Augusta Gold (TSX: G) Fair Value: $7.20 Per Share

Canadian markets were closed today for a holiday but will reopen tomorrow. From the date…

Look for Beyond (BYON) Bounce to $8-$10 Per Share

Look for Beyond (BYON) to bounce to $8-$10 per share. It is very high risk…

Contango ORE (CTGO) Bouncing Strongly Since Our Alert 24 Hours Ago

Contango ORE (CTGO) is bouncing strongly since our alert 24 hours ago at $18.82 per…

Gold Up $49.40 to $3,352.49 Per Oz

Gold is up by $49.40 to $3,352.49 per oz and Augusta Gold (TSX: G) is…

Augusta Gold (TSX: G) Gains by 7.44% to $1.30 Per Share

Augusta Gold (TSX: G) gained by 7.44% today to $1.30 per share. Augusta Gold (TSX:…

How Much Upside Do Gold Stocks Have Left?!

NIA perfectly predicted the current bull market in gold stocks in February 2024 when the…

Contango ORE (CTGO) Will Early Pay Another $7 Million in Debt This Week

Contango ORE (CTGO)'s trailing twelve-month free cash flow as of March 31st is up to…

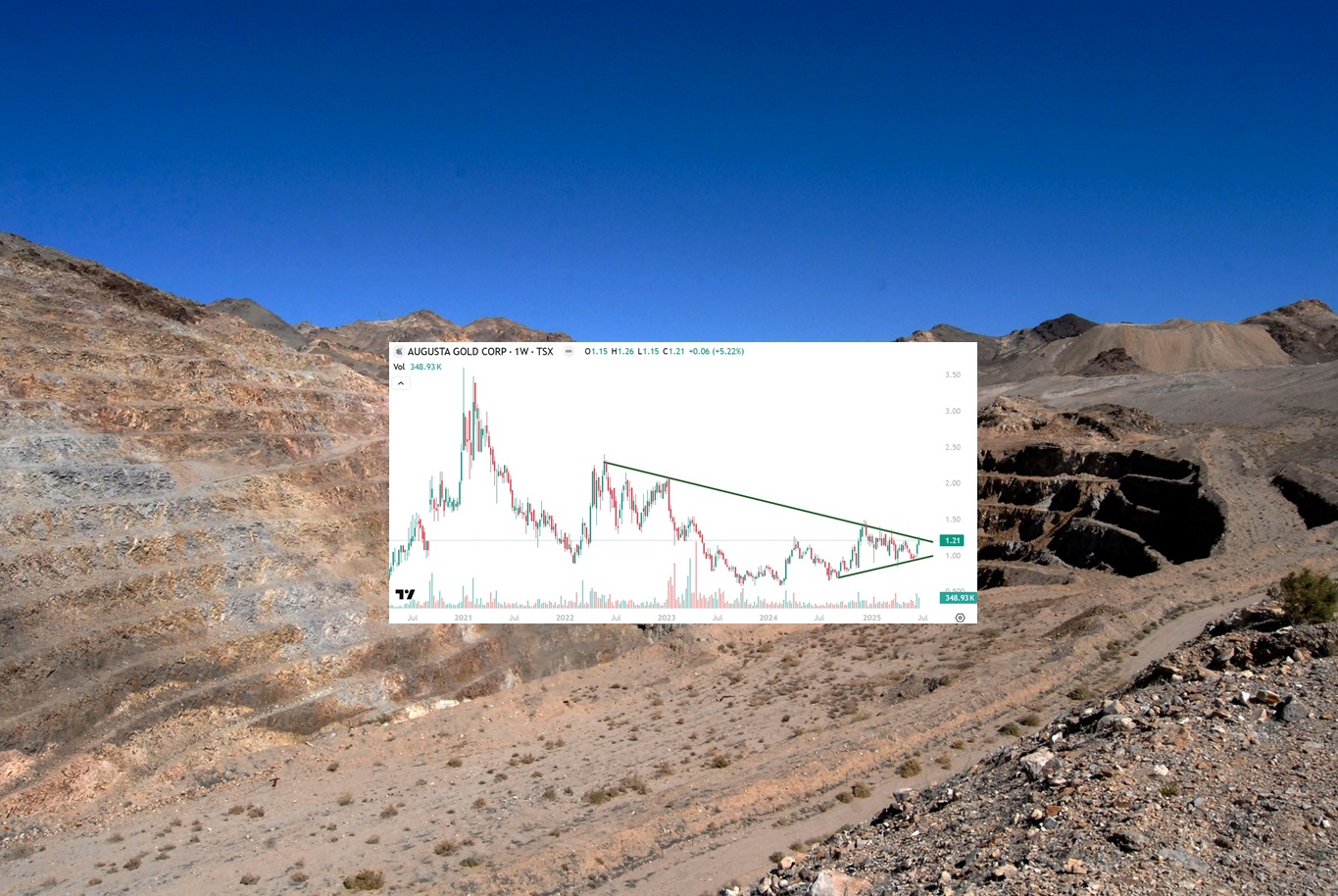

Most Bullish Chart in History

This following weekly chart of Augusta Gold (TSX: G) is the most bullish we have…

Is Circle the Best Crypto Innovation in 8 Years?

NIA Special Alert: From Ethereum at $18.50 to Augusta Gold’s Breakout Moment — Understanding the…

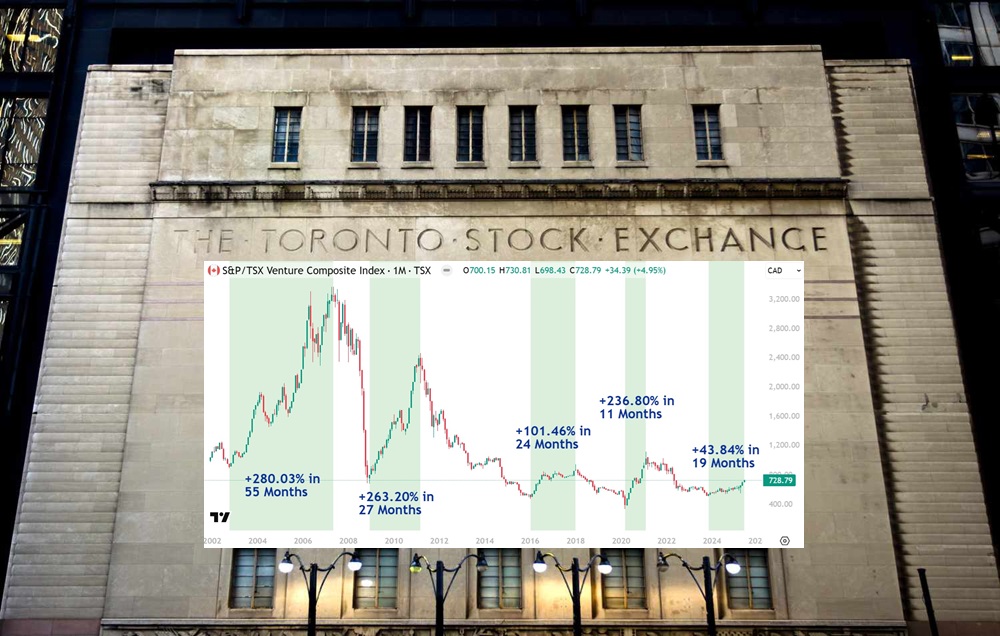

Today’s Stealth Bull Market in TSXV vs. Previous Bull Markets

The TSX Venture Composite Index has been in a stealth bull market for the last…