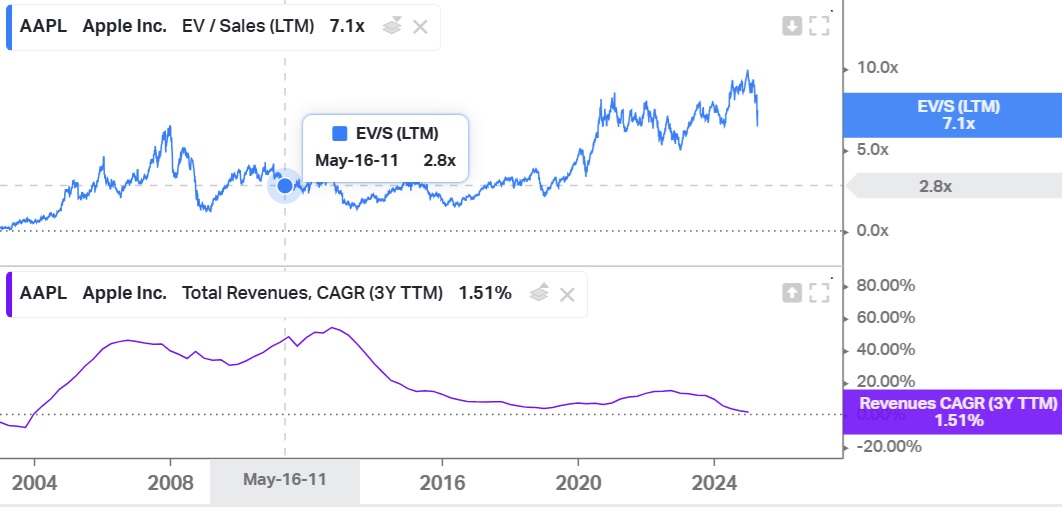

Gold ran out of steam in 2011 at about $1,900 per oz, which is today equal to $3,800+ per oz when adjusted for growth in M2 Money Supply Per Capita... because there were better opportunities than gold out there to invest in. Apple (AAPL) was trading in mid-2011 for 2.8x revenue with a 3-year compound annual growth rate (CAGR) of 40%+. Today, AAPL has a 3-year CAGR of 1.51% and is worth 7.1x revenue. For AAPL to become more attractive than gold today at a 3-year CAGR of 1.51% it needs to decline to about 1.4x revenue or about half its multiple from 2011 because it has no growth! Gold will continue to rise until AAPL is trading for 1.4x revenue!

AAPL needs to decline by 80% to reach an attractive valuation! The only way to remove exposure to AAPL is by selling VOO!