NMDA receptor, a central nervous system receptor that controls the urge to cough.

AGN's in-vivo cough study showed Ifenprodil to outperform MRK's Gefapixant by 110%!

AGN's top competitor in the IPF chronic cough treatment space is Trevi Therapeutics (TRVI) which has gained by 682.6% since February 24th when it released positive Phase 2 study data for Haduvio a treatment for IPF and chronic cough.

TRVI has been one of this year's largest gaining biotech stocks and their SEC filings warn about AGN being their top competitor saying, "If Haduvio is approved for the treatment of chronic cough associated with IPF, we expect that it would compete with product candidates currently in clinical development for the treatment of chronic cough associated with IPF, such as ifenprodil, which is being developed by Algernon Pharmaceuticals."

AGN's full Phase 2 data for Ifenprodil will be released in the upcoming days! AGN's recently released top line data was very positive with 75% of participants showing reductions in cough and the median cough count per hour falling by 38%!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from AGN of US$100,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.