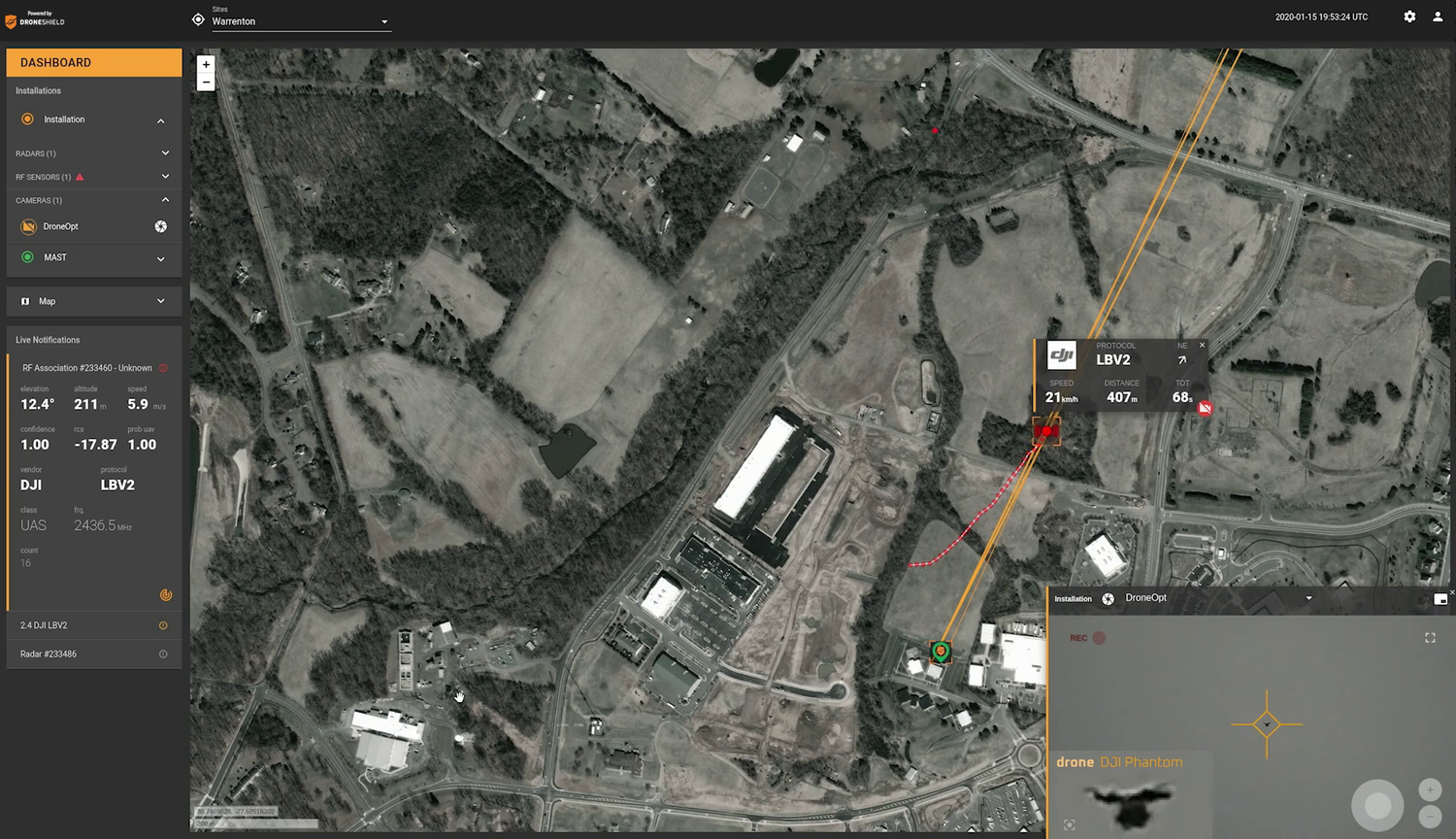

Prior to launching NIA in 2009 we had other defense technology investments that have been acquired at large premiums in the past by large defense contractors and we have been comparing multiples of what previous companies were sold for and our guess is that DroneShield (ASX: DRO) gets acquired in the upcoming months for about $1-$2 per share. DRO's software for drone detection is much more advanced than Tesla's self-driving software. Tesla's technology is not very good and based entirely on cameras, but DRO combines many different sensors with its proprietary AI software to determine the difference between a drone, a bird, or a flying paper plate many miles away as well as if the drone is a threat and what needs to be done to stop that drone immediately. DRO uses FPGAs that are many times faster than Nvidia (NVDA)'s GPUs. There are many large defense contractors that desperately need to acquire DRO's technology, and although it will end up being a 5-10 bagger from our initial suggestion price of $0.20 per share, we don't think it ends up going to $5 or anything crazy like that. Augusta Gold (TSX: G) has a 1,000X higher chance of surpassing $5 per share in the upcoming months. AngloGold Ashanti (AU) was inquiring with Waterton about G's Reward Project, but G swooped in and bought it before AU had a chance to do so.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.