Noble Mineral Exploration (TSXV: NOB) after raising $721,250 in a small private placement last month at $0.075 per share (a premium above its current share price and the newly issued shares have a mandatory four-month holding period) has 236.22 million shares outstanding for a market cap at $0.065 per share of only $15,354,300.

NOB filed its annual report on December 28th for its fiscal year ending August 31, 2023.

As of August 31st, NOB had cash of $548,280 and securities of $4,262,387 for total cash + securities of $4,810,667.

Over 97.56% of NOB's securities were in two companies: Canada Nickel Company (TSXV: CNC) and Spruce Ridge Resources (TSXV: SHL).

As of August 31st, NOB owned Canada Nickel Company (TSXV: CNC) shares worth $3,348,437. CNC was $1.16 per share on August 31st and has since gained by 20.69% to a closing price today of $1.40 per share. NOB's CNC shares are one of multiple ways that NOB is positioned to capitalize on the success of CNC.

As of August 31st, NOB owned Spruce Ridge Resources (TSXV: SHL) shares worth $810,000. SHL was $0.045 per share on August 31st and has since gained by 111.11% to a closing price today of $0.095 per share.

Based on NOB's market cap at $0.065 per share of $15,354,300 and NOB's annual report balance sheet cash + securities of $4,810,667 as of August 31st, NOB has an enterprise value at $0.065 per share of only CAD$10,543,633 or US$7,911,127.

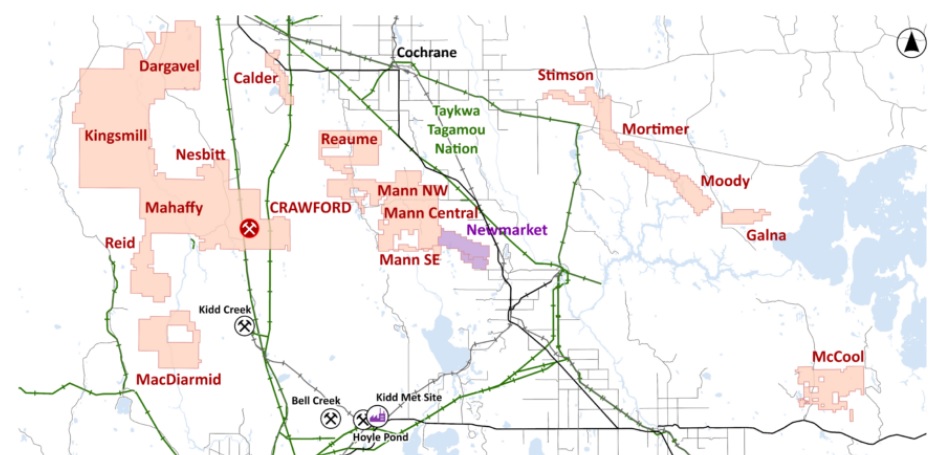

The most important thing to understand about CNC and their Crawford Nickel Project is the fact that it has already established the world's #2 largest nickel reserve/resource, but the main reason Agnico Eagle (AEM) is betting big on CNC is due to their belief that the company will establish a district scale nickel camp with Crawford being one of multiple nickel deposits to be developed for future production.

The most important CNC development in recent months was not the November filing of their Crawford feasibility study but was actually CNC's August 22nd confirmation of a significant nickel discovery at Mann Northwest located to the east of Crawford. CNC believes based on their geophysical surveys and initial drill holes at Mann Northwest that the property has potential to contain a larger nickel resource than Crawford.

NOB currently owns 100% of Mann Northwest. CNC is earning an 80% stake in Mann Northwest from NOB by funding its drilling expenditures. NOB will retain 20% ownership of Mann Northwest. NOB owns 2% NSR royalties in CNC's Mahaffy and MacDiarmid properties, which are also in close proximity to Crawford and saw strong initial drilling results.

If CNC's Crawford gets developed in the future, Crawford is likely to be one of multiple nickel deposits to be developed across a large district scale nickel camp!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from NOB of US$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.