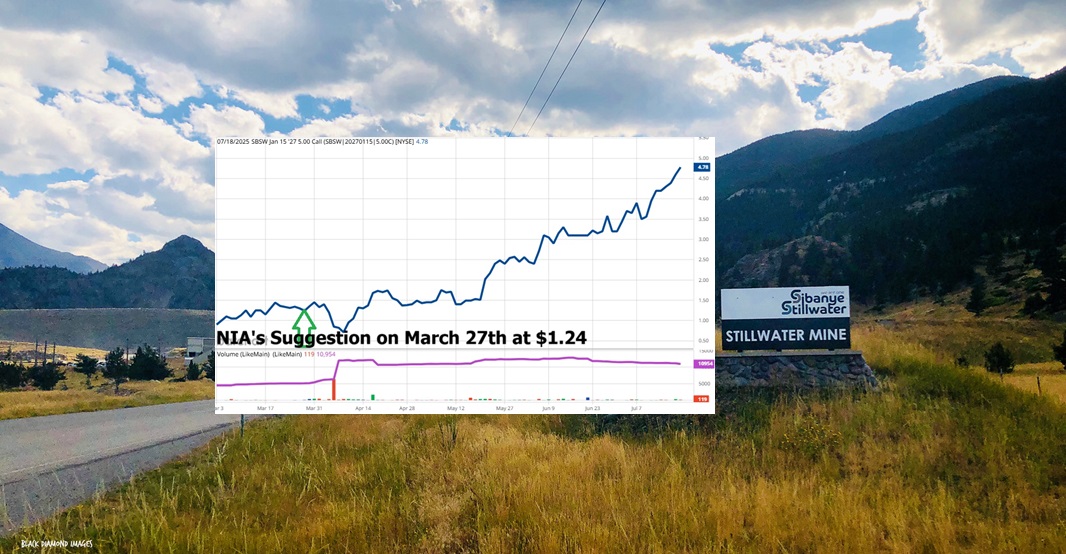

NIA’s SBSW Call Option Up 285.48%, NIA Members Profiting 7-Figures

NIA's Sibanye-Stillwater (SBSW) January 2027 $5 Call Option closed today at a new high of…

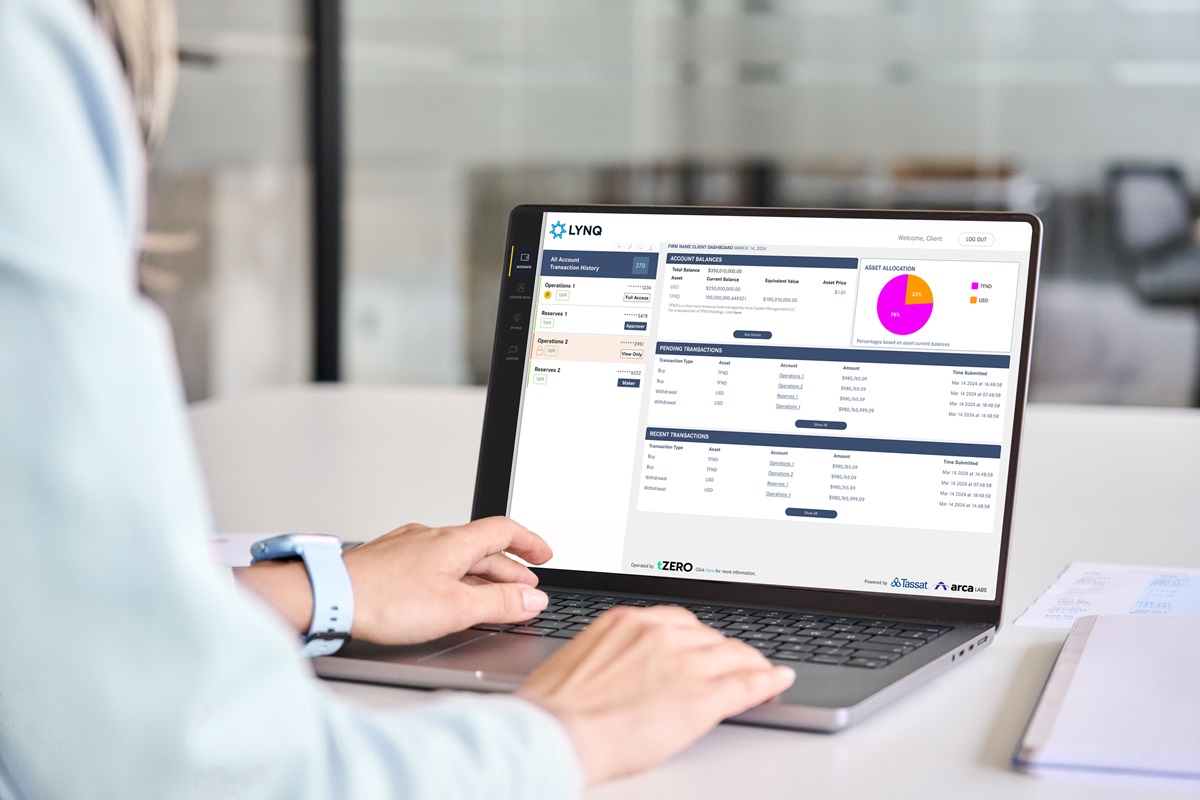

NIA’s Blockchain Play Beyond (BYON) Is Exploding

On July 1st, NIA sent out an alert entitled, 'Look for Beyond (BYON) Bounce to…

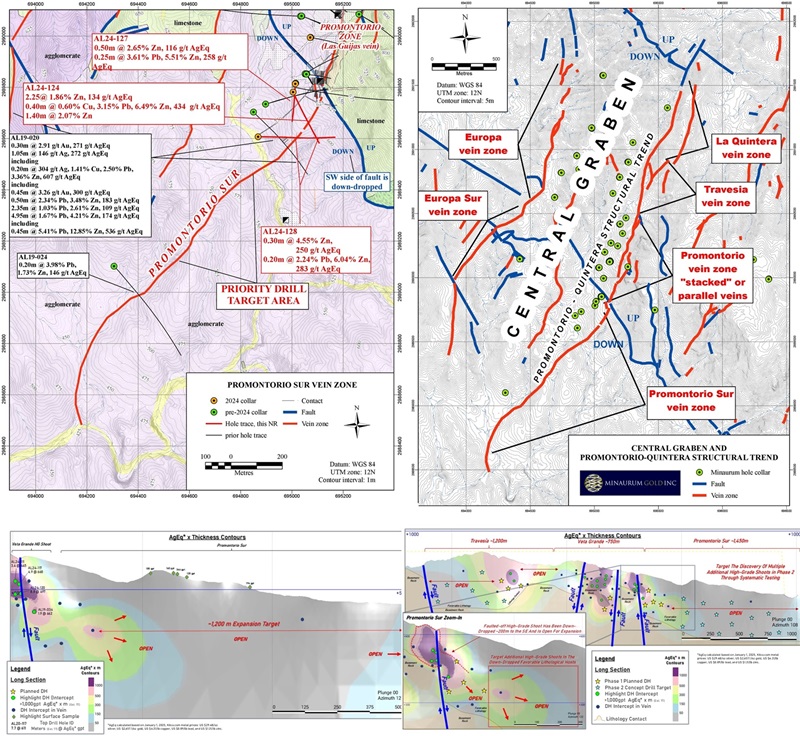

Titan Mining (TSX: TI) Is Exactly Like Sibanye-Stillwater (SBSW)

Sibanye-Stillwater (SBSW) is the only U.S. domestic producer of platinum group metals (PGMs) which has…

NIA’s #1 Top Pick for 2025 OSS Gains 3.92% to New High of $6.09!

One Stop Systems (OSS) gained by 3.92% today to a new 47-month high of $6.09 per…

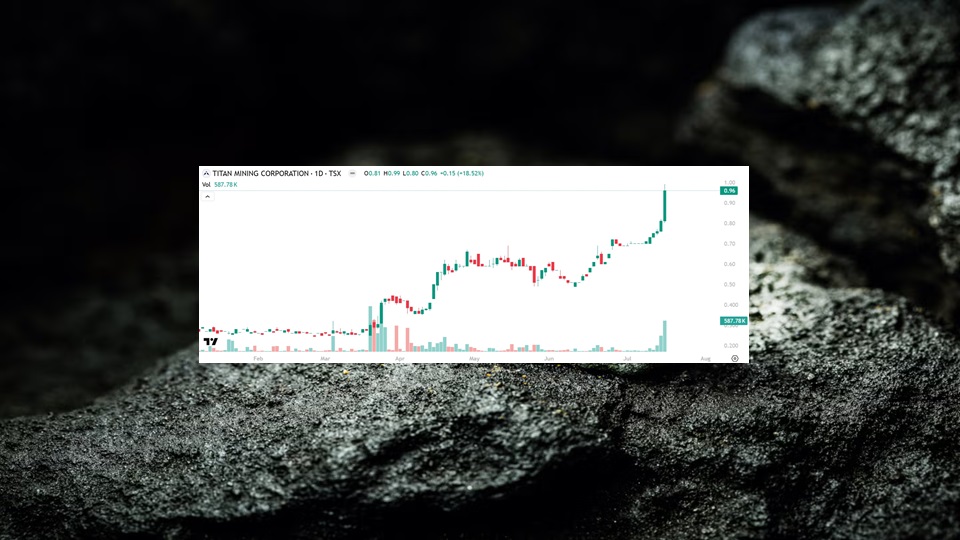

Titan Mining (TSX: TI) Gains by 18.52% to New 57-Month High of $0.96!

Titan Mining (TSX: TI) gained by 18.52% today to a new 57-month high of $0.96…

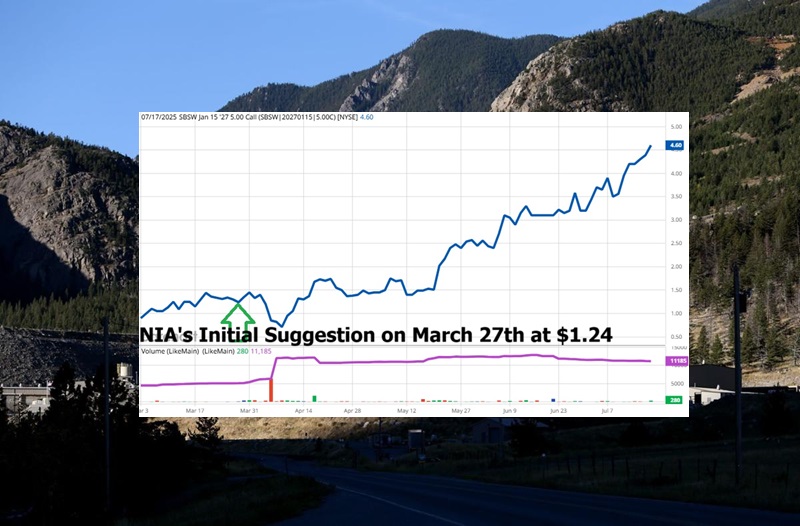

NIA’s SBSW Call Option Up 270.97%, NIA Members Profiting 7-Figures

NIA's Sibanye-Stillwater (SBSW) January 2027 $5 Call Option closed today at a new high of $4.60 and has…

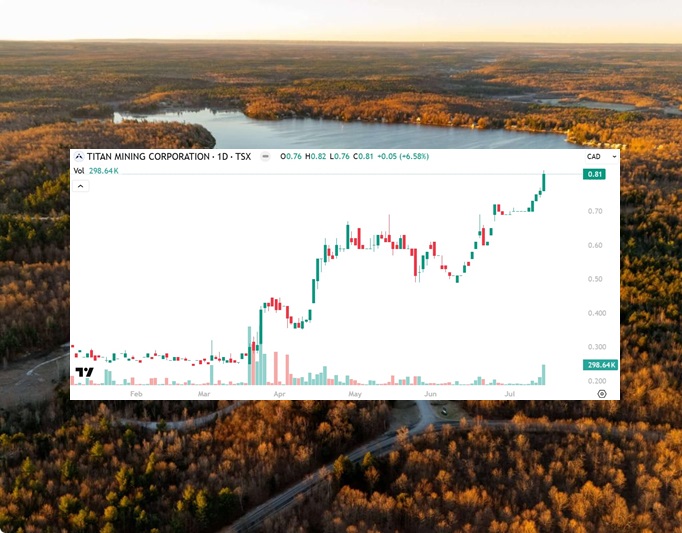

Titan Mining (TSX: TI) Gains by 6.58% to New 53-Month High of $0.81!

Titan Mining (TSX: TI) gained by 6.58% today to a new 53-month high of $0.81…

NIA’s #1 Top Pick for 2025 OSS Gains 4.64% to New High of $5.86!

One Stop Systems (OSS) gained by 4.64% today to a new 46-month high of $5.86 per…

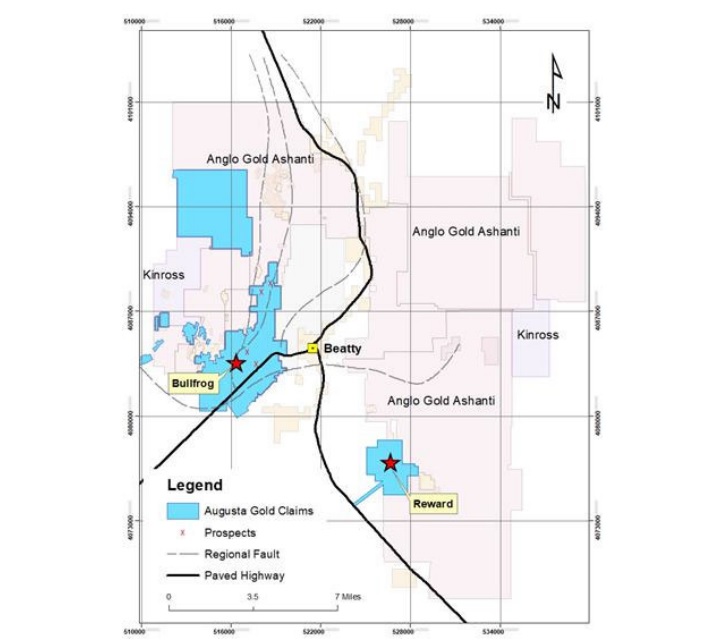

Augusta Gold (TSX: G) Acquired for $1.70 Per Share in Cash

Augusta Gold (TSX: G) is being acquired by AngloGold Ashanti (AU) for $1.70 per share…

AngloGold Ashanti Agrees to Acquire Augusta Gold to Further Consolidate Nevada District

LONDON & DENVER & JOHANNESBURG--(BUSINESS WIRE)--AngloGold Ashanti plc (“AngloGold Ashanti”) and certain of its affiliates…